Question

Santos Marketing Specialists Maria Santos has worked as a marketing specialist for a company in the New York area for many years. Due to a

Santos Marketing Specialists

Maria Santos has worked as a marketing specialist for a company in the New York area for many years. Due to a relocation she has decided instead of finding another job working for someone else she will open her own company. She will pay herself a $105,000 per year salary.

Marias family and friends are so excited for her and think that she will have terrific success as she has the knowledge, drive, and personality to run a successful marketing company. They all agree to become investors and buy shares of stock worth a total of $225,000.

In January 2, 20x1 she opened the doors for her company Santos Marketing Specialists. In preparation for opening Maria has hired three employees. One is a Marketing Specialist earning $78,000 per year, one an entry level Marketer at $42,180 per year and a graphic artist at $57,600 per year. Employees will be paid once a month. Paychecks will be received the Friday after the end of a month, this includes her paycheck too.

Maria rented a location slightly outside of Boston to save on rent coasts. She found a self-standing building which she can rent for $10,500 per month. Because she was new to the business the landlord required 6-months rent paid up front.

A contract for internet at $295/month and a cell phone plan, for four phones at $220/month/phone was signed by Maria and started on January 1.

Maria also purchased insurance policies, one for the company cars for $6,120 and one to insure her business for $22,980. Since she is a new account the insurance company required her to pay for the first years policies up front on the day the insurance was purchased.

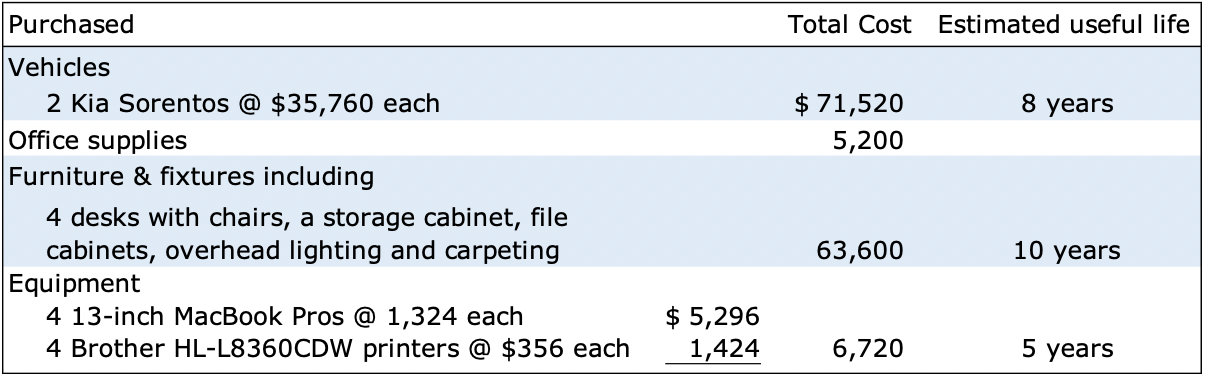

Maria also made the additional purchases:

