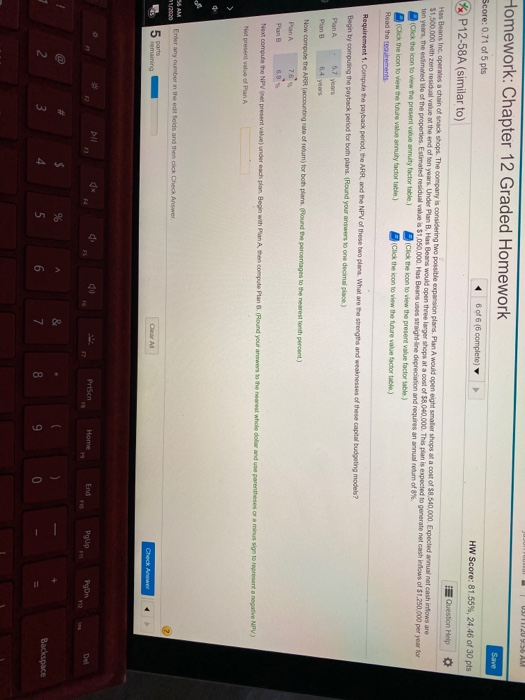

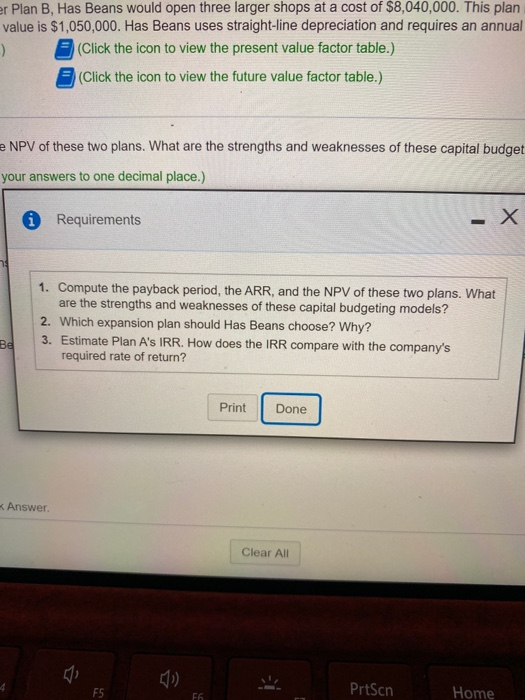

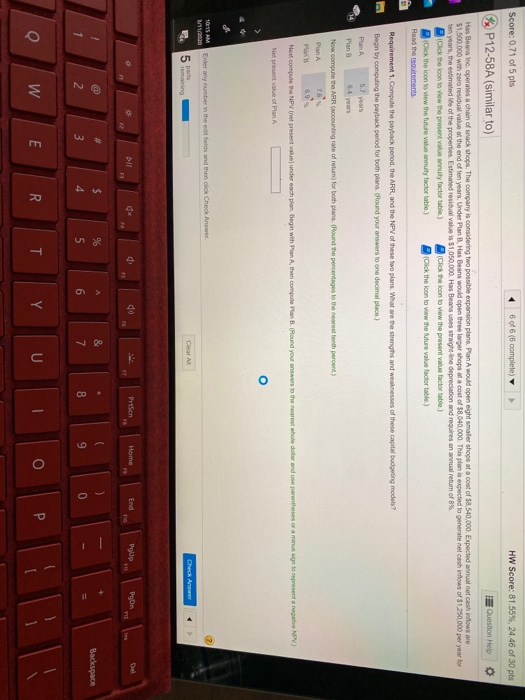

Save Homework: Chapter 12 Graded Homework Score: 0.71 of 5 pts 6 of 6 (6 complete) P12-58A (similar to) HW Score: 81.56%, 24.46 of 30 pts Question Help Has Beans Inc. operes a chain of snack shops. The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,540,000. Expected annualne cash infows are $1.500.000 with 2010 residual value of the end of ten years. Under Plan B. Has Beans would open three larger shops at a cost of $8.040.000. This plan is expected to generate net cash inflows of $1.250.000 per year for ten years. The estimated We of the properties. Estimated residual value is $1.050.000. Has Beans usos straight-line depreciation and requires an annual return of 8%. Click the icon to view the present value annuity factor table click the icon to view the present value factor table) Click the icon to view the future value muy factor table) Click the icon to view the future value factore ) Read the talents Requirement 1. Compute the payback period, the Art and the NPV of these two plans. What are the strength and weaknesses of these capital budgeting models? Begin by computing the payback period for both plans. (Round your answers to one decimal place) Plan A 57 years Plan B 4 years Now come the ARR (accounting rate of our for both plans found the percentages to the nearest ton percent) Plan A Plan B Next corro the NPV represente nder each plon Begin with Plan Athen compute Plan Pound your awers to the nearest whole dar and Uus sign to represent a negative NPV Nutrentale of Pan A Check A Plan B, Has Beans would open three larger shops at a cost of $8,040,000. This plan walue is $1,050,000. Has Beans uses straight-line depreciation and requires an annual (Click the icon to view the present value factor table.) (Click the icon to view the future value factor table.) NPV of these two plans. What are the strengths and weaknesses of these capital budget your answers to one decimal place.) * Requirements - X 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? 2. Which expansion plan should Has Beans choose? Why? 3. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? Print Done Answer. Clear All PrtScn Home Plan B 6.9 % Next compute the NPV (net present value) under each plan. Begin with Plan A, then compute Plan B. (Round your a Net present value of Plan A M Enter any number in the edit fields and then click Check Answer 320 Clear All 5 parts remaining [x 0 F4 F1 6 of 6 (complete) HW Score: 81.55%, 24.46 of 30 pts Score: 0.71 of 5 pts P12-58A (similar to) Question Help Has Beans in operates a chain of snack shops. The company is considering the possible expansion plans Plan A would open eight smaller shops at a cost of $8,540,000. Expected annual net cash inflows are $1,500,000 with zero residual value at the end of ten years. Under Plan B. Has Beans would open three larger shops at a cost of $8.040.000. This plan is expected to generate net cash inflows of $1.250,000 per year for ten years, the estimated life of the properties. Estimated resoual value is $1,050,000. Has Beans Straight line depreciation and requires an annual return of 8% cok the soon to the procent value annuity factor table.) Click the icon to view the present value factor table.) Click the icon to view the future value annuity factor table.) Click the loon to view the future value factor table) Read the reovements Requirement 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weakness of these capital Budgeting models? Begin by computing the payback period for both plans found your answers to one decimal place) Plan 5.7 years Plan Now compute the ARR (accounting rate ofreun) for both plans found the percentages to the nearest both percent Pian A 7.6 PB Next compute the NPV net present value) under each plon Begin with Pin Athen compte Pan B. Round or a mission to represent a negative NPV) Netent of Plan A l and then click check Answer 01 NEWS Ene w umbes in the 1200 Check An Backspace