Question

Sarah and Jason Worzala were married a year ago, and they are thinking about buying a home. They have saved $14,000 to put toward

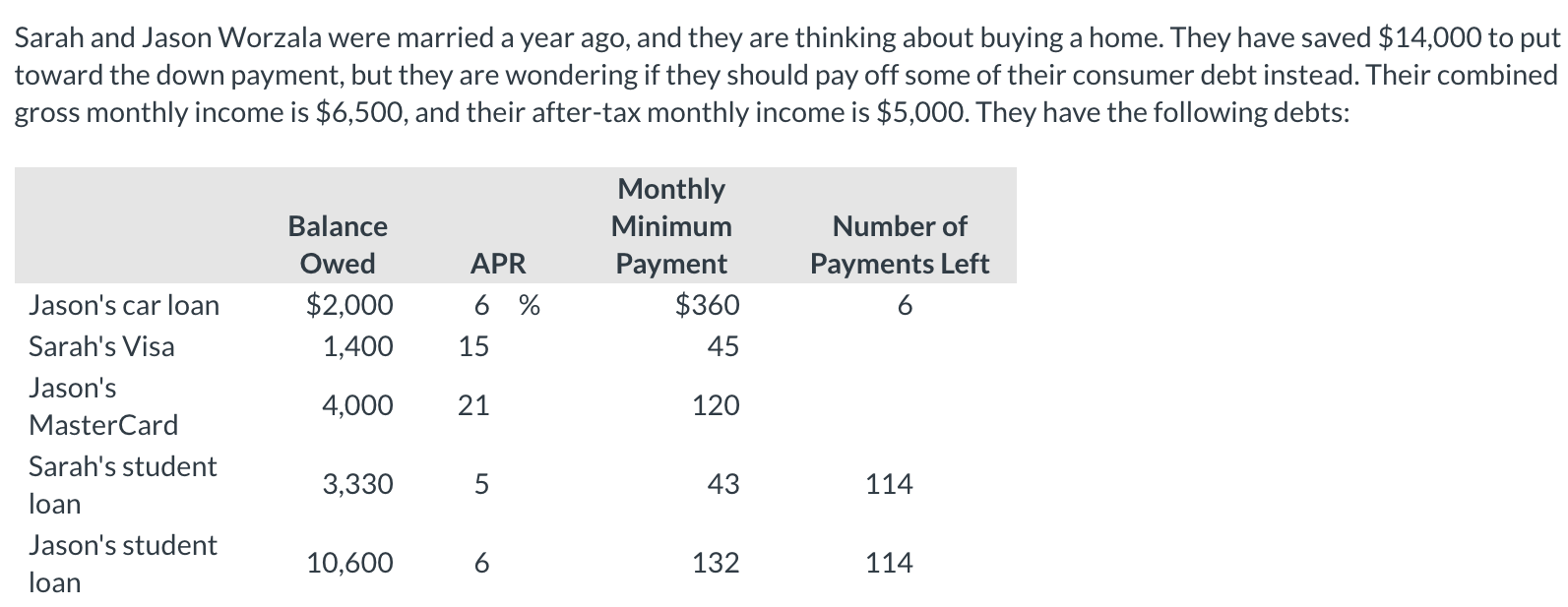

Sarah and Jason Worzala were married a year ago, and they are thinking about buying a home. They have saved $14,000 to put toward the down payment, but they are wondering if they should pay off some of their consumer debt instead. Their combined gross monthly income is $6,500, and their after-tax monthly income is $5,000. They have the following debts: Balance Owed Monthly Minimum APR Payment Number of Payments Left Jason's car loan $2,000 6 % $360 6 Sarah's Visa 1,400 15 45 Jason's 4,000 21 120 MasterCard Sarah's student 3,330 5 43 114 loan Jason's student 10,600 6 132 114 loan

Step by Step Solution

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Before deciding whether to pay off some of their consumer debt or use the money toward a down paymen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Services Marketing

Authors: Jochen Wirtz

4th Edition

1292425199, 9781292425191

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App