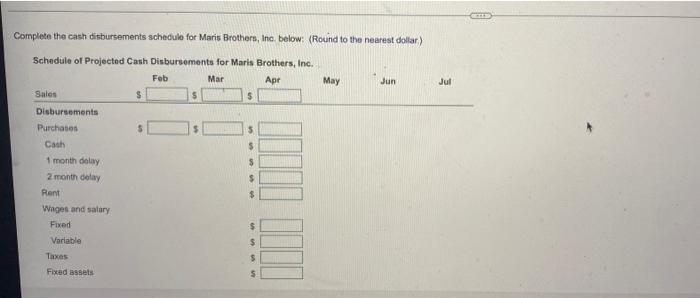

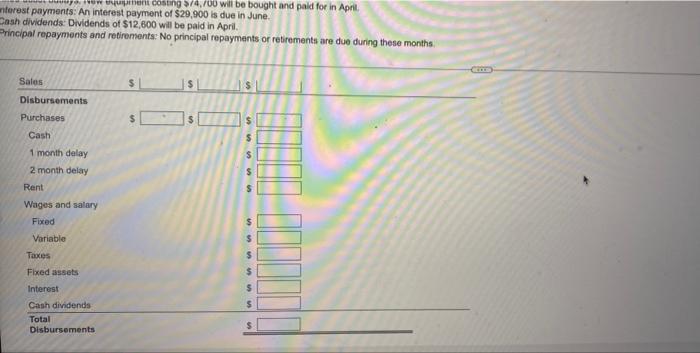

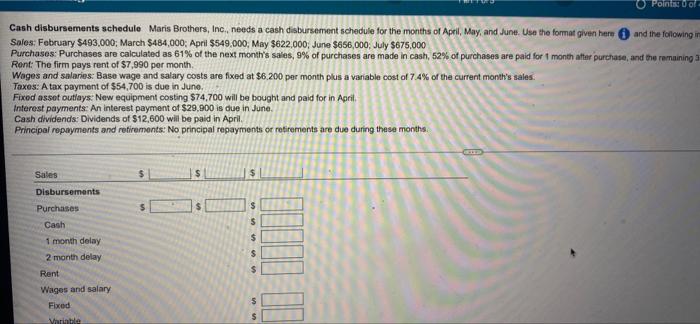

Save Cash disbursements schedule Marthens tres husement schedule foremost May, and one formative and the following into Sales February 1493.000, March $44.000 A $548.000 May 1622.000, June 45.000 175.000 Purchase Purchases are called to the next months of these we made coses het we paid tortor pune, and the maring 30% of purchase pred for more that surchase Aurt The Tom pays vert of 87.900 per month Wages and sewage and layouts are free 5.200 per months svarble cost of 745 of the current more The Atax payment of $54.700 is due in June Rred sett Newment conting $74.700 will be bought and paid for in Apr in payment Anders payment of 529.900 is doin June Cash dividends Dividends of $12.600 wil be paid in April Proprepayments and regiono propayments or retirements are sung the months Complete the cash disbursements schedule for Maris Brothers, Inc below: (Round to the nearest dollar) Apr May Jun Jul Schedule of Projected Cash Disbursements for Maris Brothers, Inc. Feb Mar Sales $ Disbursements Purchases 5 Cash $ 1 month delay $ 2 month delay $ Rent $ Wages and salary Fixed $ Variable $ Texas 5 Fixed assets $ www.cong sa pou will be bought and paid for in April wterest payments: An interest payment of $29,900 is due in June. Dash dividends: Dividends of $12,600 will be paid in April Principal repayments and retirements: No principal repayments or retirements are due during these months $ | $ $ $ $ Sales Disbursements Purchases Cash 1 month delay 2 month delay Rent Wages and salary Fixed Variable $ Taxes $ $ $ Fixed assets Interest Cash dividends Total Disbursements $ $ Points of Cash disbursements schedule Maris Brothers, Inc., needs a cash disbursement schedule for the months of April, May, and June. Use the format given here and the following in Sales: February $493,000; March $484,000; April $549,000, May $622,000, June $656,000; July $675,000 Purchases: Purchases are calculated as 61% of the next month's sales, 9% of purchases are made in cash, 52% of purchases are paid for 1 month after purchase, and the remaining 3 Rent: The firm pays rent of $7,990 per month Wages and salaries: Base wage and salary costs are fixed at $6.200 per month plus a variable cost of 74% of the current month's sales. Taxes: A tax payment of $54,700 is due in June. Fixed asset outlays: New equipment costing $74,700 will be bought and paid for in April Interest payments: An interest payment of $29,900 is due in June. Cash dividends: Dividends of $12,600 will be paid in April Principal repayments and retirements: No principal repayments or retirements are due during these months $ $ $ Sales Disbursements Purchases Cash 1 month delay 2 month delay $ $ $ Rent Wages and salary Fixed $ Variable