Answered step by step

Verified Expert Solution

Question

1 Approved Answer

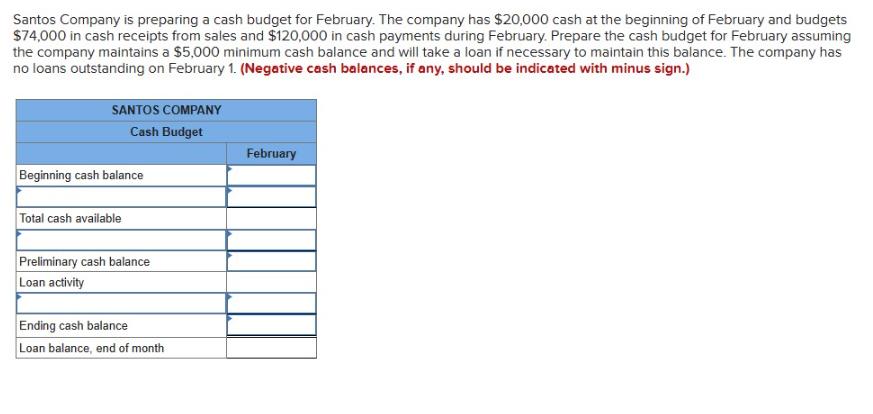

Santos Company is preparing a cash budget for February. The company has $20,000 cash at the beginning of February and budgets $74,000 in cash

