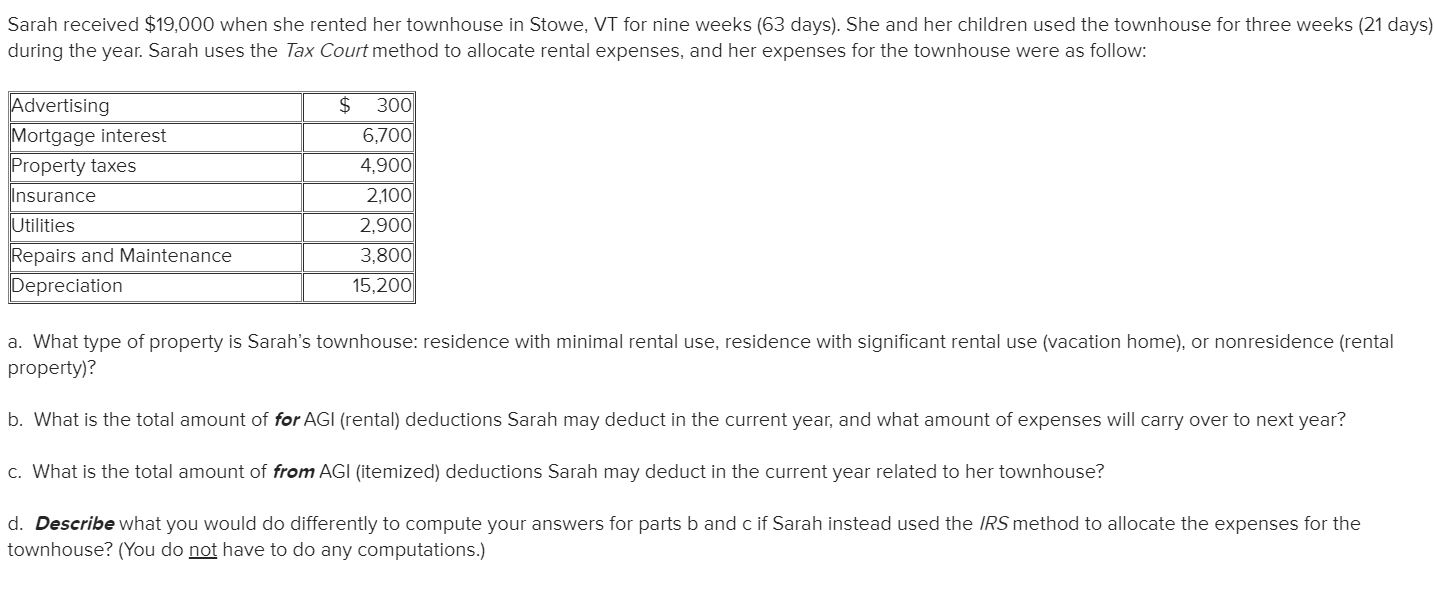

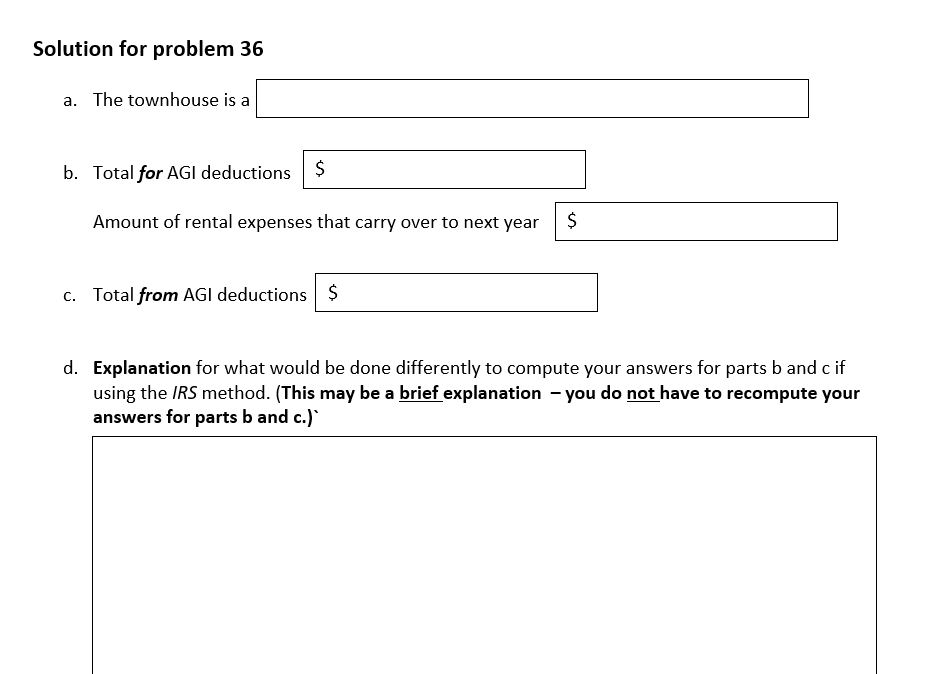

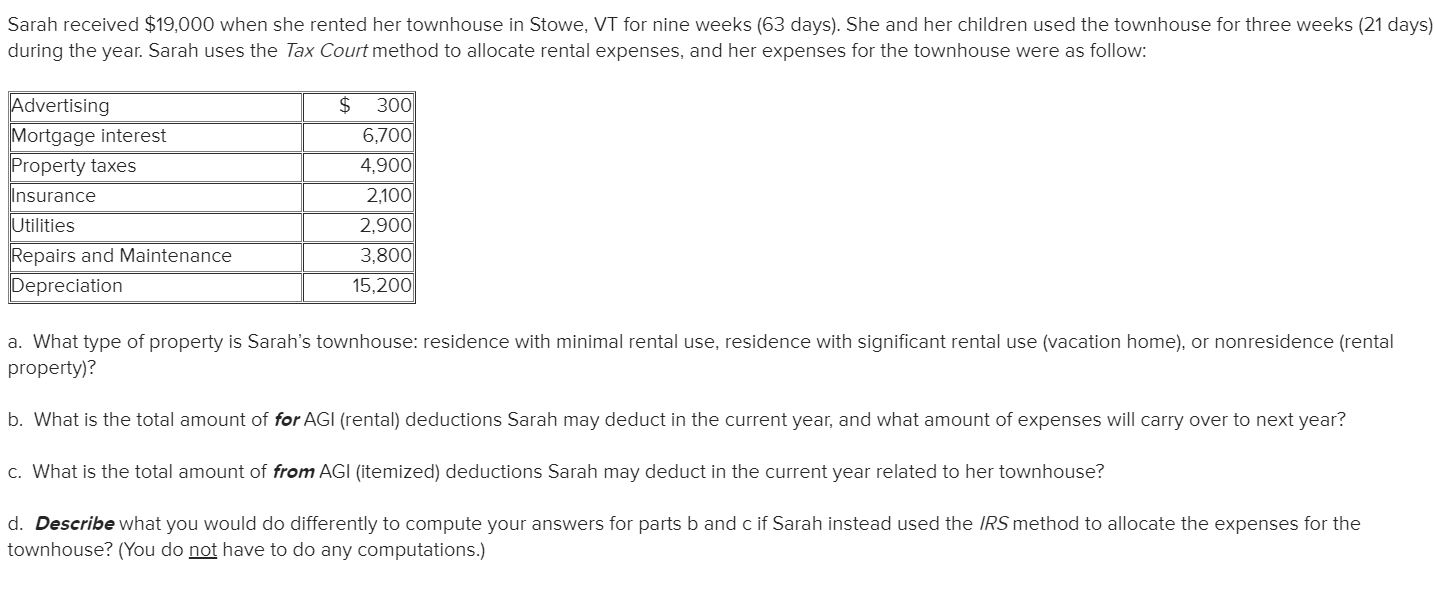

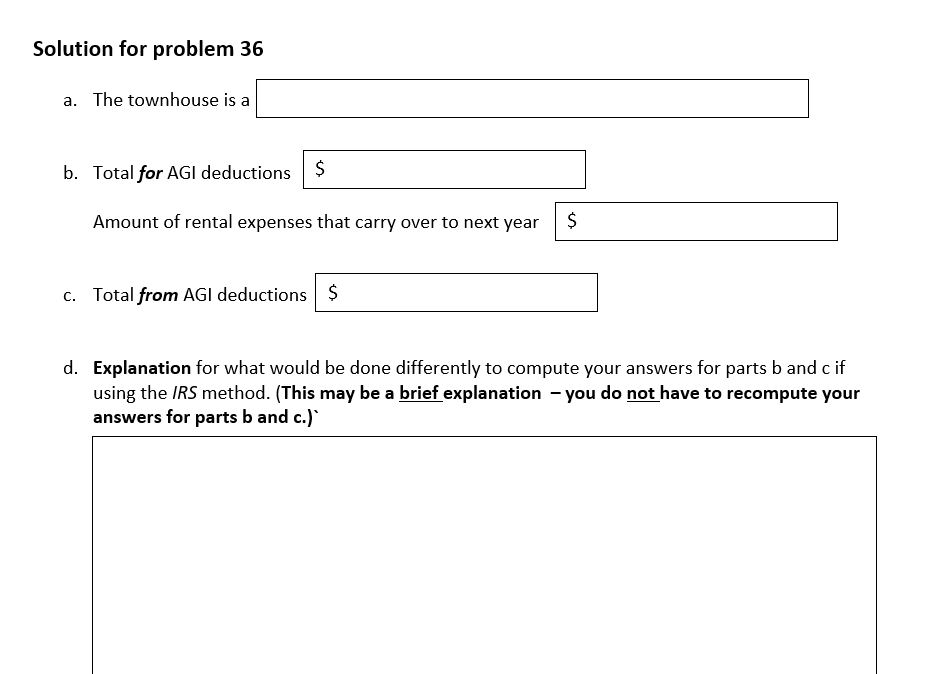

Sarah received $19,000 when she rented her townhouse in Stowe, VT for nine weeks (63 days). She and her children used the townhouse for three weeks (21 days) during the year. Sarah uses the Tax Court method to allocate rental expenses, and her expenses for the townhouse were as follow: $ Advertising Mortgage interest Property taxes Insurance Utilities Repairs and Maintenance Depreciation 300 6,700 4,900 2,100 2,900 3,800 15,200 a. What type of property is Sarah's townhouse: residence with minimal rental use, residence with significant rental use (vacation home), or nonresidence (rental property)? b. What is the total amount of for AGI (rental) deductions Sarah may deduct in the current year, and what amount of expenses will carry over to next year? C. What is the total amount of from AGI (itemized) deductions Sarah may deduct in the current year related