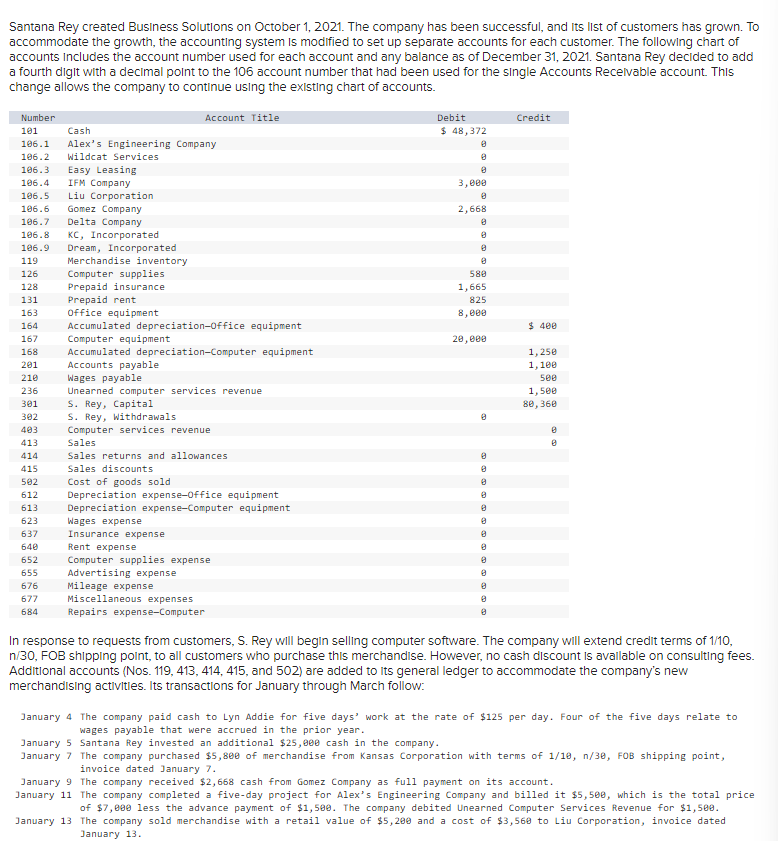

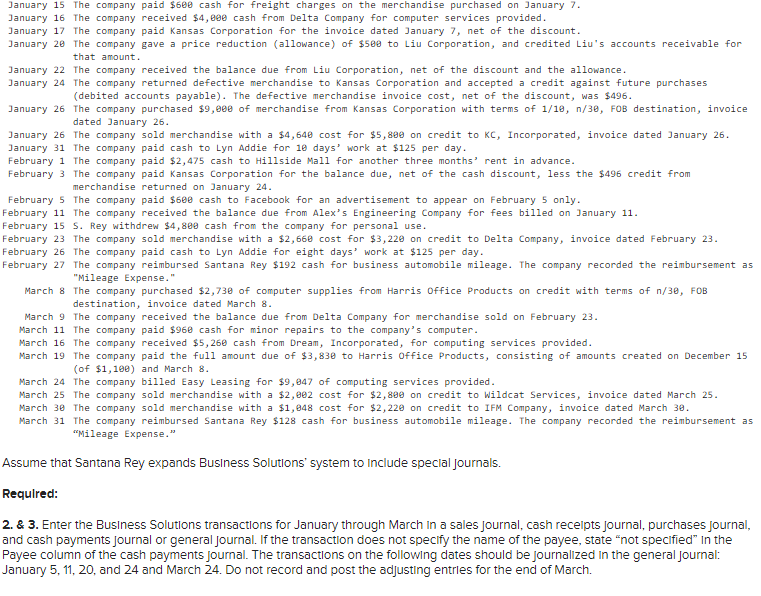

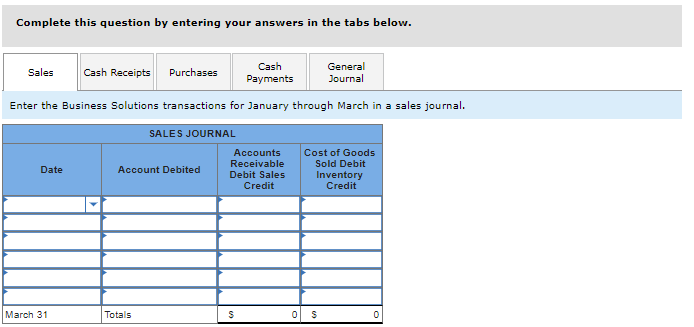

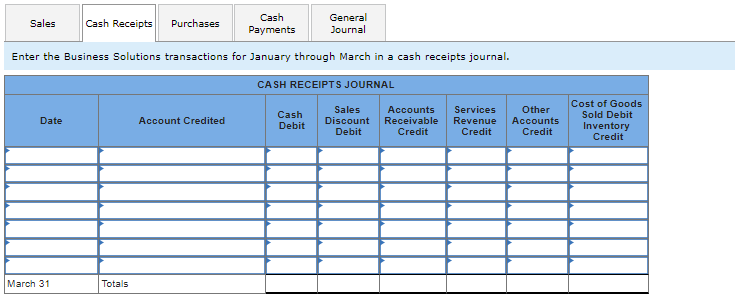

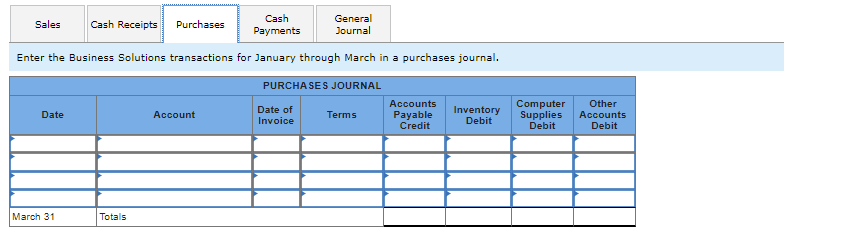

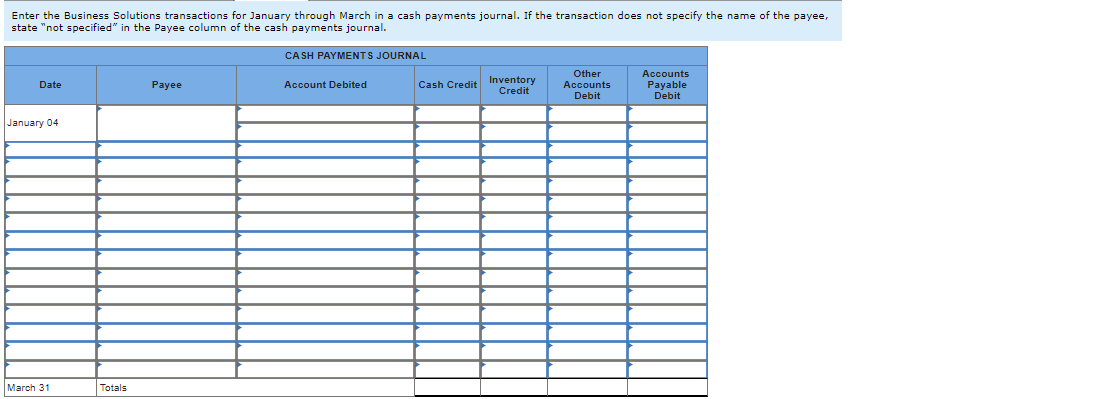

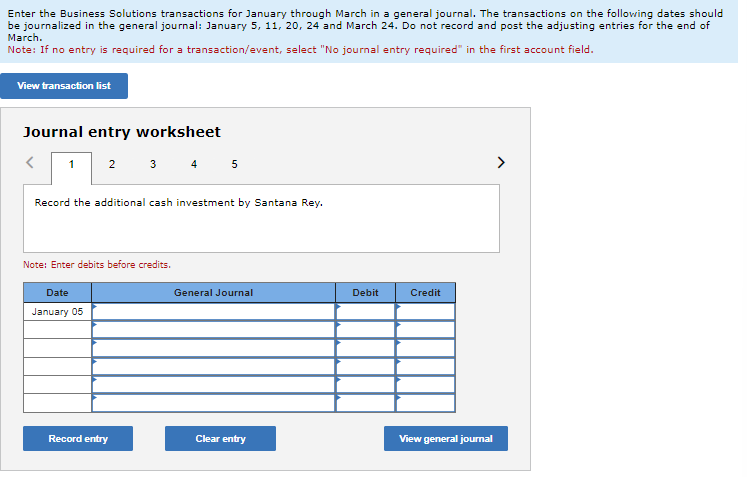

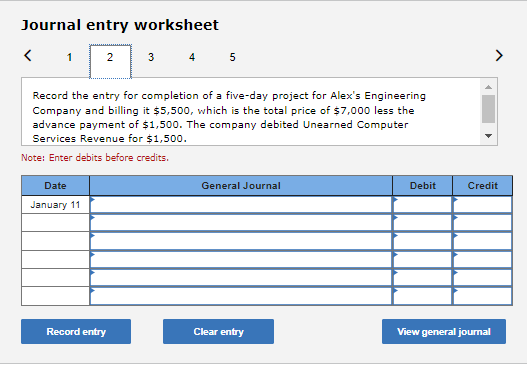

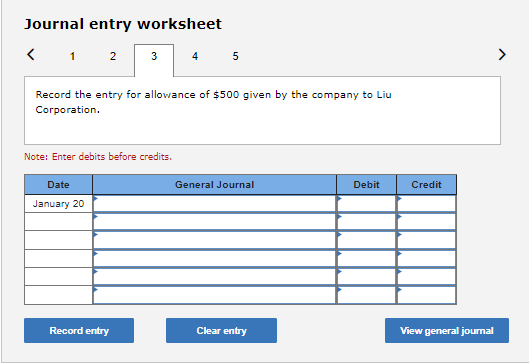

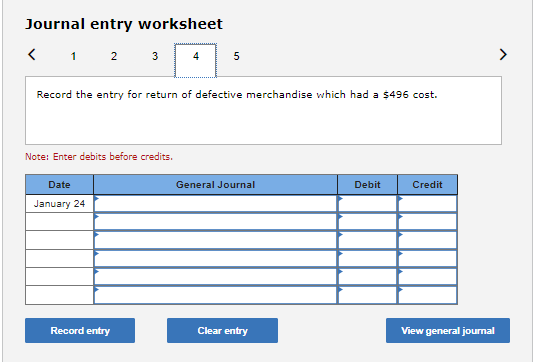

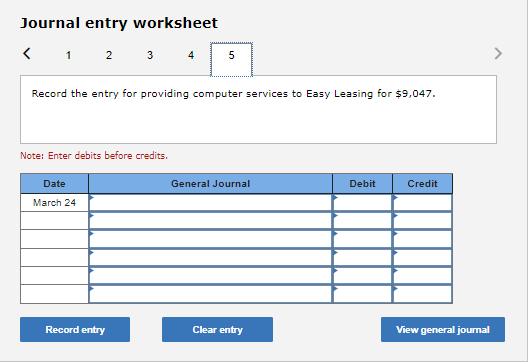

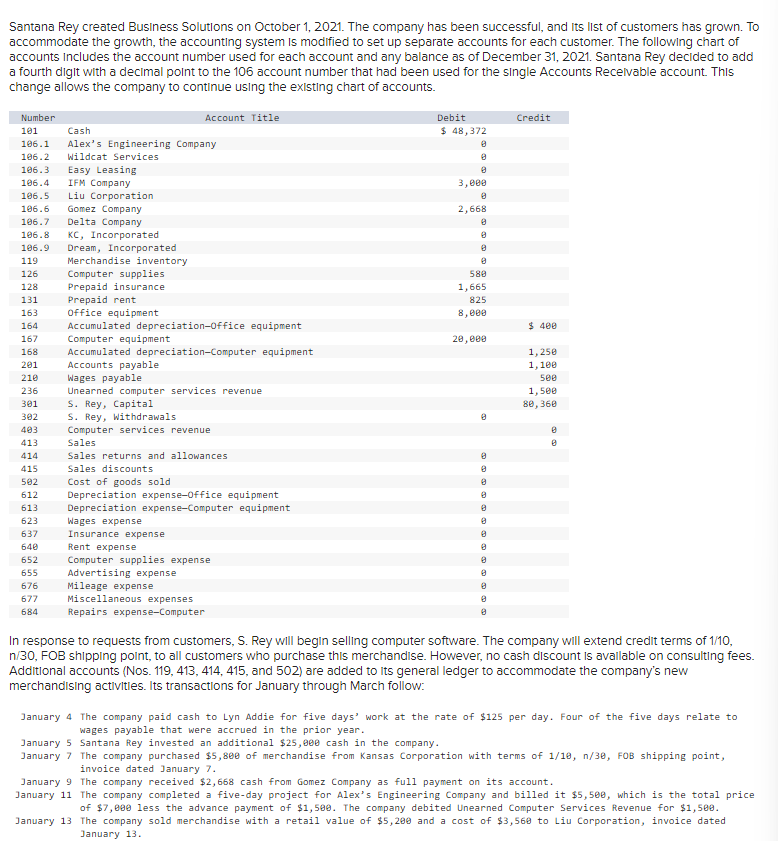

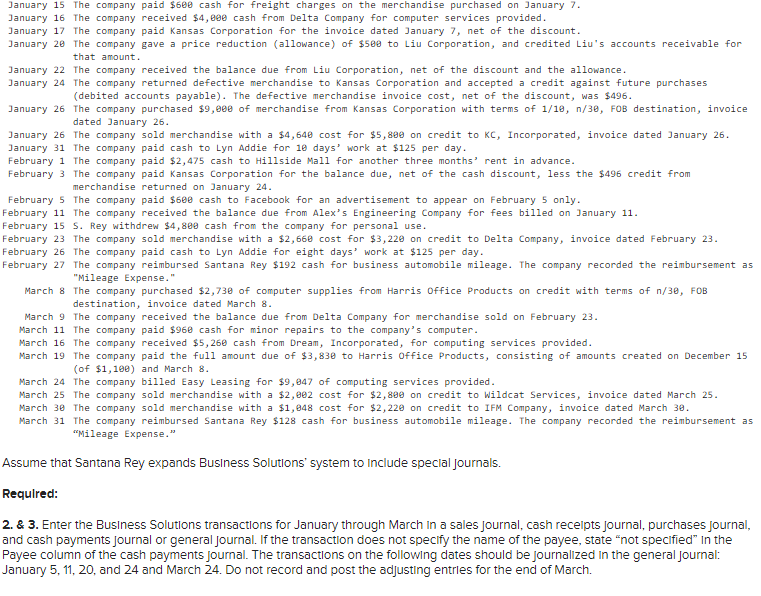

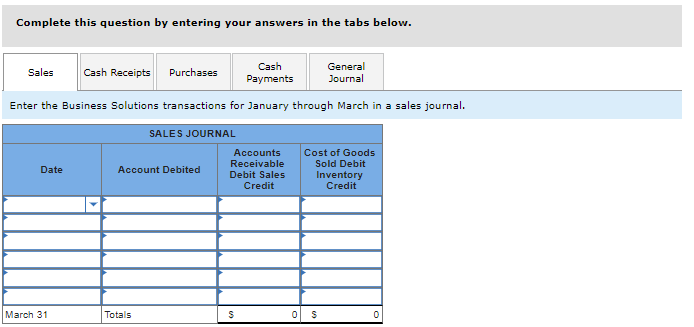

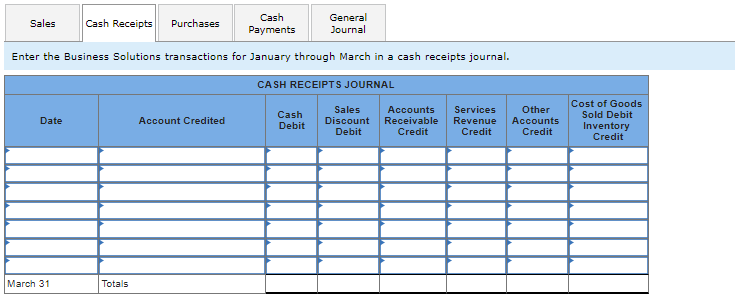

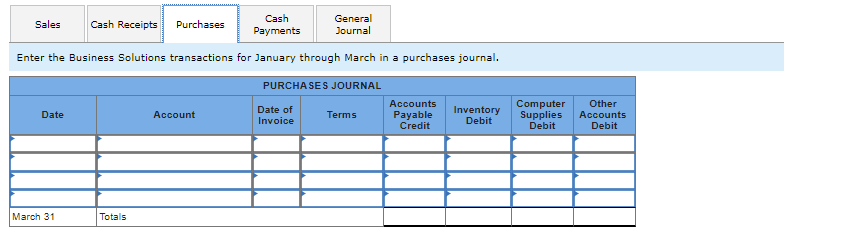

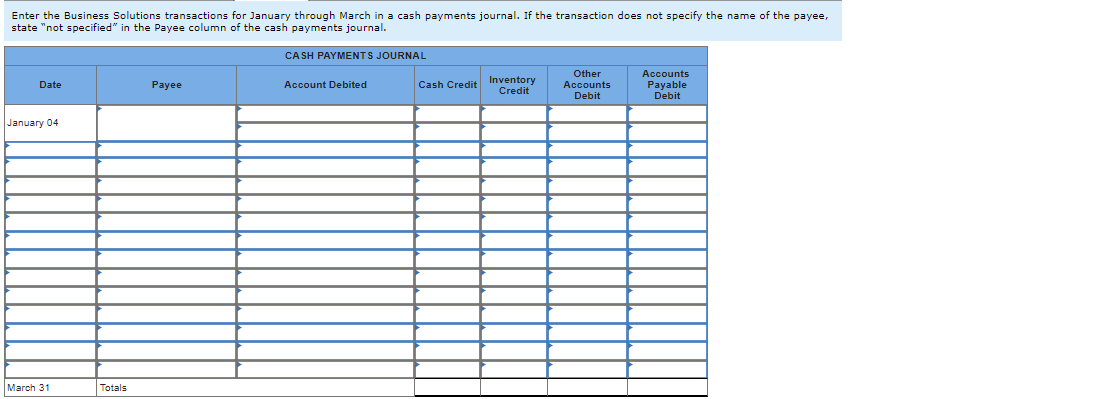

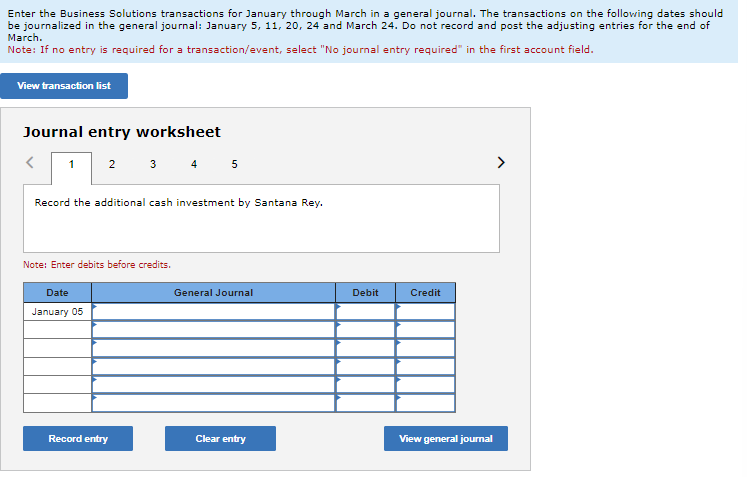

