Answered step by step

Verified Expert Solution

Question

1 Approved Answer

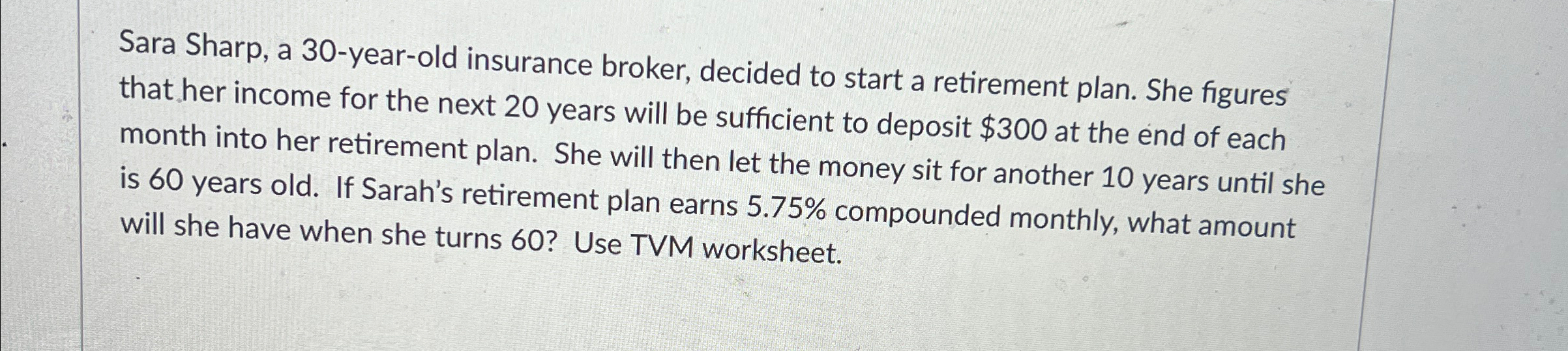

Sara Sharp, a 3 0 - year - old insurance broker, decided to start a retirement plan. She figures that her income for the next

Sara Sharp, a yearold insurance broker, decided to start a retirement plan. She figures that her income for the next years will be sufficient to deposit $ at the end of each month into her retirement plan. She will then let the money sit for another years until she is years old. If Sarah's retirement plan earns compounded monthly, what amount will she have when she turns Use TVM worksheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started