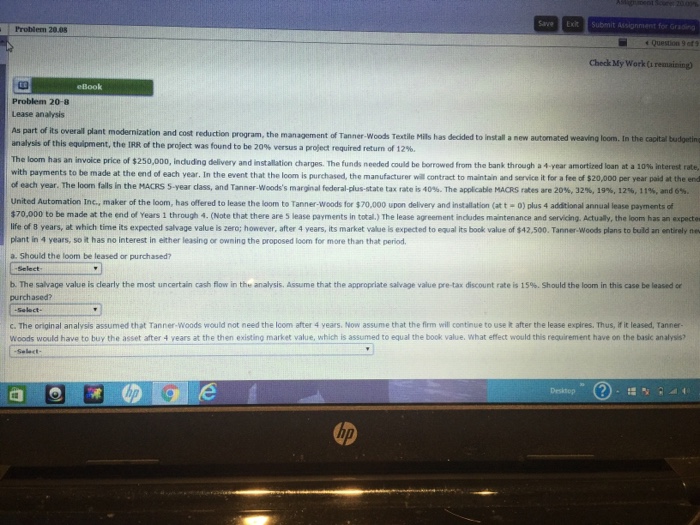

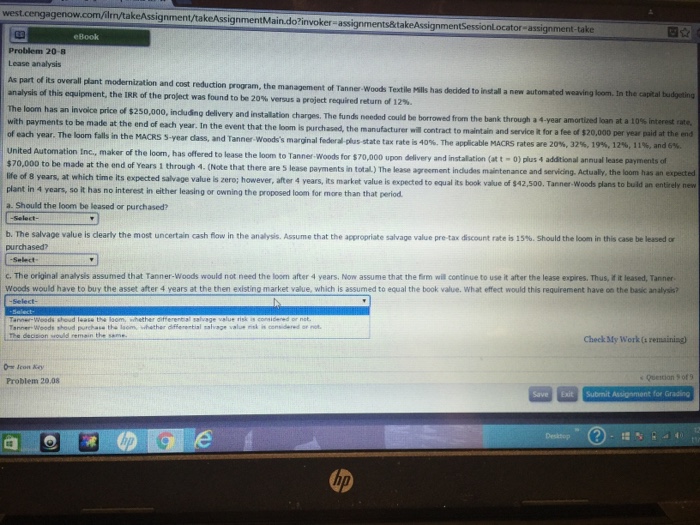

Save Exit Probiem 20.08 Question 9 ef Check My Work (i remaining eBook Problem 20-8 Lease analysis As part of its overall plant modernization and cost reduction analysis of this equipment, the IRR of the project was found to be 20% versus a pr program, the management of Tanner-Woods Textile Mils has decided to install a new automated weaving loom. In the capital budgeting oject required return of 12%. The loom has an invoice price of $250,000 ncludng delivery and installation dares. The unds need dcould be borrowed f the bank through a +Year amortized loan at 10% interest rate, with payments to be made at the end of each year. In the event that the loom is purchased, the manufactur of each year. The loon falls in the MACRS 5-year dass, and Tanner-Woods's marginal eral plus-state tax rate is 40%. The United Auto mation Inc. maker of te loom has ered to lease the loom to Tanner woods for S70 000 upon delivery and installation (at t0) plus 4 additional annual lease payments of $70,000 to be made at the end of Years 1 through 4. (Note that there are 5 lease payments in total.) The lease agreement includes maintenance and servicing Actually, the loom has an expecte ife of 8 years, at which time its expected salvage value is zero; however, after 4 years, its market value is expected to equal its book value of $42,500. Tanner-Woods plans to buld an entirely ne plant in 4 years, so it has no interest in elther leasing or owning the proposed locm for more than that period a. Should the loom be leased or purchased? be made at the end of each year. In the event that the loom is purchased, the manufacturer willcontract to maintain and service it for a fee of $20,000 per year paid at the end applicable MACRS rates are 20%, 32%, 19%, l 2%, i1%, and 6%. alue is dearly the most uncertain cash fow the analysis Assume that the appropriate salvage value re tax discount rate , ty% Should the loom in this case be leased or b. The salva purchased? Select- c. The original analysis assumed that Tanner-woods would not need the lcom after 4 years. Now assume that the firm will continue to use R after the lease expires. Thus, if it leased, Tanner- Woods would have to buy the asset after 4 years at the then existing market value, which is assumed to equal the book value. what effect would this requirement have on the basic analysis? Desktop