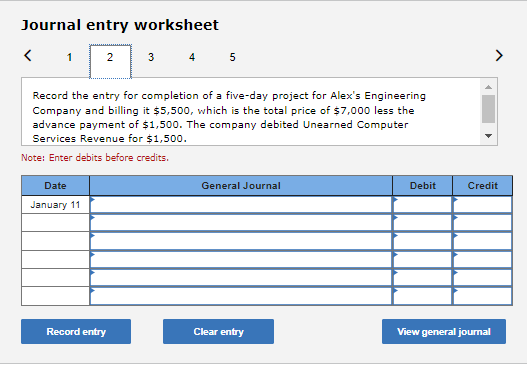

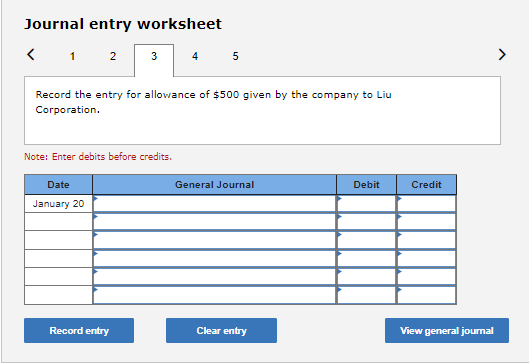

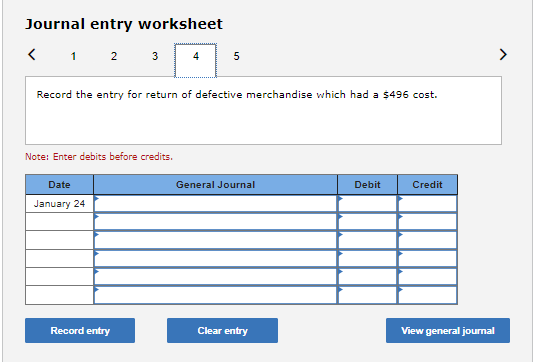

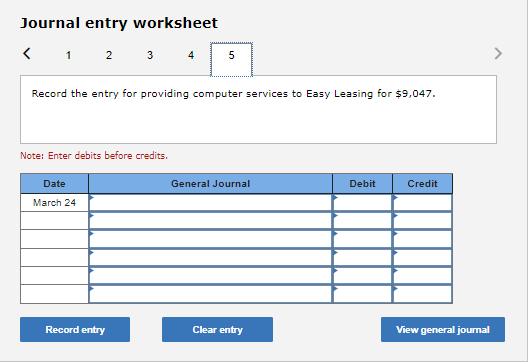

Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and Its IIst of customers has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer. The following chart of accounts Includes the account number used for each account and any balance as of December 31, 2021. Santana Rey decided to add a fourth diglt with a decimal point to the 106 account number that had been used for the single Accounts Recelvable account. This change allows the company to continue using the existing chart of accounts. In response to requests from customers, S. Rey will begin selling