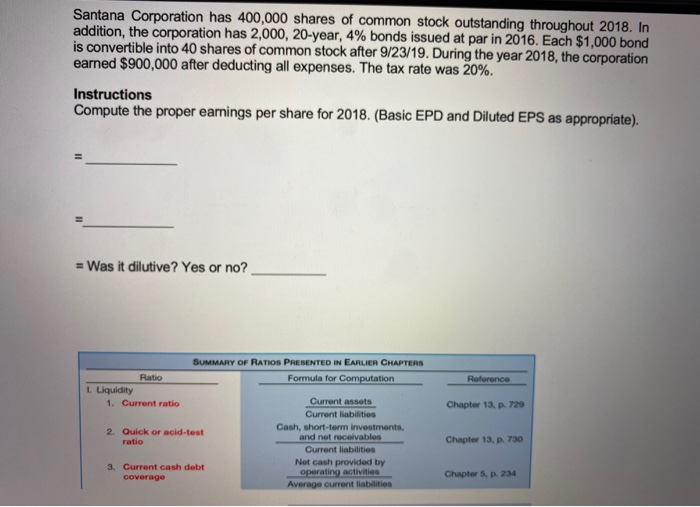

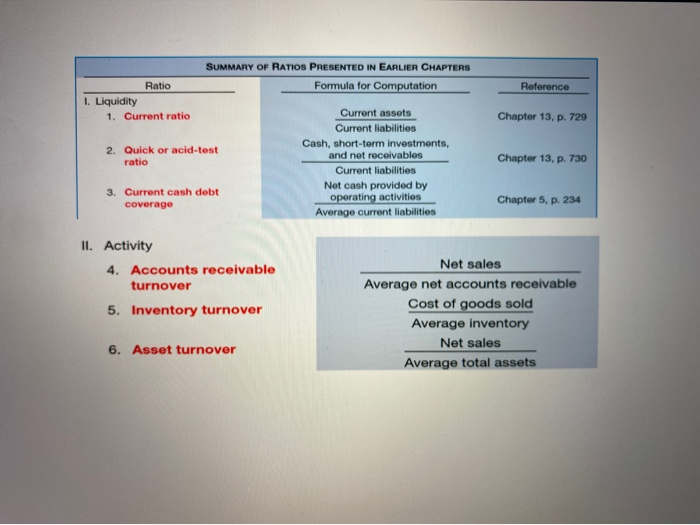

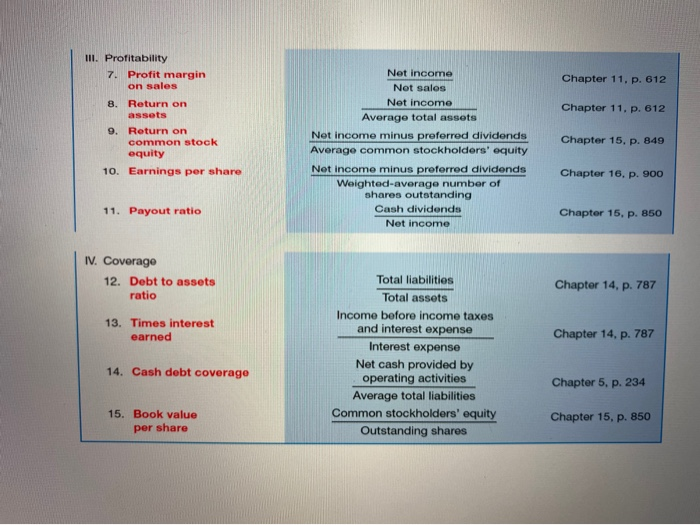

Santana Corporation has 400,000 shares of common stock outstanding throughout 2018. In addition, the corporation has 2,000, 20-year, 4% bonds issued at par in 2016. Each $1,000 bond is convertible into 40 shares of common stock after 9/23/19. During the year 2018, the corporation earned $900,000 after deducting all expenses. The tax rate was 20%. Instructions Compute the proper earnings per share for 2018. (Basic EPD and Diluted EPS as appropriate). = Was it dilutive? Yes or no? SUMMARY OF RATIOS PRESENTED IN EARLIER CHAPTERS Formula for Computation Reference Ratio 1. Liquidity 1. Current ratio Chapter 13. p. 720 2. Quick or acid-test ratio Current assets Current liabilities Cash, short-term investments, and not receivables Current liabilities Net cash provided by operating activities Average current liabilities Chapter 13. p. 730 3. Current cash debt coverage Chapter 5. p. 234 SUMMARY OF RATIOS PRESENTED IN EARLIER CHAPTERS Formula for Computation Reference Ratio 1. Liquidity 1. Current ratio Chapter 13. p. 729 2. Quick or acid-test ratio Current assets Current liabilities Cash, short-term investments, and net receivables Current liabilities Net cash provided by operating activities Average current liabilities Chapter 13, p. 730 3. Current cash debt coverage Chapter 5, p. 234 II. Activity 4. Accounts receivable turnover 5. Inventory turnover Net sales Average net accounts receivable Cost of goods sold Average inventory Net sales Average total assets 6. Asset turnover III. Profitability 7. Profit margin on sales Chapter 11, p. 612 Net income Not sales Net income Average total assets Net income minus preferred dividends Average common stockholders' equity Chapter 11. p. 612 8. Return on assets 9. Return on common stock equity 10. Earnings per share Chapter 15, p. 849 Chapter 16. p. 900 Not income minus preferred dividends Weighted-average number of shares outstanding Cash dividends Net income 11. Payout ratio Chapter 15, p. 850 IV. Coverage 12. Debt to assets ratio Chapter 14, p. 787 13. Times interest earned Chapter 14, p. 787 Total liabilities Total assets Income before income taxes and interest expense Interest expense Net cash provided by operating activities Average total liabilities Common stockholders' equity Outstanding shares 14. Cash debt coverage Chapter 5. p. 234 15. Book value per share Chapter 15, p. 850