Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sapitec Bank is South Africa's fastest growing bank. They are focused on the middle to lower income groups. They strive to simplify banking and have

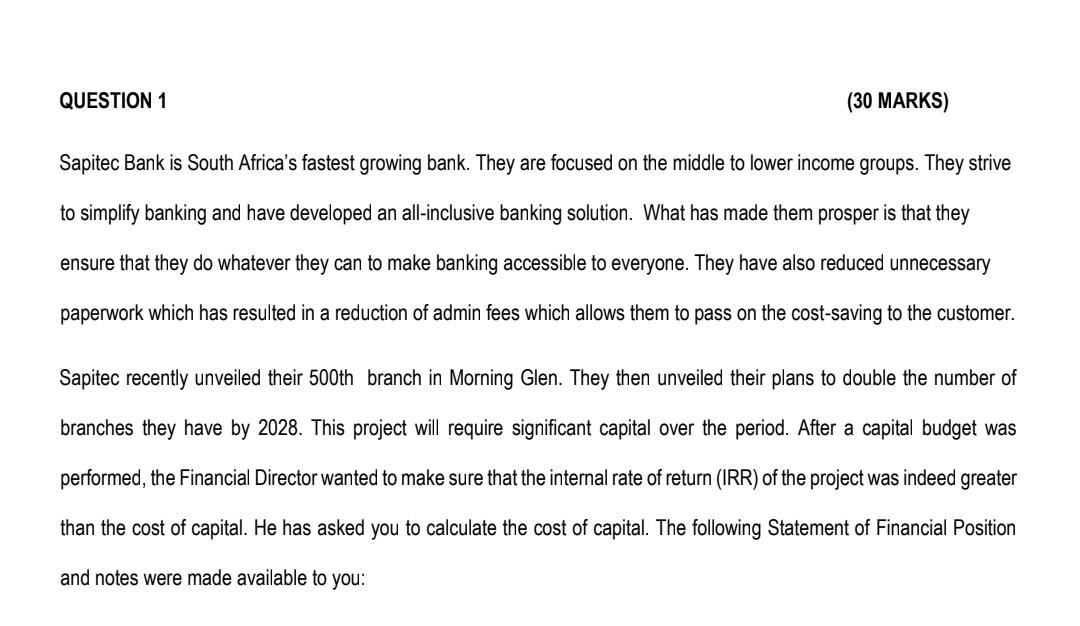

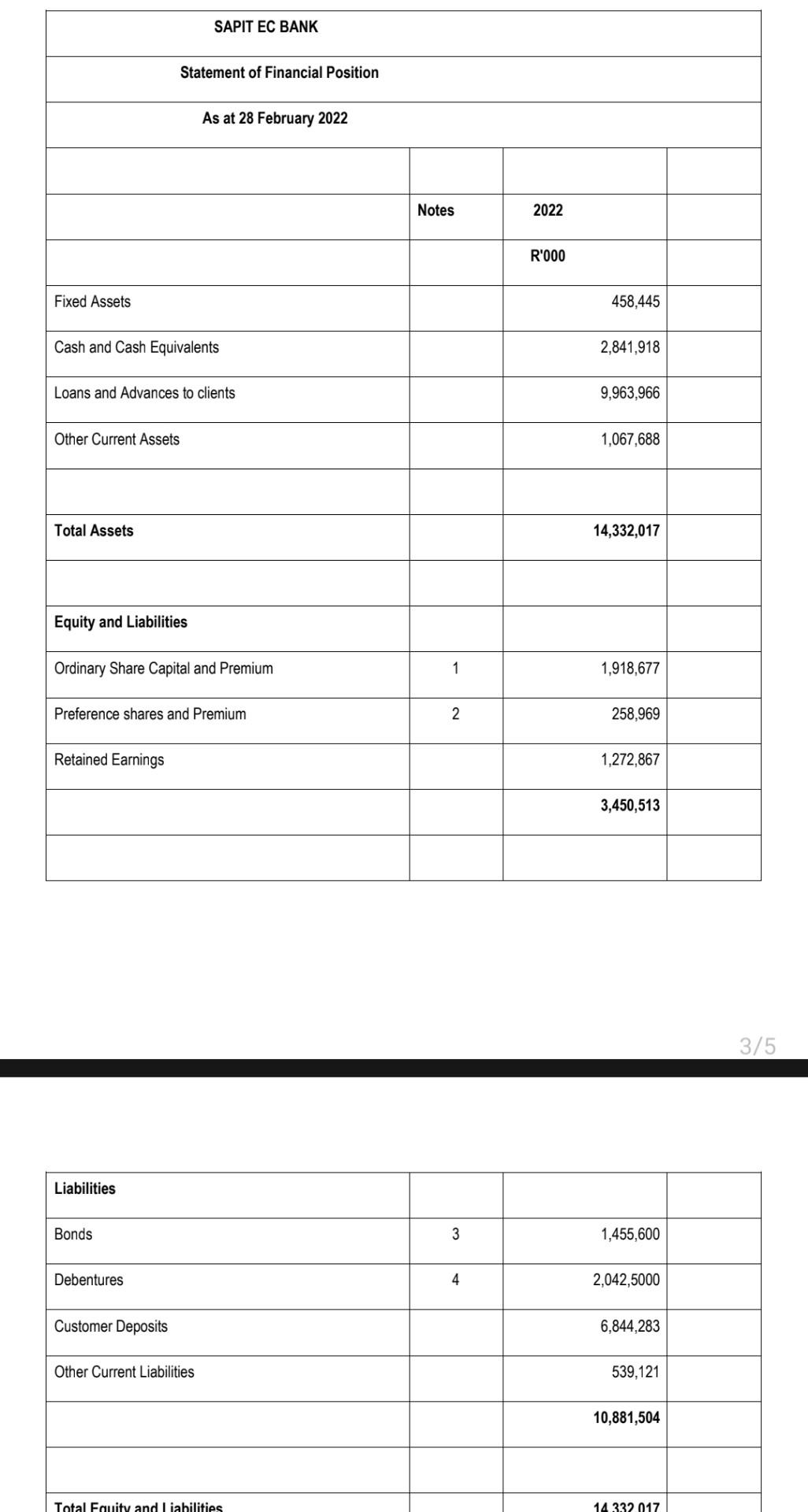

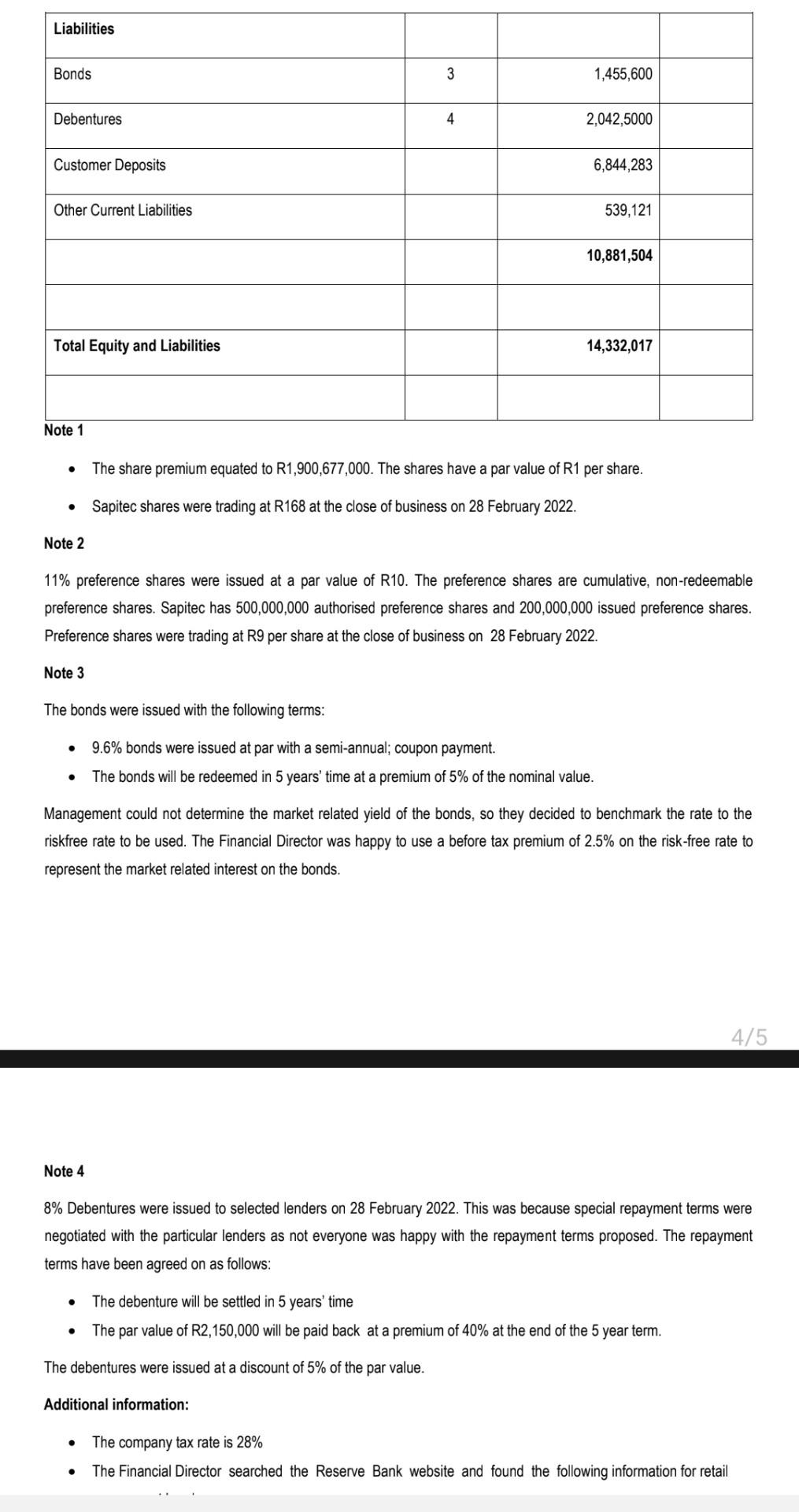

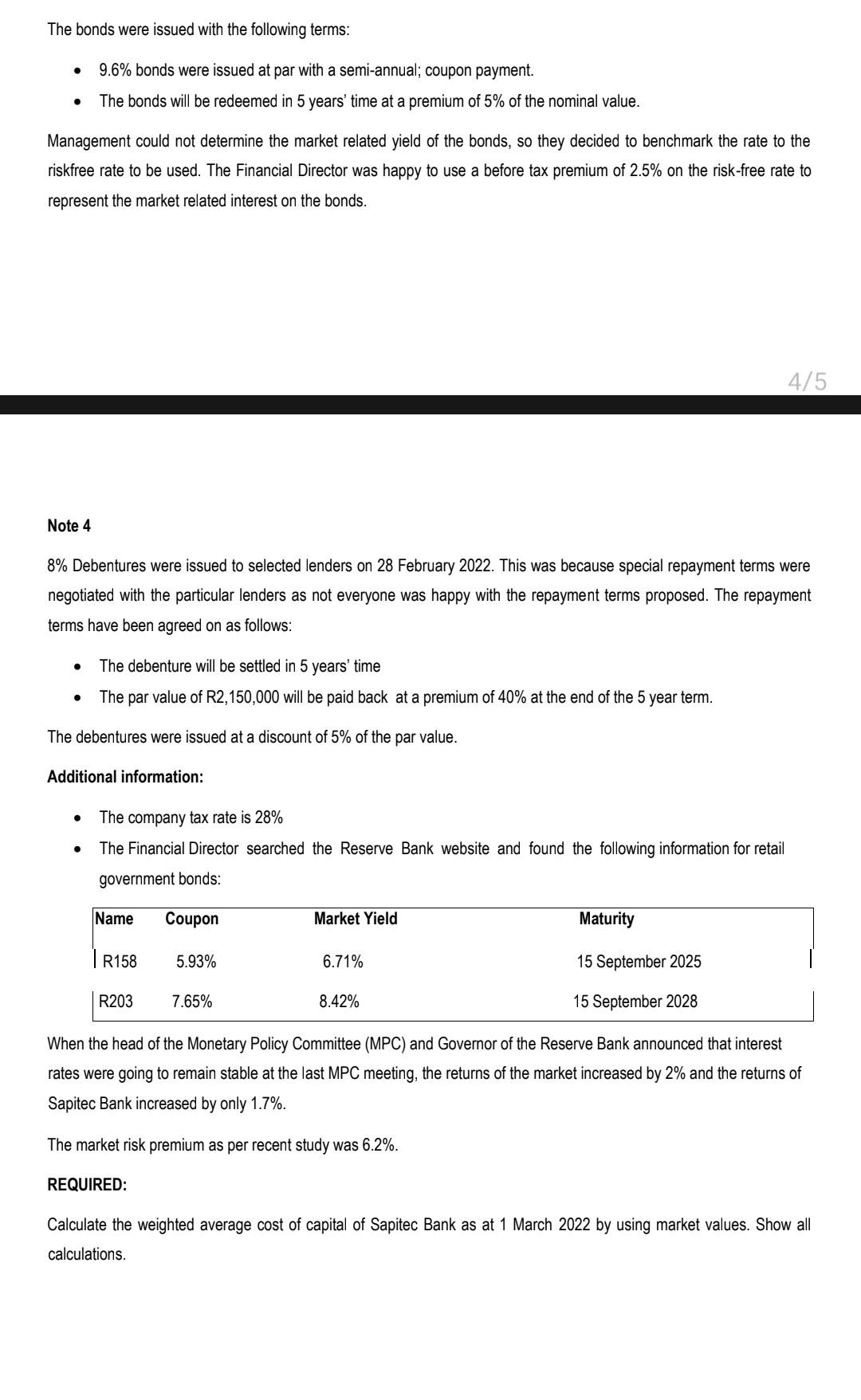

Sapitec Bank is South Africa's fastest growing bank. They are focused on the middle to lower income groups. They strive to simplify banking and have developed an all-inclusive banking solution. What has made them prosper is that they ensure that they do whatever they can to make banking accessible to everyone. They have also reduced unnecessary paperwork which has resulted in a reduction of admin fees which allows them to pass on the cost-saving to the customer. Sapitec recently unveiled their 500 th branch in Morning Glen. They then unveiled their plans to double the number of branches they have by 2028. This project will require significant capital over the period. After a capital budget was performed, the Financial Director wanted to make sure that the internal rate of return (IRR) of the project was indeed greater than the cost of capital. He has asked you to calculate the cost of capital. The