computer software. The company will extend credlt terms of 1/10, n/30, FOB shipping point, to all customers who purchase this merchandise. However, no cash discount is avallable on consulting fees. Additional accounts (Nos. 119, 413, 414, 415, and 502) are added to Its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow: wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional $25, e cash in the company. invoice dated January 7. January 9 The company received $2,668 cash from Gomez company as ful1 payment on its account. of $7, less the advance payment of $1,5. The company debited Unearned Computer Services Revenue for $1, seg. January 13. Assume that Santana Rey expands Business Solutions' system to Include special Joumals. Requlred: 2. \& 3. Enter the Business Solutions transactions for January through March in a sales journal, cash recelpts journal, purchases journal, and cash payments Journal or general Journal. If the transaction does not specify the name of the payee, state "not specified" In the Payee column of the cash payments journal. The transactions on the following dates should be journalized in the general journal: January 5, 11, 20, and 24 and March 24. Do not record and post the adjusting entrles for the end of March. Complete this question by entering your answers in the tabs below. Enter the Business Solutions transactions for January through March in a sales journal. Enter the Business Solutions transactions for January through March in a cash receipts journal. Enter the Business Solutions transactions for January through March in a purchases journal. Enter the Business Solutions transactions for January through March in a cash payments journal. If the transaction does not specify the name of the payee, state "not specified" in the Payee column of the cash payments journal. Enter the Business Solutions transactions for January through March in a general journal. The transactions on the following dates should be journalized in the general journal: January 5,11,20,24 and March 24 . Do not record and post the adjusting entries for the end of March. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 5 Record the additional cash investment by Santana Rey. Note: Enter debits before credits. Journal entry worksheet Record the entry for completion of a five-day project for Alex's Engineering Company and billing it $5,500, which is the total price of $7,000 less the advance payment of $1,500. The company debited Unearned Computer Services Revenue for $1,500. Note: Enter debits before credits. Journal entry worksheet Record the entry for allowance of $500 given by the company to Liu Corporation. Note: Enter debits before credits. Journal entry worksheet 1 Record the entry for return of defective merchandise which had a $496 cost. Note: Enter debits before credits. Journal entry worksheet 1 2 Record the entry for providing computer services to Easy Leasing for $9,047. Note: Enter debits before credits