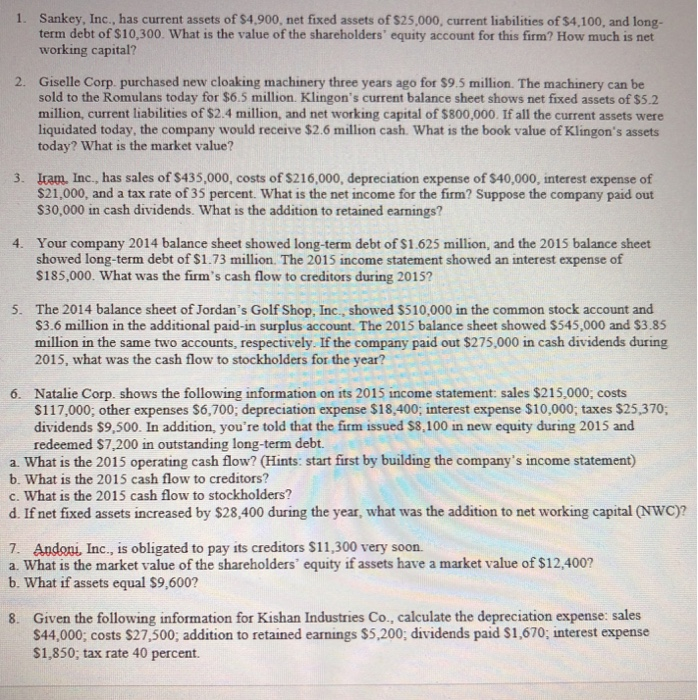

Sankey, Inc., has current assets of $4,900, net fixed assets of $25,000, current liabilities of $4,100, and long term debt of $10,300. What is the value of the shareholders' equity account for this firm? How much is net working capital? 1. Giselle Corp. purchased new cloaking machinery three years ago for $9.5 million. The machinery can be sold to the Romulans today for $6.5 million. Klingon's current balance sheet shows net fixed assets of $ million, current liabilities of $2.4 million, and net working capital of $800,000. If all the current assets were liquidated today, the company would receive $2.6 million cash. What is the book value of Klingon's assets today? What is the market value? Iram. Inc., has sales of $435,000, costs of $216,000, depreciation expense of $40,000, interest expense of $21,000, and a tax rate of 35 percent. What is the net income for the firm? Suppose the company paid out S30,000 in cash dividends. What is the addition to retained earnings? Your company 2014 balance sheet showed long-term debt of $1.625 million, and the 2015 balance sheet showed long-term debt of $1.73 million. The 2015 income statement showed an interest expense of S185,000. What was the firm's cash flow to creditors during 2015? 4. 5. The 2014 balance sheet of Jordan's Golf Shop, Inc, showed $510,000 in the common stock account and S3.6 million in the additional paid-in surplus account. The 2015 balance sheet showed S545,000 and $3.85 million in the same two accounts, respectively. If the company paid out $275,000 in cash dividends during 2015, what was the cash flow to stockholders for the year? 6. Natalie Corp. shows the following information on its 2015 income statement: sales $215,000, costs $117,000; other expenses $6,700; depreciation expense $18,400; interest expense $10,000; taxes $25,370 dividends $9,500. In addition, you're told that the firm issued $8,100 in new equity during 2015 and redeemed $7,200 in outstanding long-term debt. a What is the 2015 operating cash flow? (Hints: start first by building the company's income statement) b. What is the 2015 cash flow to creditors? c. What is the 2015 cash flow to stockholders? d. If net fixed assets increased by $28,400 during the year, what was the addition to net working capital (NWC)? 7. Andoni Inc., is obligated to pay its creditors $11,300 very soon. a. What is the market value of the shareholders' equity if assets have a market value of $12,400 b. What if assets equal s9,600? 8. Given the following information for Kishan Industries Co., calculate the depreciation expense: sales $44,000; costs $27,500; addition to retained earnings $5,200; dividends paid $1,670; interest expense $1,850; tax rate 40 percent