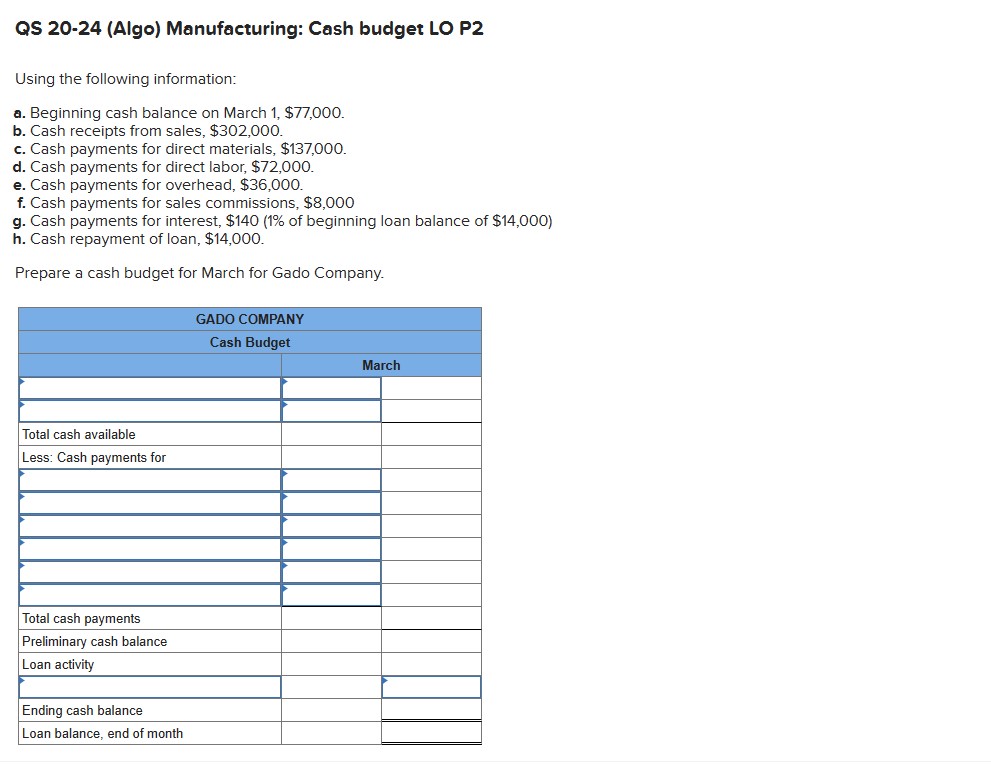

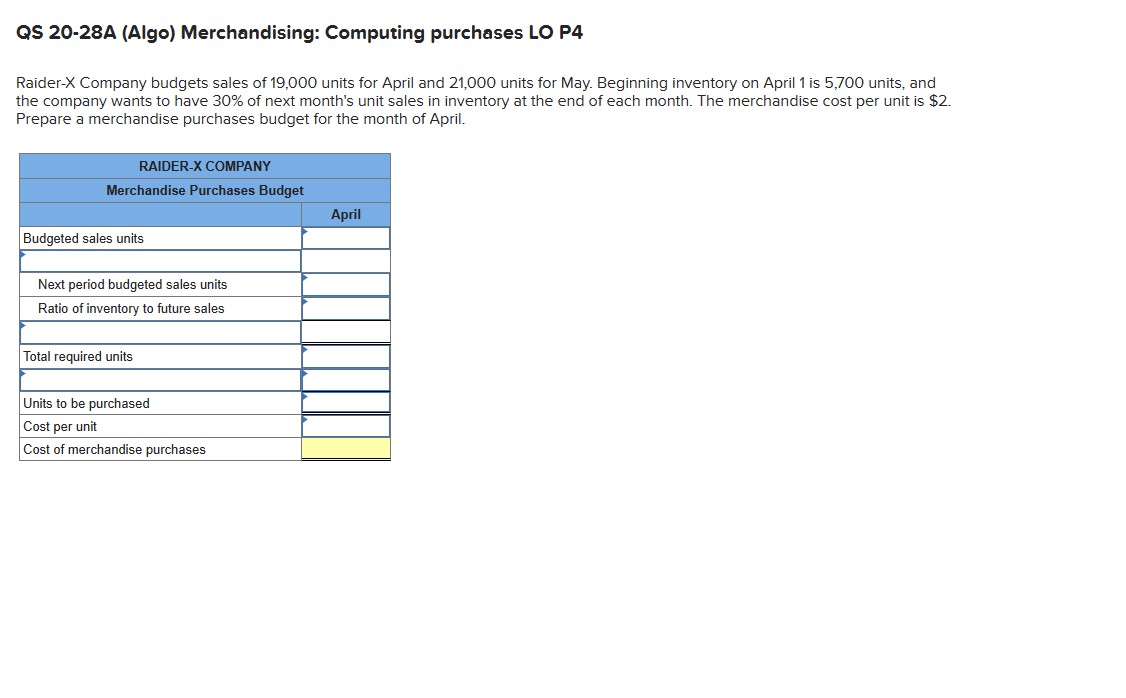

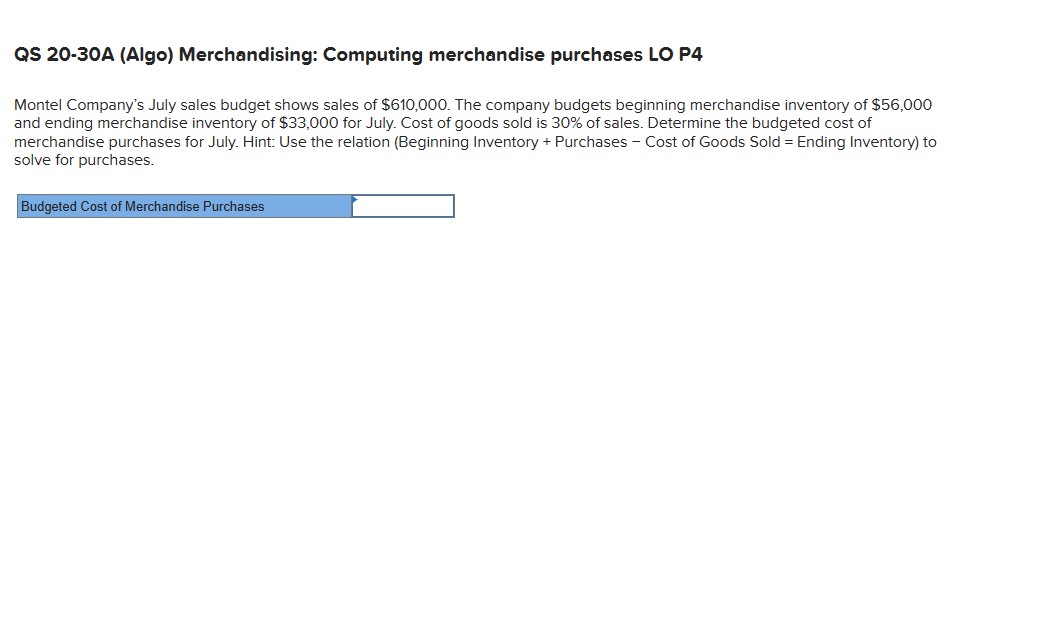

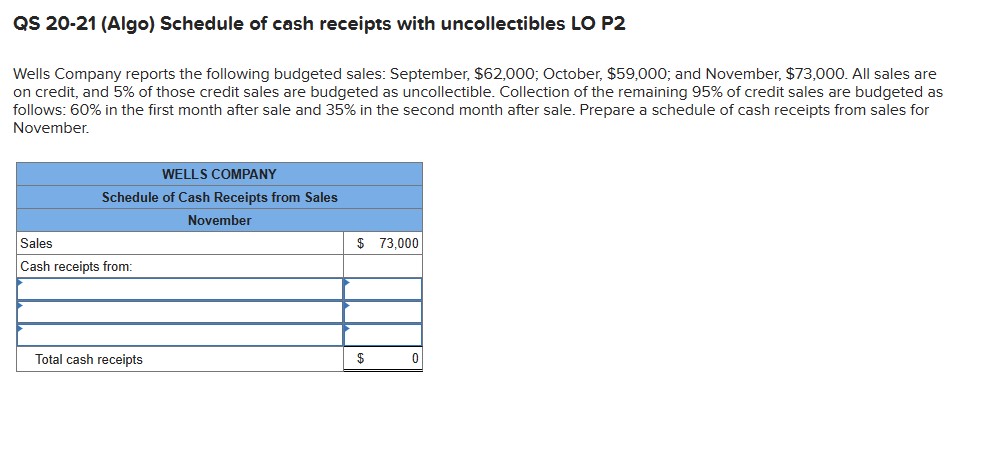

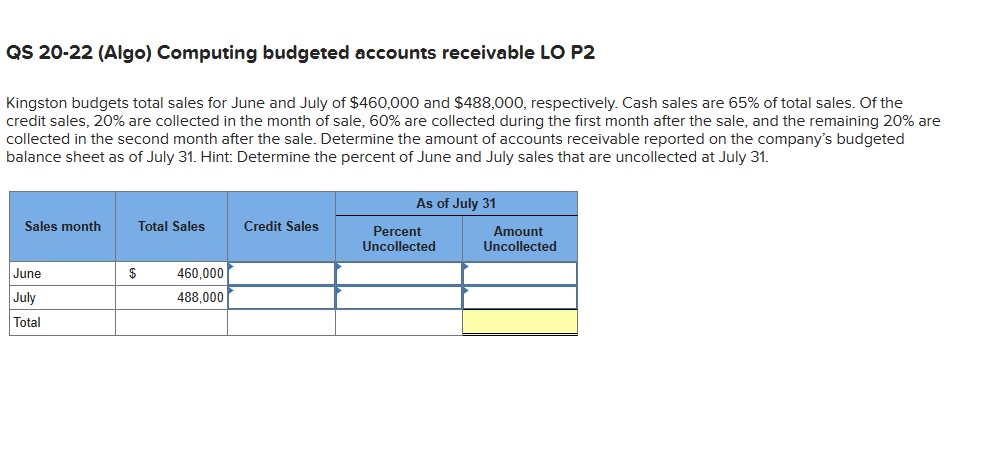

Santos Company is preparing a cash budget for February. The company has $20,000 cash at the beginning of February and budgets $74,000 in cash receipts from sales and $120,000 in cash payments during February. Prepare the cash budget for February assuming the company maintains a $5,000 minimum cash balance and will take a loan if necessary to maintain this balance. The company has no loans outstanding on February 1. (Negative cash balances, if any, should be indicated with minus sign.) SANTOS COMPANY Cash Budget Beginning cash balance Total cash available Preliminary cash balance Loan activity Ending cash balance Loan balance, end of month February QS 20-24 (Algo) Manufacturing: Cash budget LO P2 Using the following information: a. Beginning cash balance on March 1, $77,000. b. Cash receipts from sales, $302,000. c. Cash payments for direct materials, $137,000. d. Cash payments for direct labor, $72,000. e. Cash payments for overhead, $36,000. f. Cash payments for sales commissions, $8,000 g. Cash payments for interest, $140 (1% of beginning loan balance of $14,000) h. Cash repayment of loan, $14,000. Prepare a cash budget for March for Gado Company. Total cash available Less: Cash payments for Total cash payments Preliminary cash balance Loan activity Ending cash balance Loan balance, end of month GADO COMPANY Cash Budget March QS 20-28A (Algo) Merchandising: Computing purchases LO P4 Raider-X Company budgets sales of 19,000 units for April and 21,000 units for May. Beginning inventory on April 1 is 5,700 units, and the company wants to have 30% of next month's unit sales in inventory at the end of each month. The merchandise cost per unit is $2. Prepare a merchandise purchases budget for the month of April. RAIDER-X COMPANY Merchandise Purchases Budget April Budgeted