Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Santa Isabel, a food company located in Chile in South America, is planning to expand its operations internationally, and is considering buying a relatively small

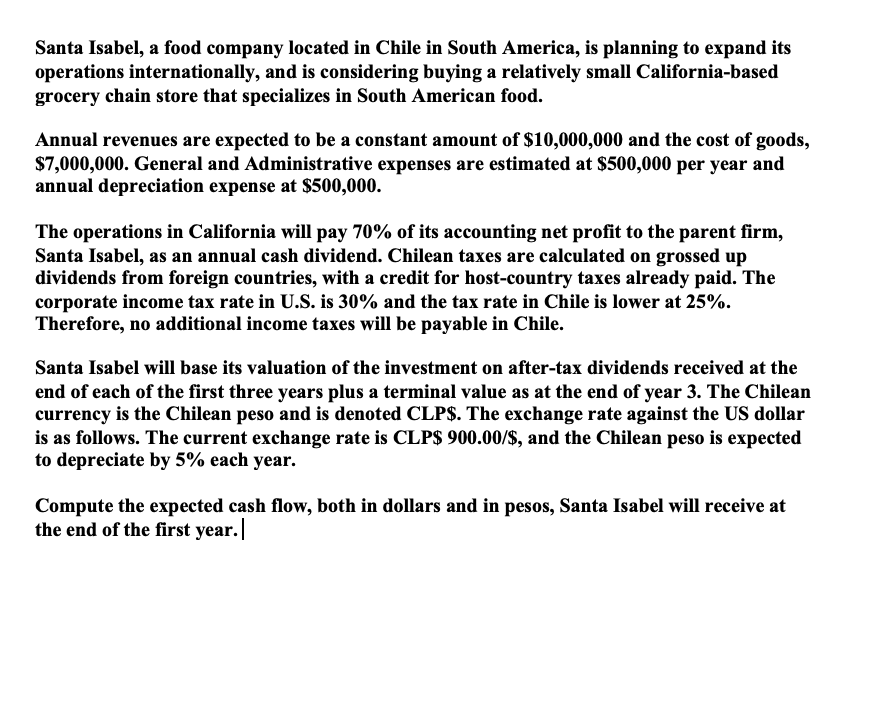

Santa Isabel, a food company located in Chile in South America, is planning to expand its

operations internationally, and is considering buying a relatively small Californiabased

grocery chain store that specializes in South American food.

Annual revenues are expected to be a constant amount of $ and the cost of goods,

$ General and Administrative expenses are estimated at $ per year and

annual depreciation expense at $

The operations in California will pay of its accounting net profit to the parent firm,

Santa Isabel, as an annual cash dividend. Chilean taxes are calculated on grossed up

dividends from foreign countries, with a credit for hostcountry taxes already paid. The

corporate income tax rate in US is and the tax rate in Chile is lower at

Therefore, no additional income taxes will be payable in Chile.

Santa Isabel will base its valuation of the investment on aftertax dividends received at the

end of each of the first three years plus a terminal value as at the end of year The Chilean

currency is the Chilean peso and is denoted CLP$ The exchange rate against the US dollar

is as follows. The current exchange rate is CLP$$ and the Chilean peso is expected

to depreciate by each year.

Compute the expected cash flow, both in dollars and in pesos, Santa Isabel will receive at

the end of the first year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started