Question

Sandy International is considering two major projects, Project A and Project B. Due to various constraints, only one of these two projects can be chosen

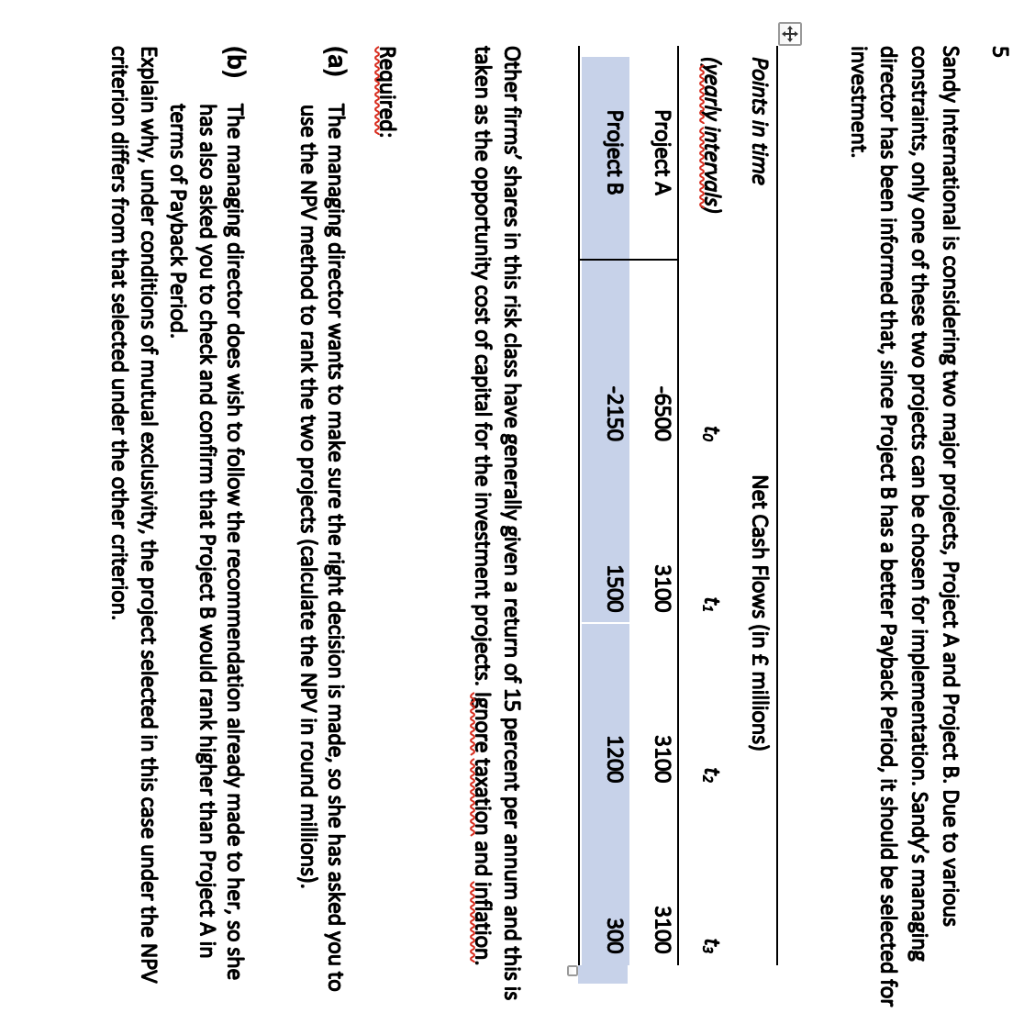

Sandy International is considering two major projects, Project A and Project B. Due to various constraints, only one of these two projects can be chosen for implementation. Sandys managing director has been informed that, since Project B has a better Payback Period, it should be selected for investment. Points in time Net Cash Flows (in millions) (yearly intervals) t0 t1 t2 t3 Project A -6500 3100 3100 3100 Project B -2150 1500 1200 300 Other firms shares in this risk class have generally given a return of 15 percent per annum and this is taken as the opportunity cost of capital for the investment projects. Ignore taxation and inflation. Required: (a) The managing director wants to make sure the right decision is made, so she has asked you to use the NPV method to rank the two projects (calculate the NPV in round millions). (b) The managing director does wish to follow the recommendation already made to her, so she has also asked you to check and confirm that Project B would rank higher than Project A in terms of Payback Period. Explain why, under conditions of mutual exclusivity, the project selected in this case under the NPV criterion differs from that selected under the other criterion.

Sandy International is considering two major projects, Project A and Project B. Due to various constraints, only one of these two projects can be chosen for implementation. Sandys managing director has been informed that, since Project B has a better Payback Period, it should be selected for investment. Points in time Net Cash Flows (in millions) (yearly intervals) t0 t1 t2 t3 Project A -6500 3100 3100 3100 Project B -2150 1500 1200 300 Other firms shares in this risk class have generally given a return of 15 percent per annum and this is taken as the opportunity cost of capital for the investment projects. Ignore taxation and inflation. Required: (a) The managing director wants to make sure the right decision is made, so she has asked you to use the NPV method to rank the two projects (calculate the NPV in round millions). (b) The managing director does wish to follow the recommendation already made to her, so she has also asked you to check and confirm that Project B would rank higher than Project A in terms of Payback Period. Explain why, under conditions of mutual exclusivity, the project selected in this case under the NPV criterion differs from that selected under the other criterion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started