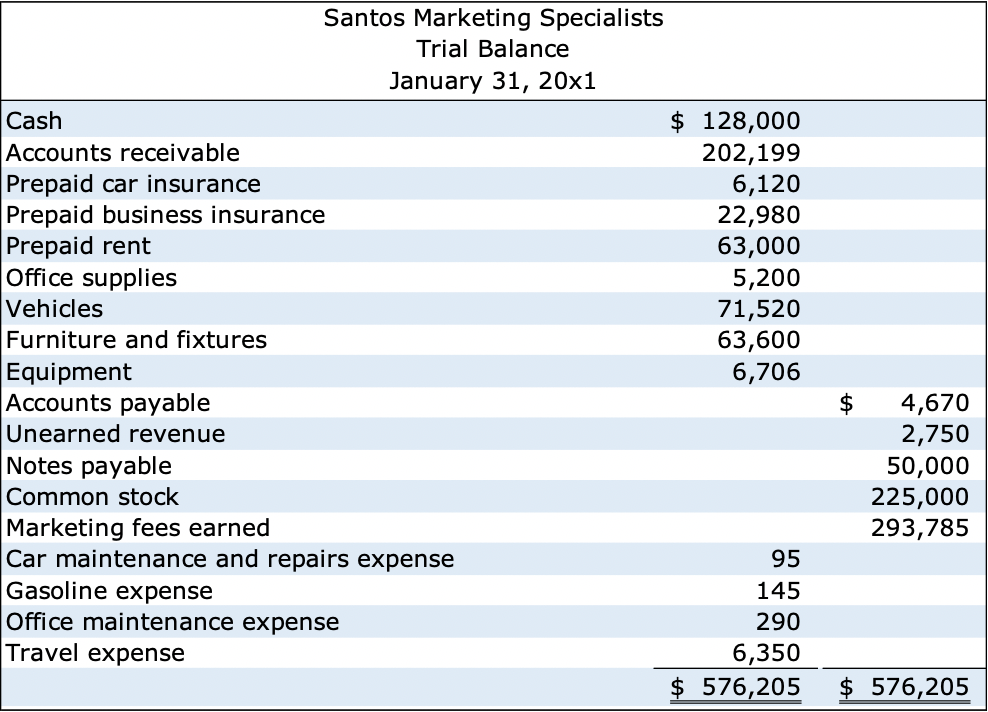

One month has passed since Marias business started. She has already made all of the journal entries required for the day-to-day transactions and they have all been posted. Since Marias business is new she wants to be sure she knows exactly how she is doing each month. Therefore she will close her books at the end of every month for the first year. She has already started the process by preparing Januarys trial balance. You are an accounting student from a nearby university who is interning for Maria. You just started at the end of January. Maria has asked you to first finish the books for January before February starts.

- Prepare and post the adjusting entries

- Prepare the financial statements for the month

- Close out the accounts.

Maria knows from the information given above about salaries and how often they will be paid, her purchases, her contracts, how many months in advance she paid for some purchases, and the useful lives of her fixed assets you will already be able to do most of the adjusting entries with no further information. As of the last day of the month no entries have been made for any of the monthly expenses discussed above. She does provide the following additional information for you

- All of the unearned revenue has been earned.

- 60% of the supplies have been used up.

- The note was taken out on the 2nd to help pay for the two cars purchased. The note has a 3.45% interest rate. The loan agreement states that monthly interest needs to be paid at the end of every month with the principle borrowed to be paid at the end of 5 years. Maria did not record the interest yet. When you record it she wants it paid also.

- The company did not receive a utility bill yet but research tells Maria that the company used $215 worth of electricity. The bill wont be paid until the actual printed bill is received.

- The bill for the internet and cell phones should be here soon.

HINTS:

- To do the adjusting entries, and to be sure you get all of them, start rereading this problem from the very top. Each time you read something that discusses a transaction which will required an adjusting entry make the adjusting entry. If you do this carefully you will not miss any.

- Dont forget this is for one month only so be careful on entries such as depreciation.

When recording journal entries ALL work must be shown. If you are using Excel, and using it properly you work can be through your properly done formulas referring to the cells where numbers are coming from. If you decide to do this by hand include an extra piece of paper with your work. Make sure all this work is properly labeled so there is no question which calculations go with which entry. This will be easiest if you assign a letter to every adjusting entry and then use those letters to title your work. Round all numbers to the closest dollar amount. This should not need to be done often. I tried to stick to whole numbers as often as possible.

Once you have completed the books for January, Maria asks you to do all of the accounting needed for the entire month of February. This means you will start with the day-to-day entries and take the company through the close of February. Make sure you do not miss any of the steps in the accounting cycle.

Here are the day-to-day transactions from February.

2nd Purchased $2,850 worth of office supplies on credit.

