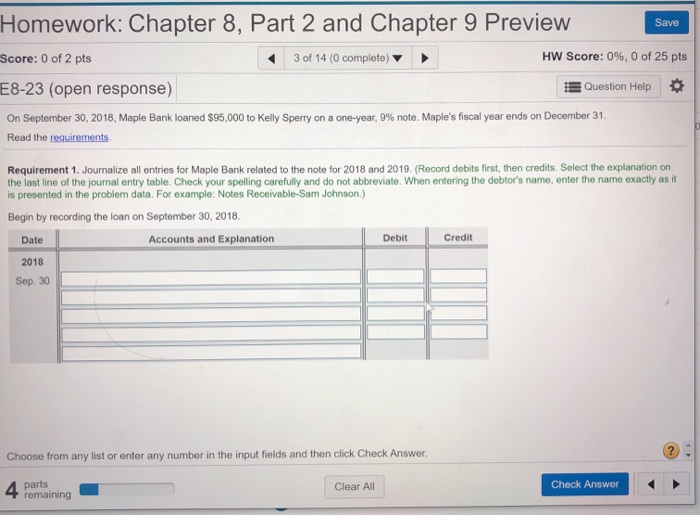

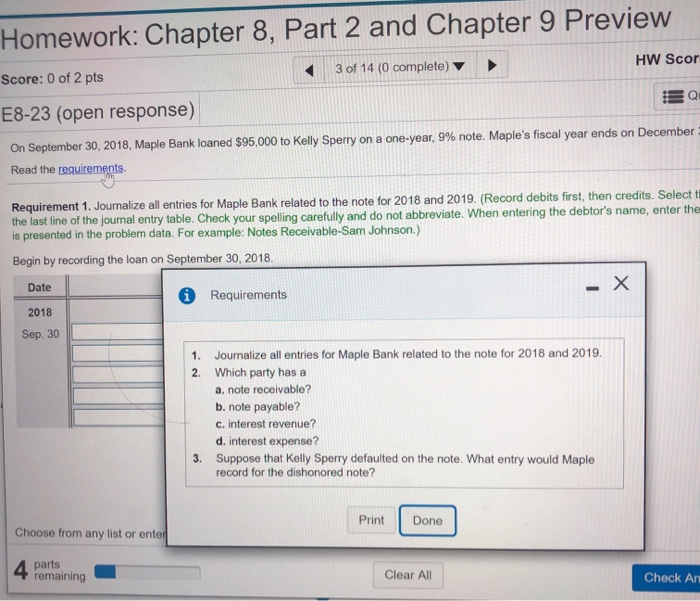

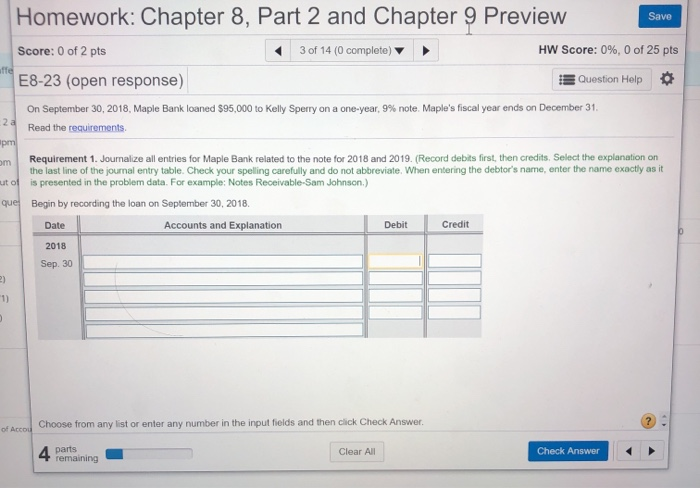

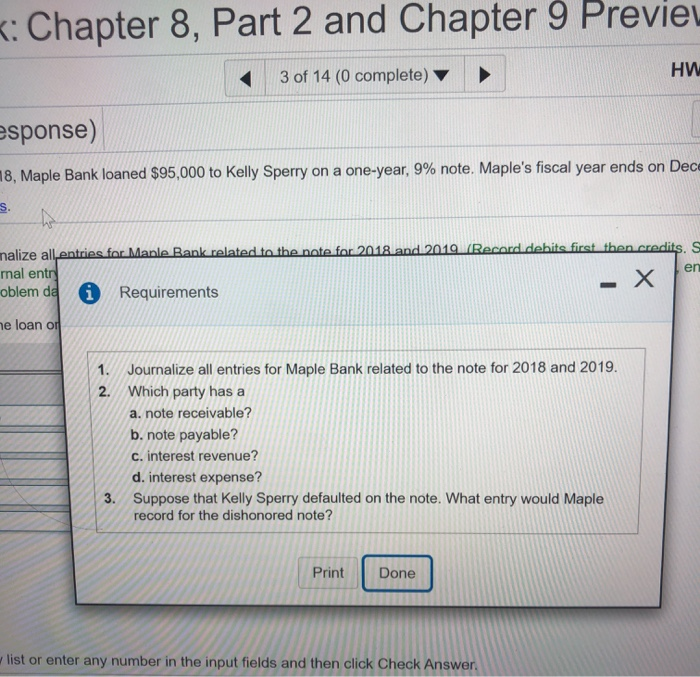

Save Homework: Chapter 8, Part 2 and Chapter 9 Preview Score: 0 of 2 pts 3 of 14 (0 complete) HW Score: 0%, 0 of 25 pts E8-23 (open response) Question Help On September 30, 2018, Maple Bank loaned $95,000 to Kelly Sperry on a one-year, 9% note. Maple's fiscal year ends on December 31 Read the requirements Requirement 1. Journalize all entries for Maple Bank related to the note for 2018 and 2019. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Check your spelling carefully and do not abbreviate. When entering the debtor's name, enter the name exactly as it is presented in the problem data. For example: Notes Receivable-Sam Johnson.) Begin by recording the loan on September 30, 2018 Date Accounts and Explanation Debit Credit 2018 Sep 30 Choose from any list or enter any number in the input fields and then click Check Answer A parts Check Answer 4 Clear All remaining Homework: Chapter 8, Part 2 and Chapter 9 Preview Score: 0 of 2 pts 3 of 14 (0 complete) HW Scor E8-23 (open response) EQ On September 30, 2018, Maple Bank loaned $95,000 to Kelly Sperry on a one-year, 9% note. Maple's fiscal year ends on December Read the requirements. Requirement 1. Journalize all entries for Maple Bank related to the note for 2018 and 2019. (Record debits first, then credits. Select t the last line of the journal entry table. Check your spelling carefully and do not abbreviate. When entering the debtor's name, enter the is presented in the problem data. For example: Notes Receivable-Sam Johnson.) Begin by recording the loan on September 30, 2018 Date 0 Requirements 2018 Sep. 30 1. Journalize all entries for Maple Bank related to the note for 2018 and 2019. 