to her townhouse? d. Describe what you would do differently to compute your answers for parts b and c if Sarah instead used the IRS method to allocate the expenses for the townhouse? (You do not have to do any computations.) Solution for problem 36 a. The townhouse is a b. Total for AGI deductions $ Amount of rental expenses that carry over to next year c. Total from AGI deductions $ d. Explanation for what would be done differently to compute your answers for parts b and cif using the IRS method. (This may be a brief explanation - you do not have to recompute your answers for parts b and c.)" Sarah received $19,000 when she rented her townhouse in Stowe, VT for nine weeks (63 days). She and her children used the townhouse for three weeks (21 days) during the year. Sarah uses the Tax Court method to allocate rental expenses, and her expenses for the townhouse were as follow: $ Advertising Mortgage interest Property taxes Insurance Utilities Repairs and Maintenance Depreciation 300 6,700 4,900 2,100 2,900 3,800 15,200 a. What type of property is Sarah's townhouse: residence with minimal rental use, residence with significant rental use (vacation home), or nonresidence (rental property)? b. What is the total amount of for AGI (rental) deductions Sarah may deduct in the current year, and what amount of expenses will carry over to next year? C. What is the total amount of from AGI (itemized) deductions Sarah may deduct in the current year related to her townhouse? d. Describe what you would do differently to compute your answers for parts b and c if Sarah instead used the IRS method to allocate the expenses for the townhouse? (You do not have to do any computations.) Solution for problem 36 a. The townhouse is a b. Total for AGI deductions $ Amount of rental expenses that carry over to next year c. Total from AGI deductions $ d. Explanation for what would be done differently to compute your answers for parts b and cif using the IRS method. (This may be a brief explanation - you do not have to recompute your answers for parts b and c.)