Answered step by step

Verified Expert Solution

Question

1 Approved Answer

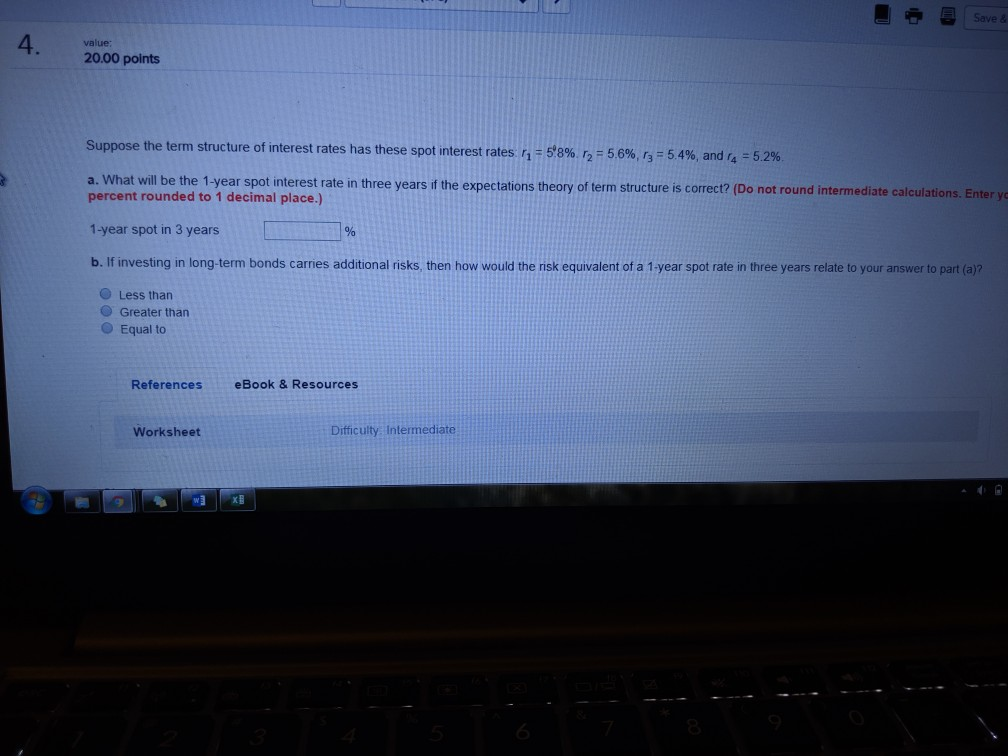

Save & 4. value: 20.00 points Suppose the term structure of interest rates has these spot interest rates 11 = 5'8%. r2 = 5.6%, r