following Statement of Financial Position and notes were made available to you: \\( 3 / 5 \\) \\begin{tabular}{|l|r|r|l|} \\hline Liabilities & & & \\\\ \\hline Bonds & 3 & \\( 1,455,600 \\) & \\\\ \\hline Debentures & 4 & \\( 2,042,5000 \\) & \\\\ \\hline Customer Deposits & & \\( 6,844,283 \\) & \\\\ \\hline Other Current Liabilities & & 539,121 & \\\\ \\hline & & \\( 10,881,504 \\) & \\\\ \\hline & & & \\\\ \\hline Total Fouitv and I iahilities & & 14332017 & \\\\ \\hline \\end{tabular} The bonds were issued with the following terms: - \9.6 bonds were issued at par with a semi-annual; coupon payment. - The bonds will be redeemed in 5 years' time at a premium of \5 of the nominal value. Management could not determine the market related yield of the bonds, so they decided to benchmark the rate to the riskfree rate to be used. The Financial Director was happy to use a before tax premium of \2.5 on the risk-free rate to represent the market related interest on the bonds. Note 4 \8 Debentures were issued to selected lenders on 28 February 2022. This was because special repayment terms were negotiated with the particular lenders as not everyone was happy with the repayment terms proposed. The repayment terms have been agreed on as follows: - The debenture will be settled in 