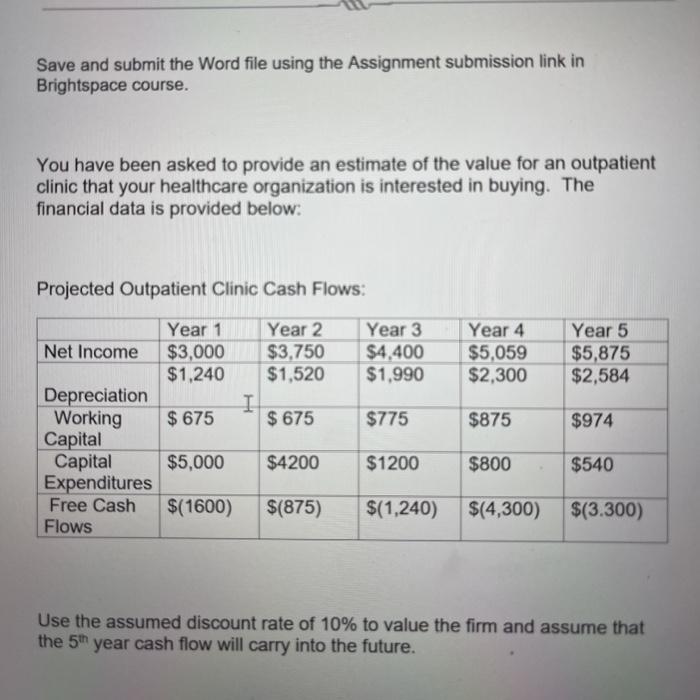

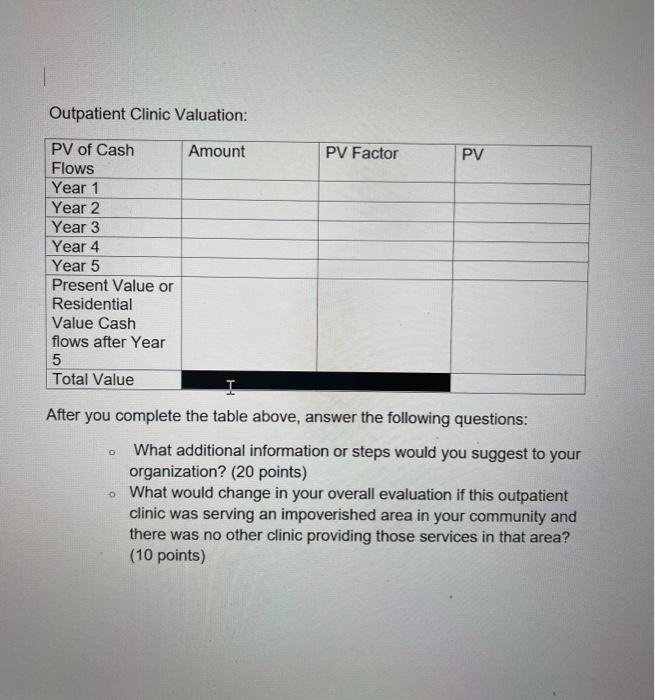

Save and submit the Word file using the Assignment submission link in Brightspace course. You have been asked to provide an estimate of the value for an outpatient clinic that your healthcare organization is interested in buying. The financial data is provided below: Projected Outpatient Clinic Cash Flows: Year 3 $4,400 $1.990 Year 4 $5,059 $2,300 Year 5 $5,875 $2,584 Year 1 Year 2 Net Income $3,000 $3,750 $1,240 $1,520 Depreciation I Working $ 675 $ 675 Capital Capital $5,000 $4200 Expenditures Free Cash $(1600) $(875) Flows $775 $875 $974 $1200 $800 $540 $(1,240) $(4,300) $(3.300) Use the assumed discount rate of 10% to value the firm and assume that the 5th year cash flow will carry into the future. Outpatient Clinic Valuation: PV of Cash Amount PV Factor PV Flows Year 1 Year 2 Year 3 Year 4 Year 5 Present Value or Residential Value Cash flows after Year 5 Total Value I After you complete the table above, answer the following questions: o What additional information or steps would you suggest to your organization? (20 points) . What would change in your overall evaluation if this outpatient clinic was serving an impoverished area in your community and there was no other clinic providing those services in that area? (10 points) Save and submit the Word file using the Assignment submission link in Brightspace course. You have been asked to provide an estimate of the value for an outpatient clinic that your healthcare organization is interested in buying. The financial data is provided below: Projected Outpatient Clinic Cash Flows: Year 3 $4,400 $1.990 Year 4 $5,059 $2,300 Year 5 $5,875 $2,584 Year 1 Year 2 Net Income $3,000 $3,750 $1,240 $1,520 Depreciation I Working $ 675 $ 675 Capital Capital $5,000 $4200 Expenditures Free Cash $(1600) $(875) Flows $775 $875 $974 $1200 $800 $540 $(1,240) $(4,300) $(3.300) Use the assumed discount rate of 10% to value the firm and assume that the 5th year cash flow will carry into the future. Outpatient Clinic Valuation: PV of Cash Amount PV Factor PV Flows Year 1 Year 2 Year 3 Year 4 Year 5 Present Value or Residential Value Cash flows after Year 5 Total Value I After you complete the table above, answer the following questions: o What additional information or steps would you suggest to your organization? (20 points) . What would change in your overall evaluation if this outpatient clinic was serving an impoverished area in your community and there was no other clinic providing those services in that area? (10 points)