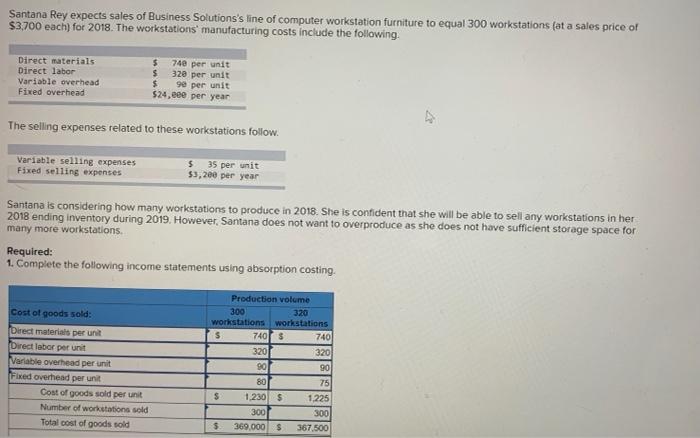

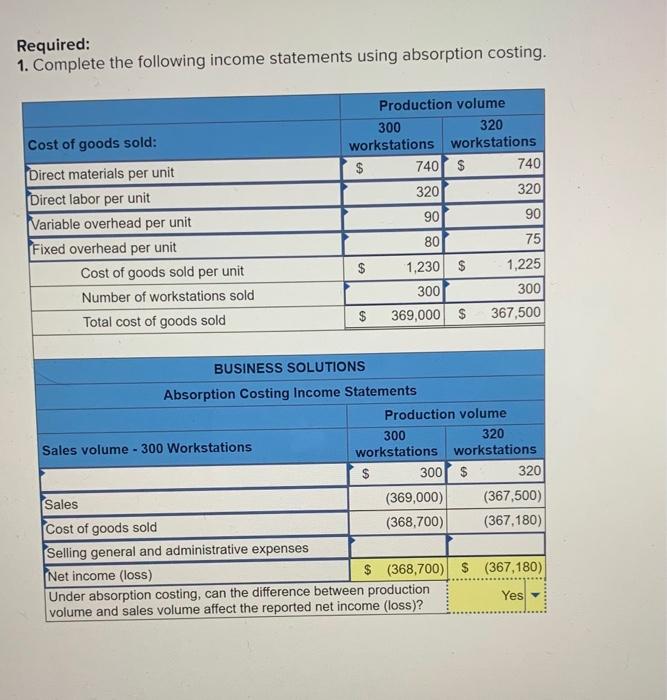

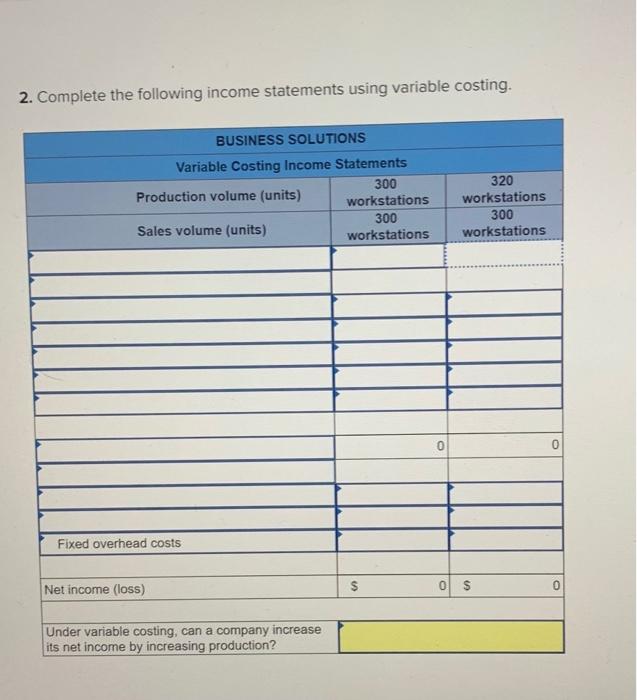

Santana Rey expects sales of Business Solutions's line of computer workstation furniture to equal 300 workstations (at a sales price of $3.700 each) for 2018. The workstations' manufacturing costs include the following Direct materials Direct labor Variable overhead Fixed overhead 5 740 per unit $ 320 per unit $ 9e per unit $24,eee per year The selling expenses related to these workstations follow. Variable selling expenses Fixed selling expenses $ 35 per unit 33,2ee per year Santana is considering how many workstations to produce in 2018. She is confident that she will be able to sell any workstations in her 2018 ending inventory during 2019. However, Santana does not want to overproduce as she does not have sufficient storage space for many more workstations, Required: 1. Complete the following income statements using absorption costing. Cost of goods sold: Direct materials per unit Direct labor per unit Variable overhead per unit Fixed overhead per unit Cost of goods sold per unit Number of workstations sold Total cost of goods sold Production volume 300 320 workstations workstations 7407 s 7401 320 320 90 90 80 75 $ 1.2305 1.225 300 300 $ 369.000 $ 367.500 $ Required: 1. Complete the following income statements using absorption costing. 300 Cost of goods sold: Direct materials per unit Direct labor per unit Variable overhead per unit Fixed overhead per unit Cost of goods sold per unit Number of workstations sold Total cost of goods sold Production volume 320 workstations workstations $ 740 $ 740 320 320 90 90 80 75 $ 1,230 $ 1,225 300 300 $ 369,000 $ 367,500 BUSINESS SOLUTIONS Absorption Costing Income Statements Production volume 300 320 Sales volume - 300 Workstations workstations workstations $ 300 $ 320 Sales (369,000) (367,500) Cost of goods sold (368,700) (367,180) Selling general and administrative expenses Net income (loss) $ (368,700) $ (367,180) Under absorption costing, can the difference between production Yes volume and sales volume affect the reported net income (loss)? 2. Complete the following income statements using variable costing. BUSINESS SOLUTIONS Variable Costing Income Statements 300 Production volume (units) workstations 300 Sales volume (units) workstations 320 workstations 300 workstations 0 Fixed overhead costs Net income (loss) $ 0 $ Under variable costing, can a company increase its net income by increasing production