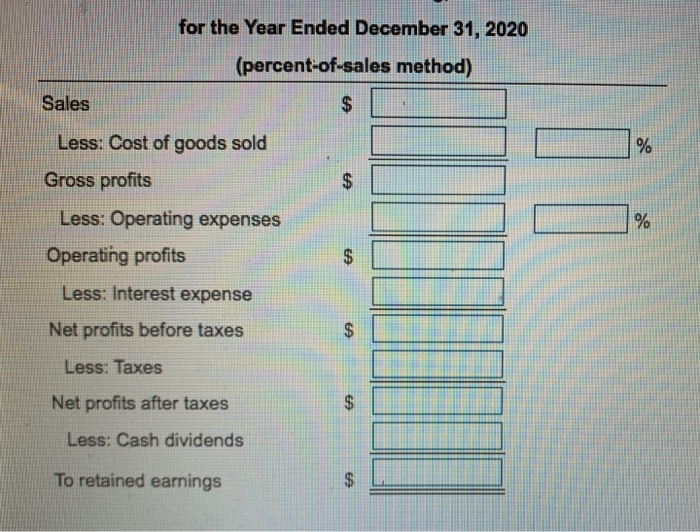

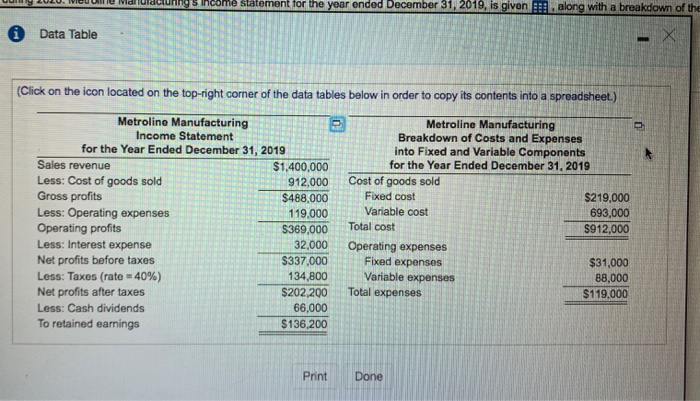

Save Homework: Chapt. 4 - Cash Flow & Financial Planning Score: 0 of 30 pts 5 of 6 (1 complete) HW Score: 1.6%, 2 of 125 pts P4-16 (similar to) E Question Help Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.63 million. Interest expense is expected to remain unchanged at $32,000, and the firm plans to pay $66,000 in cash dividends during 2020. Metroline Manufacturing's income statement for the year onded December 31, 2019, is given along with a breakdown of the firm's cost of goods sold and operating expenses into their fixed and variable components a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020 b. Use fixed and variable cost data to develop a pro forma income statement for the year ended December 31, 2020, c. Compare and contrast the statements developed in parts a, and b. Which statement probably provides the better estimate of 2020 income? Explain why a. Use the percent of sales method to prepare a proforma income statement for the year ended December 31, 2020 Complete the pro forma income statement for the year ended December 31, 2020 below. (Round the percentage of sales to four decimal places and the pro forma income statement amounts to the nearest dollar) for the Year Ended December 31, 2020 (percent-of-sales method) Sales Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Cash dividends To retained earnings w e aruanny come statement for the year ended December 31, 2019, is given 11. alona with a breakdown of the i Data Table (Click on the icon located on the top-right corner of the data tables below in order to copy its contents into a spreadsheet.) Metroline Manufacturing Income Statement for the Year Ended December 31, 2019 Sales revenue $1,400,000 Less: Cost of goods sold 912,000 Gross profits $488,000 Less: Operating expenses 119,000 Operating profits $369,000 Less: Interest expense 32,000 Net profits before taxes $337,000 Less: Taxes (rate = 40%) 134,800 Net profits after taxes $202,200 Less: Cash dividends 66,000 To retained earnings $136,200 Metroline Manufacturing Breakdown of Costs and Expenses into Fixed and Variable Components for the Year Ended December 31, 2019 Cost of goods sold Fixed cost $219.000 Variable cost 693,000 Total cost S912,000 Operating expenses Fixed expenses $31,000 Variable expenses 88,000 Total expenses $119,000 Print