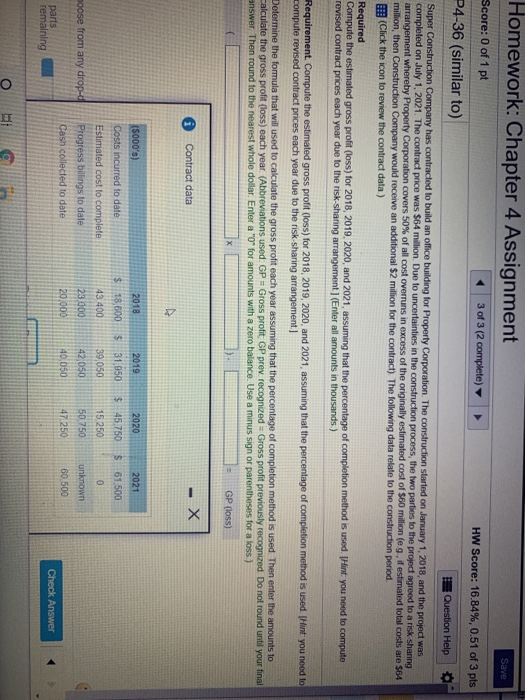

Save Homework: Chapter 4 Assignment Score: 0 of 1 pt 3 of 3 (2 complete) P4-36 (similar to) HW Score: 16.84%, 0.51 of 3 pts Question Help Super Construction Company has contracted to build an office building for Property Corporation. The construction started on January 1, 2018, and the project was completed on July 1, 2021. The contract price was $64 million Due to uncertainties in the construction process, the two parties to the project agreed to a risk sharing arrangement whereby Property Corporation covers 50% of all cost overruns in excess of the originally estimated cost of $60 million (eg, if estimated total costs are $64 million, then Construction Company would receive an additional $2 million for the contract) The following data relate to the construction period. (Click the icon to review the contract data) Required Compute the estimated gross profit (loss) for 2018, 2019 2020 and 2021, assuming that the percentage of completion method is used. (Hint: you need to compute revised contract prices each year due to the risk sharing arrangement) (Enter all amounts in thousands) Requirement. Compute the estimated gross profit (loss) for 2018, 2019, 2020 and 2021, assuming that the percentage of completion method is used. (Mint you need to compute revised contract prices each year due to the risk sharing arrangement) Determine the formula that will used to calculate the gross profit each year assuming that the percentage of completion method is used Then enter the amounts to Calculate the gross profit (loss) each year. (Abbreviations used. GP = Gross profit GP prev recognized = Gross profit previously recognized. Do not round until your final answer. Then round to the nearest whole dollar. Enter a "O for amounts with a zero balance. Use a minus sign or parentheses for a loss.) X GP (loss) Contract data - X (5000's) 2019 2018 $ 18,600 Costs incurred to date 2021 $ 61,500 $ 31,950 2020 $ 45,750 15 250 43.400 39,050 hoose from any drop- Estimated cost to complete Progress billings to date Cash collected to date 50.750 23 000 20.000 42,050 40.050 0 unknown 60 500 47.250 parts remaining Check Answer O DI Save Homework: Chapter 4 Assignment Score: 0 of 1 pt 3 of 3 (2 complete) P4-36 (similar to) HW Score: 16.84%, 0.51 of 3 pts Question Help Super Construction Company has contracted to build an office building for Property Corporation. The construction started on January 1, 2018, and the project was completed on July 1, 2021. The contract price was $64 million Due to uncertainties in the construction process, the two parties to the project agreed to a risk sharing arrangement whereby Property Corporation covers 50% of all cost overruns in excess of the originally estimated cost of $60 million (eg, if estimated total costs are $64 million, then Construction Company would receive an additional $2 million for the contract) The following data relate to the construction period. (Click the icon to review the contract data) Required Compute the estimated gross profit (loss) for 2018, 2019 2020 and 2021, assuming that the percentage of completion method is used. (Hint: you need to compute revised contract prices each year due to the risk sharing arrangement) (Enter all amounts in thousands) Requirement. Compute the estimated gross profit (loss) for 2018, 2019, 2020 and 2021, assuming that the percentage of completion method is used. (Mint you need to compute revised contract prices each year due to the risk sharing arrangement) Determine the formula that will used to calculate the gross profit each year assuming that the percentage of completion method is used Then enter the amounts to Calculate the gross profit (loss) each year. (Abbreviations used. GP = Gross profit GP prev recognized = Gross profit previously recognized. Do not round until your final answer. Then round to the nearest whole dollar. Enter a "O for amounts with a zero balance. Use a minus sign or parentheses for a loss.) X GP (loss) Contract data - X (5000's) 2019 2018 $ 18,600 Costs incurred to date 2021 $ 61,500 $ 31,950 2020 $ 45,750 15 250 43.400 39,050 hoose from any drop- Estimated cost to complete Progress billings to date Cash collected to date 50.750 23 000 20.000 42,050 40.050 0 unknown 60 500 47.250 parts remaining Check Answer O DI