sales units Next period budgeted sales units Ratio of inventory to future sales Total required units Units to be purchased Cost per unit Cost of merchandise purchases QS 20-30A (Algo) Merchandising: Computing merchandise purchases LO P4 Montel Company's July sales budget shows sales of $610,000. The company budgets beginning merchandise inventory of $56,000 and ending merchandise inventory of $33,000 for July. Cost of goods sold is 30% of sales. Determine the budgeted cost of merchandise purchases for July. Hint: Use the relation (Beginning Inventory + Purchases - Cost of Goods Sold - Ending Inventory) to solve for purchases. Budgeted Cost of Merchandise Purchases QS 20-21 (Algo) Schedule of cash receipts with uncollectibles LO P2 Wells Company reports the following budgeted sales: September, $62,000; October, $59,000; and November, $73,000. All sales are on credit, and 5% of those credit sales are budgeted as uncollectible. Collection of the remaining 95% of credit sales are budgeted as follows: 60% in the first month after sale and 35% in the second month after sale. Prepare a schedule of cash receipts from sales for November. Sales WELLS COMPANY Schedule of Cash Receipts from Sales Cash receipts from: November $ 73,000 Total cash receipts $ 0 QS 20-22 (Algo) Computing budgeted accounts receivable LO P2 Kingston budgets total sales for June and July of $460,000 and $488,000, respectively. Cash sales are 65% of total sales. Of the credit sales, 20% are collected in the month of sale, 60% are collected during the first month after the sale, and the remaining 20% are collected in the second month after the sale. Determine the amount of accounts receivable reported on the company's budgeted balance sheet as of July 31. Hint: Determine the percent of June and July sales that are uncollected at July 31. As of July 31 Sales month Total Sales Credit Sales Percent Uncollected Amount Uncollected June July Total $ 460,000 488,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started