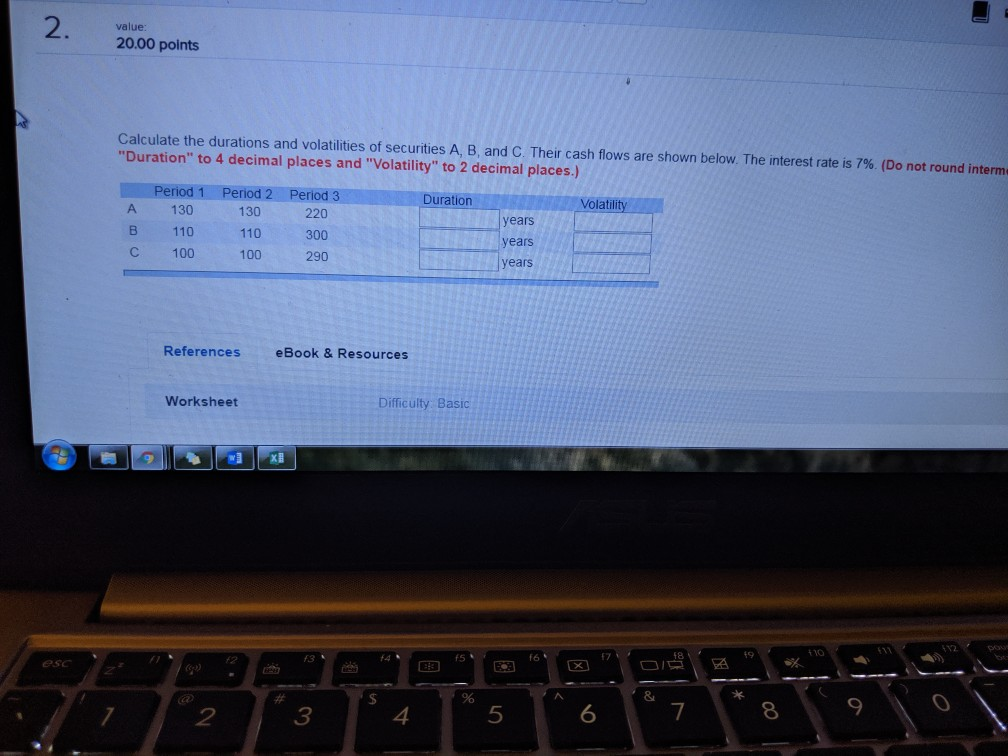

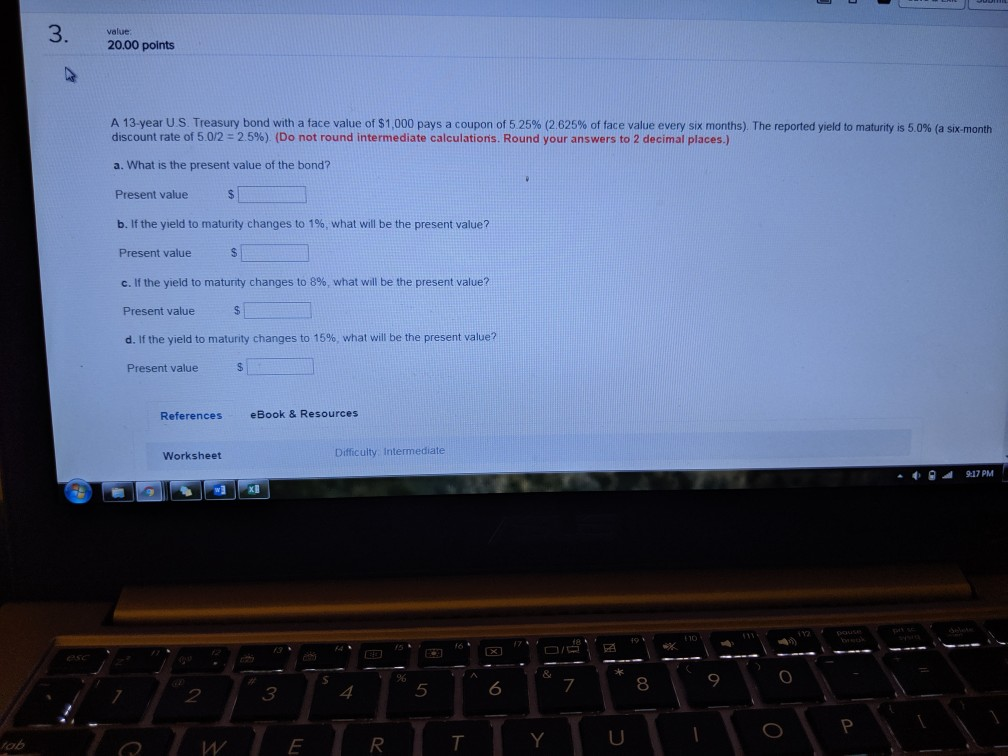

Save & 4. value: 20.00 points Suppose the term structure of interest rates has these spot interest rates 11 = 5'8%. r2 = 5.6%, r = 5.4%, andra = 5.2% a. What will be the 1-year spot interest rate in three years if the expectations theory of term structure is correct? (Do not round intermediate calculations. Enter ve percent rounded to 1 decimal place.) 1-year spot in 3 years b. If investing in long-term bonds carries additional risks, then how would the risk equivalent of a 1 year spot rate in three years relate to your answer to part (a)? Less than Greater than Equal to References eBook & Resources Worksheet Difficulty. Intermediate 2. value: 20.00 points Calculate the durations and volatilities of securities A, B, and C. Their cash flows are shown below. The interest rate is 7%. (Do not round interm "Duration" to 4 decimal places and "Volatility" to 2 decimal places. Duration Volatility A B Period 1 130 110 Period 2 130 110 100 Period 3 220 300 290 years years years 100 References eBook & Resources Worksheet Difficulty Basic esc 4. * 5 6 & 7 * 8 9 lo 3. value 20.00 points A 13-year U.S. Treasury bond with a face value of $1,000 pays a coupon of 5.25% (2.625% of face value every six months). The reported yield to maturity is 5.0% (a six-month discount rate of 5.0/2 = 2.5%). (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. What is the present value of the bond? Present value b. If the yield to maturity changes to 1%, what will be the present value? Present value c. If the yield to maturity changes to 8%, what will be the present value? Present value d. If the yield to maturity changes to 15%, what will be the present value? Present value References eBook & Resources Worksheet Difficulty intermediate 94 9:17 PM lab THEIR Telur

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started