Answered step by step

Verified Expert Solution

Question

1 Approved Answer

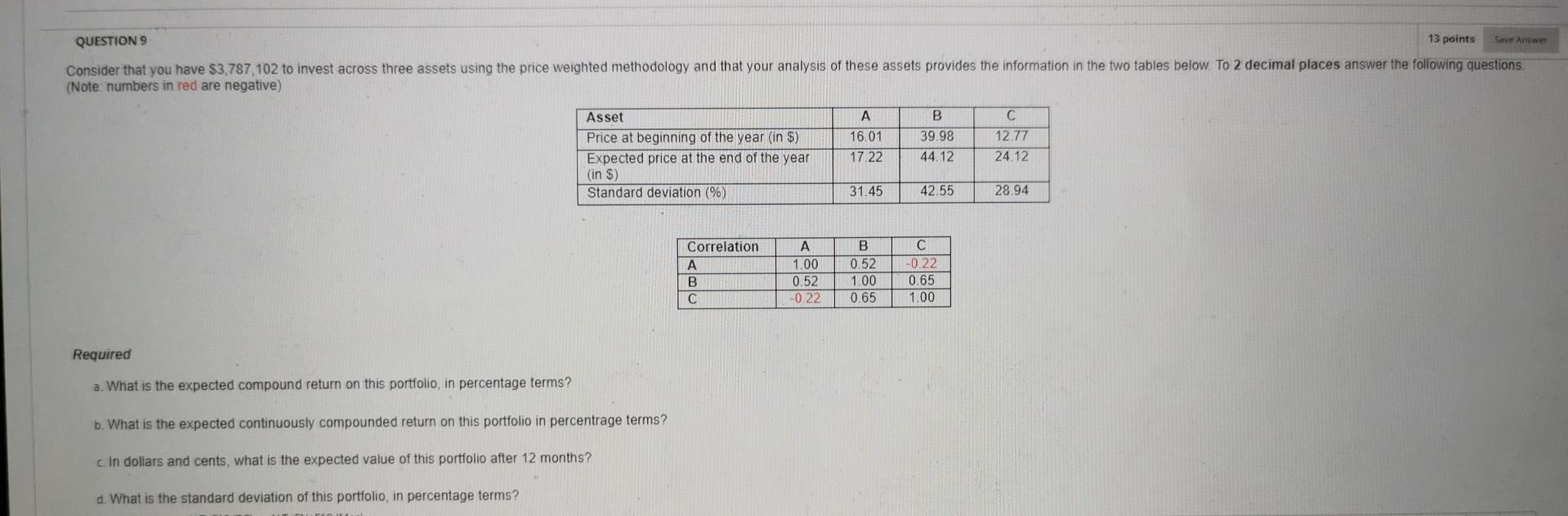

Save Answer QUESTION 9 13 points Consider that you have $3.787,102 to invest across three assets using the price weighted methodology and that your analysis

Save Answer QUESTION 9 13 points Consider that you have $3.787,102 to invest across three assets using the price weighted methodology and that your analysis of these assets provides the information in the two tables below. To 2 decimal places answer the following questions (Note: numbers in red are negative) A Asset Price at beginning of the year (in %) Expected price at the end of the year (in $) Standard deviation (%) 16.01 17.22 B 39.98 44.12 12.77 24.12 31.45 42.55 28.94 Correlation A B 1.00 0.52 -0.22 B 0.52 1.00 0.65 C -0.22 0.65 1.00 Required a. What is the expected compound return on this portfolio, in percentage terms? b. What is the expected continuously compounded return on this portfolio in percentage terms? c. In dollars and cents, what is the expected value of this portfolio after 12 months? d. What is the standard deviation of this portfolio, in percentage terms? Save Answer QUESTION 9 13 points Consider that you have $3.787,102 to invest across three assets using the price weighted methodology and that your analysis of these assets provides the information in the two tables below. To 2 decimal places answer the following questions (Note: numbers in red are negative) A Asset Price at beginning of the year (in %) Expected price at the end of the year (in $) Standard deviation (%) 16.01 17.22 B 39.98 44.12 12.77 24.12 31.45 42.55 28.94 Correlation A B 1.00 0.52 -0.22 B 0.52 1.00 0.65 C -0.22 0.65 1.00 Required a. What is the expected compound return on this portfolio, in percentage terms? b. What is the expected continuously compounded return on this portfolio in percentage terms? c. In dollars and cents, what is the expected value of this portfolio after 12 months? d. What is the standard deviation of this portfolio, in percentage terms

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started