Answered step by step

Verified Expert Solution

Question

1 Approved Answer

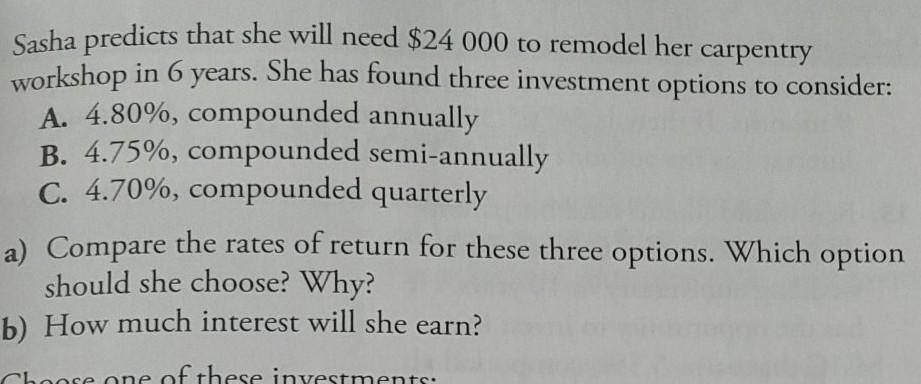

Sasha predicts that she will need $24 000 to remodel her carpentry workshop in 6 years. She has found three investment options to consider: A.

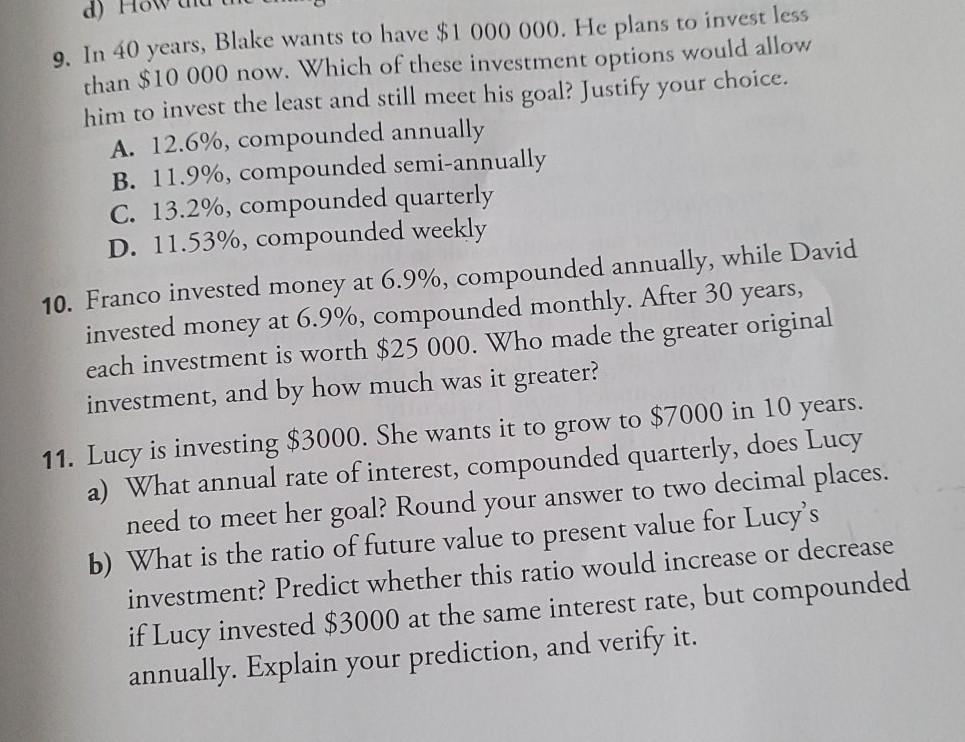

Sasha predicts that she will need $24 000 to remodel her carpentry workshop in 6 years. She has found three investment options to consider: A. 4.80%, compounded annually B. 4.75%, compounded semi-annually C. 4.70%, compounded quarterly a) Compare the rates of return for these three options. Which option should she choose? Why? b) How much interest will she earn? Choose one of these investments. d) 9. In 40 years, Blake wants to have $ 1 000 000. He plans to invest less than $10 000 now. Which of these investment options would allow him to invest the least and still meet his goal? Justify your choice. A. 12.6%, compounded annually B. 11.9%, compounded semi-annually C. 13.2%, compounded quarterly D. 11.53%, compounded weekly 10. Franco invested money at 6.9%, compounded annually, while David invested money at 6.9%, compounded monthly. After 30 years, each investment is worth $25 000. Who made the greater original investment, and by how much was it greater? 11. Lucy is investing $3000. She wants it to grow to $7000 in 10 years. a) What annual rate of interest, compounded quarterly, does Lucy need to meet her goal? Round your answer to two decimal places. b) What is the ratio of future value to present value for Lucy's investment? Predict whether this ratio would increase or decrease if Lucy invested $3000 at the same interest rate, but compounded annually. Explain your prediction, and verify it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started