Question

Saratoga Ag Industries has 14,000,000 shares outstanding with a current stock price of $4.00. The company is going to declare a one-for-six reverse stock

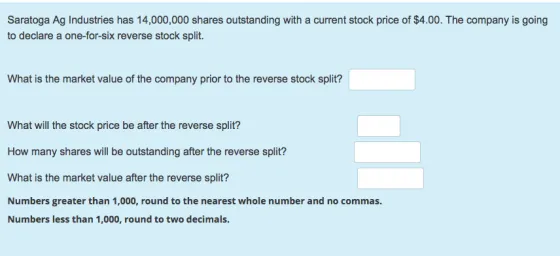

Saratoga Ag Industries has 14,000,000 shares outstanding with a current stock price of $4.00. The company is going to declare a one-for-six reverse stock split. What is the market value of the company prior to the reverse stock split? What will the stock price be after the reverse split? How many shares will be outstanding after the reverse split? What is the market value after the reverse split? Numbers greater than 1,000, round to the nearest whole number and no commas. Numbers less than 1,000, round to two decimals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Saratoga Ag Industries Reverse Stock Split Analysis Market Value Before Split O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

4th Edition

1439078084, 978-1439078082

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App