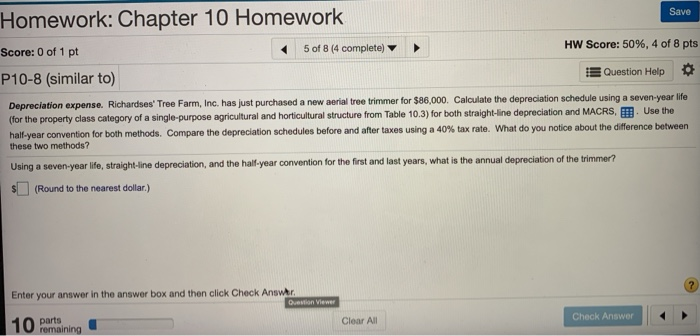

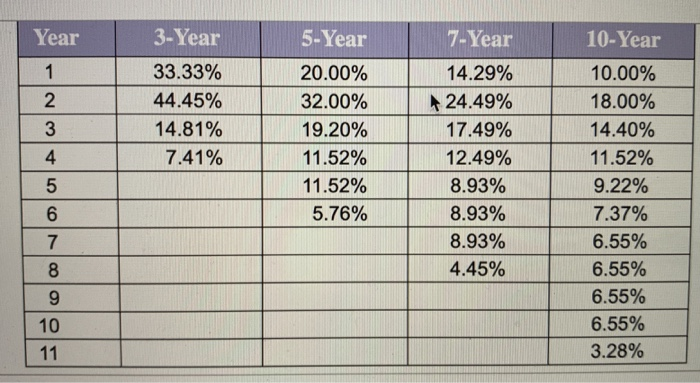

Save Homework: Chapter 10 Homework Score: 0 of 1 pt 5 of 8 (4 complete) P10-8 (similar to) HW Score: 50%, 4 of 8 pts Question Help Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new aerial tree trimmer for $86,000. Calculate the depreciation schedule using a seven-year life (for the property class category of a single-purpose agricultural and horticultural structure from Table 10.3) for both straight-line depreciation and MACRS, F. Use the half-year convention for both methods. Compare the depreciation schedules before and after taxes using a 40% tax rate. What do you notice about the difference between these two methods? Using a seven-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the trimmer? $ (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer 10 parts 10 remaining Clear All Check Answer Year 3-Year 33.33% 44.45% 14.81% 7.41% 3 4 5 6 7 8 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% 9 10 11 Save Homework: Chapter 10 Homework Score: 0 of 1 pt 5 of 8 (4 complete) P10-8 (similar to) HW Score: 50%, 4 of 8 pts Question Help Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new aerial tree trimmer for $86,000. Calculate the depreciation schedule using a seven-year life (for the property class category of a single-purpose agricultural and horticultural structure from Table 10.3) for both straight-line depreciation and MACRS, F. Use the half-year convention for both methods. Compare the depreciation schedules before and after taxes using a 40% tax rate. What do you notice about the difference between these two methods? Using a seven-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the trimmer? $ (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer 10 parts 10 remaining Clear All Check Answer Year 3-Year 33.33% 44.45% 14.81% 7.41% 3 4 5 6 7 8 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% 9 10 11