5 years' time - The par value of R2,150,000 will be paid back at a premium of \40 at the end of the 5 year term. The debentures were issued at a discount of \5 of the par value. Additional information: - The company tax rate is \28 - The Financial Director searched the Reserve Bank website and found the following information for retail government bonds: When the head of the Monetary Policy Committee (MPC) and Governor of the Reserve Bank announced that interest rates were going to remain stable at the last MPC meeting, the returns of the market increased by \2 and the returns of Sapitec Bank increased by only \1.7. The market risk premium as per recent study was \6.2. REQUIRED: Calculate the weighted average cost of capital of Sapitec Bank as at 1 March 2022 by using market values. Show all calculations. - The share premium equated to \\( \\mathrm{R} 1,900,677,000 \\). The shares have a par value of \\( \\mathrm{R} 1 \\) per share. - Sapitec shares were trading at R168 at the close of business on 28 February 2022. Note 2 \11 preference shares were issued at a par value of R10. The preference shares are cumulative, non-redeemable preference shares. Sapitec has 500,000,000 authorised preference shares and 200,000,000 issued preference shares. Preference shares were trading at R9 per share at the close of business on 28 February 2022. Note 3 The bonds were issued with the following terms: - \9.6 bonds were issued at par with a semi-annual; coupon payment. - The bonds will be redeemed in 5 years' time at a premium of \5 of the nominal value. Management could not determine the market related yield of the bonds, so they decided to benchmark the rate to the riskfree rate to be used. The Financial Director was happy to use a before tax premium of \2.5 on the risk-free rate to represent the market related interest on the bonds. Note 4 \8 Debentures were issued to selected lenders on 28 February 2022. This was because special repayment terms were negotiated with the particular lenders as not everyone was happy with the repayment terms proposed. The repayment terms have been agreed on as follows: - The debenture will be settled in 5 years' time - The par value of \\( \\mathrm{R} 2,150,000 \\) will be paid back at a premium of \40 at the end of the 5 year term. The debentures were issued at a discount of \5 of the par value. Additional information: - The company tax rate is \28 - The Financial Director searched the Reserve Bank website and found the following information for retail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started