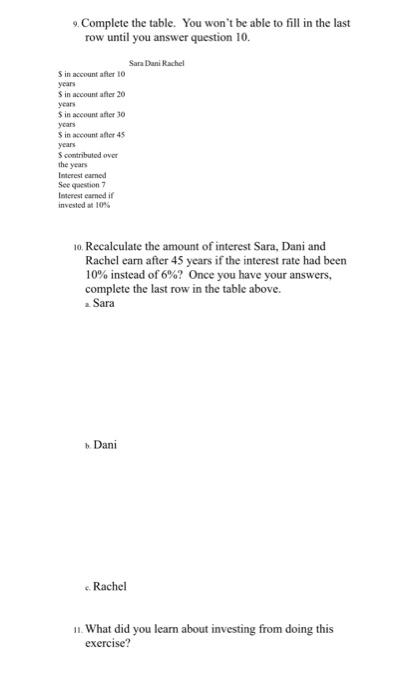

Sara, Dani and Rachel are triplets. Their grandparents decided to set up a trust for each of them that would pay out 53,000 each year, starting when they turned 20 , and would continue until they were 65 . Although the triplets appeared to have similar tastes, they had different perspectives on investing money. Sara learned at an carly age to be concerned about ber future and became fiscally conservative, investing her trust funds each year in a savings program earning 6% interest compounded annually until she turned 65 . She delayed vacations until she secured a job and could afford vacations out of her own salary. Dani was concemed about her future as well, so she also invested her trust funds of $3000 each year in a savings program earning 6% interest compounded annually. However, Dani decided after 10 years, at age 30 , to stop investing the $3000. Instead she started to spend the $3000 on vacations skiing in Utah each year and she continued to do this until she tumed 65. Although she stopped making additional deposits each year into her trust fund, sbe never withdrew the moncy and allowed the balance to stay in the account and earn 6% interest compounded annually. Rachel loved to play and thought that life was too short to be overly concerned about saving for the future. For 20 years, she spent her annual trust fund on vacations in Hawaii. At age 40 , she began to realize that there might come a day where she might not be able to work and would need funds to support herself. She began to invest her annual funds in a savings program earning 6% compounded annually. She continued to do this until she tumed 65 . Although the triplets were close, they never discussed finances until their joint 65 th birthday party. They began to compare their retirement plans. Each sister was proud of her savings and showed the others a spreadsheet describing her savings plans and accumulations. Let's see what happened with each of the retirement/ savings plans. 1. Predict which sister had the most money in her retirement account based on her savings plan? Do you think Dani or Rachel will have more money at age 65 in their account? Why do you think that? 2. Al age 65 (after 45 years since each girl is 20 when she starts receiving the money). a. How much moncy had Sara contributed to her savings program? b. How much money had Dani contributed? c. How much moncy had Rachel contributed? 3. a. How much money does. Sara have after 10 years? b. How much moncy does Dani have after 10 years? c. How much money does Rachel have after 10 years? 4. a. How much money does Sara have after 20 years? b. How much money does Dani have after 20 years? (Give some thought to what equation you need to use.) c. How much moncy does Rachel have after 20 years? 5. a. How much moncy docs Sara have after 30 years? b. How much money does Dani have after 30 years? c. How much moncy does Rachel have after 30 years? 6. a. How much money does Sara have after 45 years? b. How much money does Dani have after 45 years? c. How much money does Rachel have after 45 years? 7. Calculate the interest that each girl earned? Be sure to take into account how much each girl contributed over the years (see question 2). a. Sara b. Dani c. Rachel 8. Do you think Dani or Rachel's plan was best? Which would you prefer to follow in a savings program? Why? (Consider how much each of them contributed and how much each of them made.) 9. Complete the table. You won't be able to fill in the last row until you answer question 10 . 10. Recalculate the amount of interest Sara, Dani and Rachel earn after 45 years if the interest rate had been 10% instead of 6% ? Once you have your answers, complete the last row in the table above. 2. Sara b. Dani c. Rachel 11. What did you learn about investing from doing this exercise