Answered step by step

Verified Expert Solution

Question

1 Approved Answer

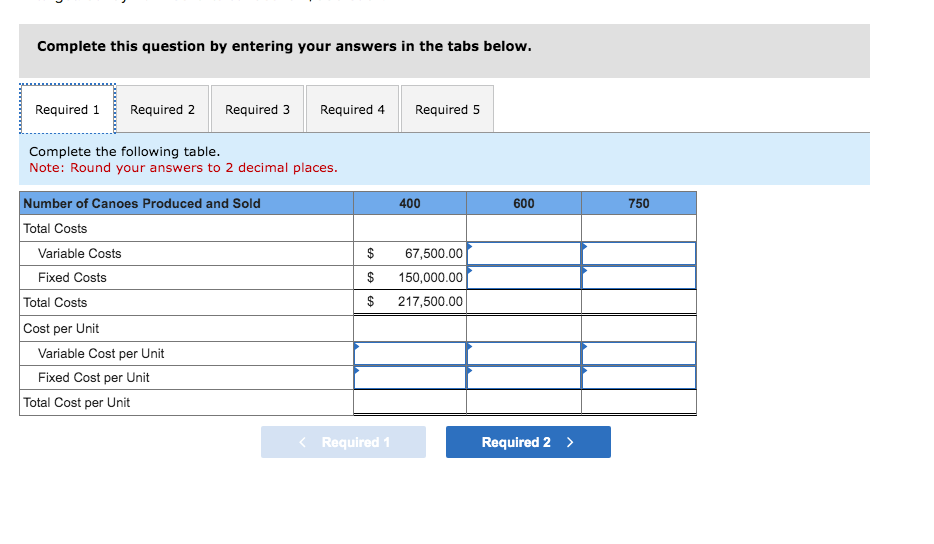

Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: Complete the following table. Suppose Sandy Bank sells its canoes

Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below.

Required:

- Complete the following table.

- Suppose Sandy Bank sells its canoes for $550 each. Calculate the contribution margin per canoe and the contribution margin ratio.

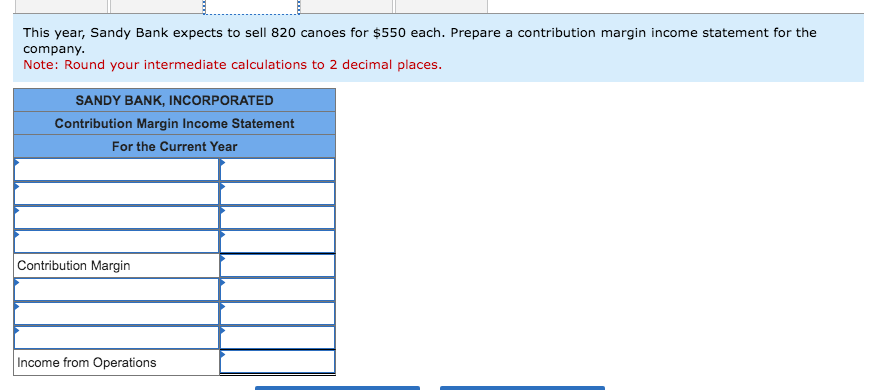

- This year, Sandy Bank expects to sell 820 canoes for $550 each. Prepare a contribution margin income statement for the company.

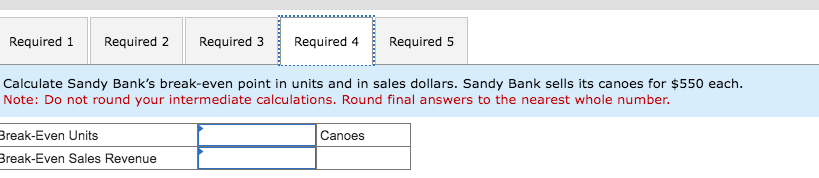

- Calculate Sandy Banks break-even point in units and in sales dollars. Sandy Bank sells its canoes for $550 each.

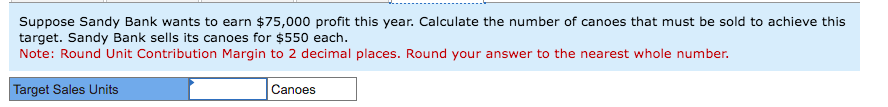

- Suppose Sandy Bank wants to earn $75,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $550 each.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started