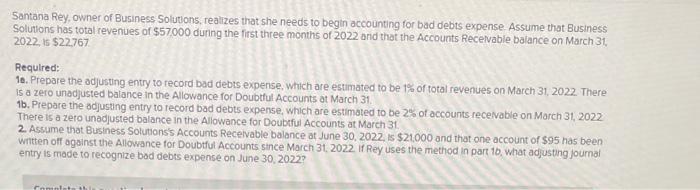

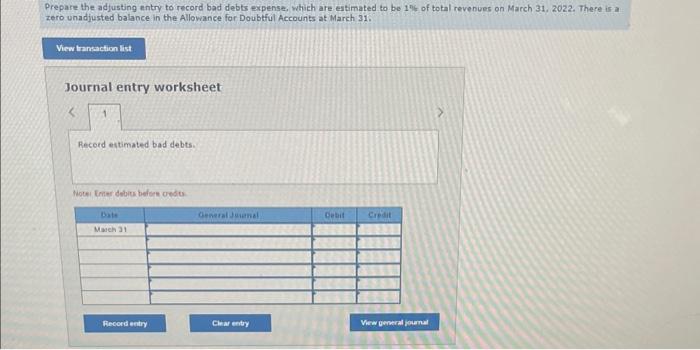

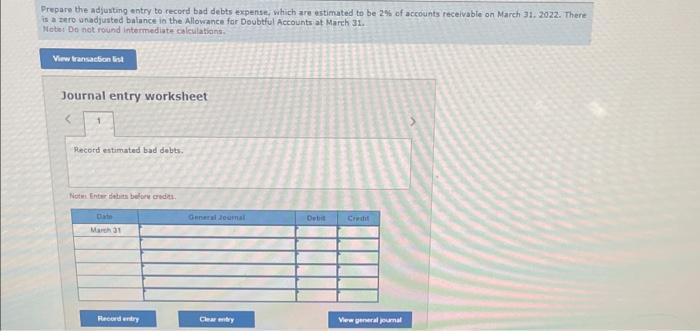

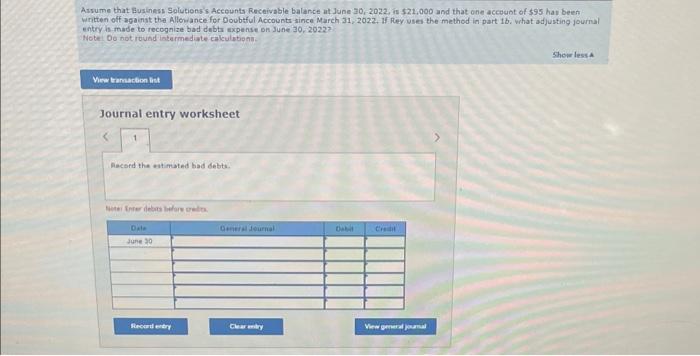

Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad debts expense. Assume that Business Solutions has total revenues of $57,000 dunng the first three months of 2022 and that the Accounts Recelvable baiance on March 31 , 2022,15$22767 Requlred: 10. Prepare the adjusting entry to record bad debts expense, which are estimated to be 1% of total revenues on March 31, 2022. There is a zero unadjusted balance in the Allowance for Doubtul Accounts at March 31. 16. Prepare the odjusting entry to record bad debts expense, which are estimated to be 2% of accounts recevable on March 31,2022 There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31 2. Assume that Business Solutions's Accounts Recelvable balance at June 30,2022 is $21,000 and that one account of $95 has been Written off against the Allowance for Doubtful Accounts since March 31, 2022. If Rey uses the method in part 10, what adjusting journal entry is made to recognize bod debts expense on June 30,2022? Prepare the adjusting entry to record bad debts expense, which are estimated to be 10 of total revenues on March 31, 2022. There is a zero unadjusted balance in the Allowance for Doubtful Accourits at March 31 . Journal entry worksheet Record estimated bad debts. Howe lmer debiu beftern oudts. Prepare the adjusting entry to cecord bad debts expense- which are estimated to be 24 of accounts receivable on March 31.2022 . There is a zero anadjusted balance io the Allowance for Doubtful Accounts at March 32 . Note: Do not round intermediate calculatians. Journal entry worksheet Record estimated bad dobts. Notes Entmr dithith berloru ardath. Assume that Business Solutions's Accounts Receivable balance at June 30,2022, is 521,000 and that one accuunt of $95 hav been Written off againit the Allowance for Doubfful Accounts aince March 31,2022 . If Rey uses the method in part 1b. what adjusting journal entry is made to recognize bad debts sxpense on June 30,29227 . Note 00 hot rovind intermediate cakulatipni. Journal entry worksheet Recsed the outimated bad debts. Eyher Inrer desera luefors treilr