3rd Paid the interest on the loan which accrued in January.

4th Received and paid the phone and internet bill.

5th It is the first Friday after January, all employees are paid.

7th Had routine maintenance done on the heating system with a cost of $280 the company paid cash for the service.

10th Filled the gas tanks of both cars on account $68.

14th Changed the oil in both cars $54.

17th Received $25,600 in advance for a small marketing campaign which will run from the last week of February the first three weeks of March.

18th Paid $6,250 on account.

20th Received $185,000 on account.

24th Ordered a larger printer that can print larger, poster sized window advertisements and print smaller pamphlets more quickly and efficiently. The printer should come in mid-March.

27th Completed travel to visit a client. Total cost of travel was $4,840.

28th The company signed contracts worth $168,500 in early February. All of the work required on those contracts was completed in February. 40% of the customers paid immediately upon completion. The remaining customers asked to be billed.

28th Since the company did so well in January Maria decides to pay off the note payable early. Of course they owe for this months interest as well as the principal.

28th Paid $25,000 in dividends.

The following information is needed for the adjusting entries.

- Most of the information you already have from what you did in January so first go through all of last months entries to see what entries you might need to make again this month.

- There are $1,675 worth of office supplies not used.

REMINDER! ALL I NEED IS THE FOLLOWING:

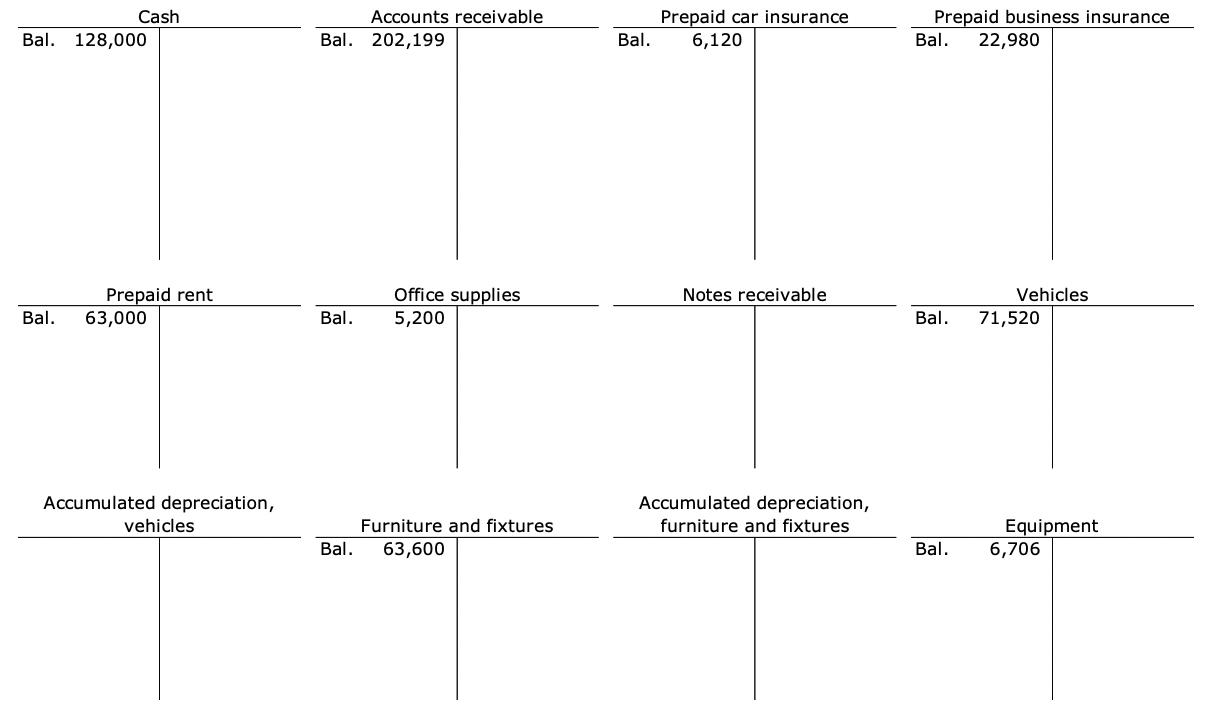

-All T-accounts filled in, disregard trial balances for January and February

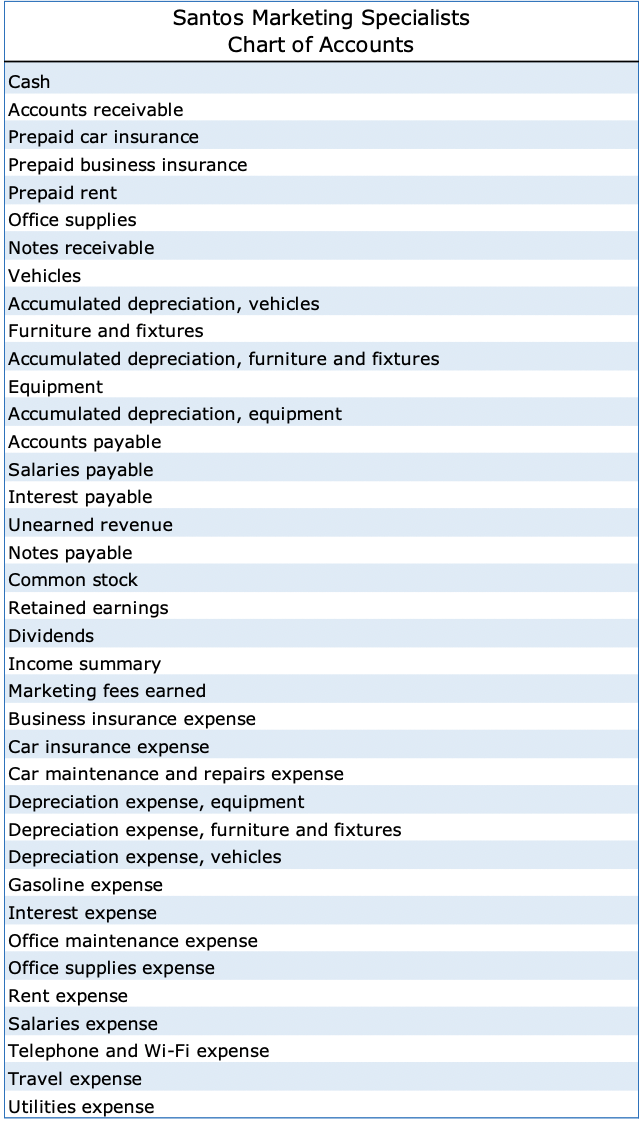

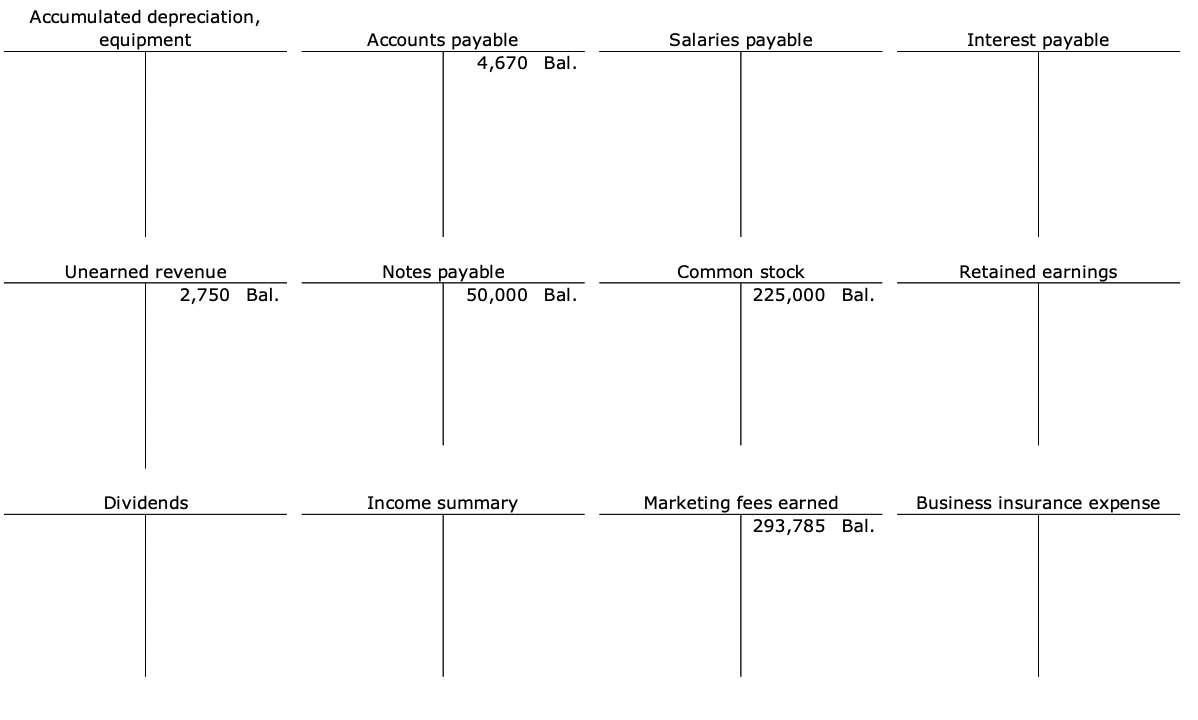

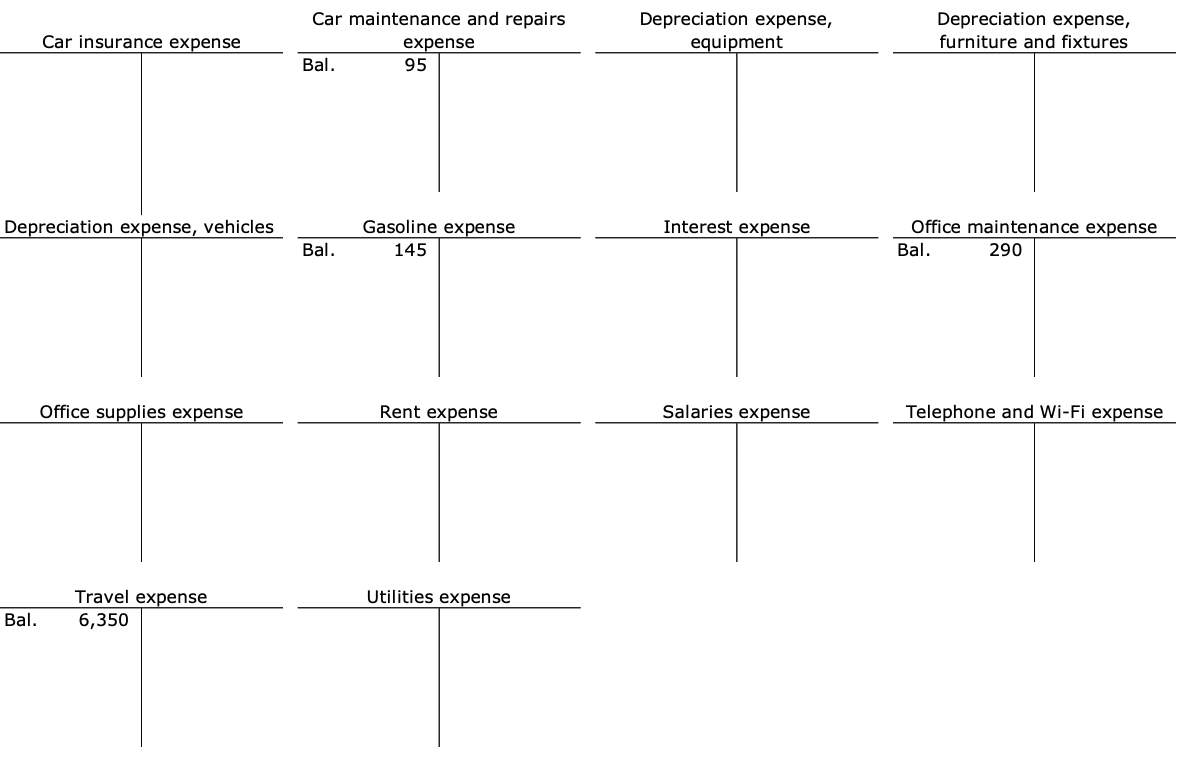

Purchased Total Cost Estimated useful life 8 years $ 71,520 5,200 Vehicles 2 Kia Sorentos @ $35,760 each Office supplies Furniture & fixtures including 4 desks with chairs, a storage cabinet, file cabinets, overhead lighting and carpeting Equipment 4 13-inch MacBook Pros @ 1,324 each 4 Brother HL-L8360CDW printers @ $356 each 63,600 10 years $ 5,296 1,424 6,720 5 years Santos Marketing Specialists Chart of Accounts Cash Accounts receivable Prepaid car insurance Prepaid business insurance Prepaid rent Office supplies Notes receivable Vehicles Accumulated depreciation, vehicles Furniture and fixtures Accumulated depreciation, furniture and fixtures Equipment Accumulated depreciation, equipment Accounts payable Salaries payable Interest payable Unearned revenue Notes payable Common stock Retained earnings Dividends Income summary Marketing fees earned Business insurance expense Car insurance expense Car maintenance and repairs expense Depreciation expense, equipment Depreciation expense, furniture and fixtures Depreciation expense, vehicles Gasoline expense Interest expense Office maintenance expense Office supplies expense Rent expense Salaries expense Telephone and Wi-Fi expense Travel expense Utilities expense Santos Marketing Specialists Trial Balance January 31, 20x1 Cash $ 128,000 Accounts receivable 202,199 Prepaid car insurance 6,120 Prepaid business insurance 22,980 Prepaid rent 63,000 Office supplies 5,200 Vehicles 71,520 Furniture and fixtures 63,600 Equipment 6,706 Accounts payable Unearned revenue Notes payable Common stock Marketing fees earned Car maintenance and repairs expense 95 Gasoline expense 145 Office maintenance expense 290 Travel expense 6,350 $ 576,205 $ 4,670 2,750 50,000 225,000 293,785 $ 576,205 Cash 128,000 Accounts receivable Bal. 202,199 Prepaid car insurance 6,120 Prepaid business insurance Bal. 22,980 Bal. Bal. Notes receivable Prepaid rent 63,000 Office supplies 5,200 Vehicles 71,520 Bal. Bal. Bal. Accumulated depreciation, vehicles Accumulated depreciation, furniture and fixtures Furniture and fixtures Bal. 63,600 Bal. Equipment 6,706 Accumulated depreciation, equipment Accounts payable 4,670 Bal. Salaries payable Interest payable Retained earnings Unearned revenue 2,750 Bal. Notes payable 50,000 Bal. Common stock 225,000 Bal. Dividends Income summary Business insurance expense Marketing fees earned 293,785 Bal. Car maintenance and repairs expense Bal. 95 Depreciation expense, equipment Depreciation expense, furniture and fixtures Car insurance expense Depreciation expense, vehicles Interest expense Gasoline expense 145 Office maintenance expense Bal. 290 Bal. Office supplies expense Rent expense Salaries expense Telephone and Wi-Fi expense Utilities expense Travel expense 6,350 BalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started