2. Which party has a a. note receivable? b. note payable? c. interest revenue? d. interest expense? Suppose that Kelly Sperry defaulted on the note. What entry would Maple record for the dishonored note? Print Print Done Done Choose from any list or enter 4 parts 4 remaining Clear All Check An Homework: Chapter 8, Part 2 and Chapter 9 Preview Save Score: 0 of 2 pts 3 of 14 (0 complete) HW Score: 0%, 0 of 25 pts affe E8-23 (open response) Question Help 28 om On September 30, 2018, Maple Bank loaned $95,000 to Kelly Sperry on a one-year, 9% note. Maple's fiscal year ends on December 31 Read the requirements. pm Requirement 1. Journalize all entries for Maple Bank related to the note for 2018 and 2019. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Check your spelling carefully and do not abbreviate. When entering the debtor's name, enter the name exactly as it ut of is presented in the problem data. For example: Notes Receivable-Sam Johnson.) que Begin by recording the loan on September 30, 2018 Date Accounts and Explanation Debit Credit 2018 Sep. 30 of Accou Choose from any list or enter any number in the input fields and then click Check Answer. 4 parts 4 Check Answer Clear All remaining K: Chapter 8, Part 2 and Chapter 9 Preview 3 of 14 (0 complete) HW esponse) m8, Maple Bank loaned $95,000 to Kelly Sperry on a one-year, 9% note, Maple's fiscal year ends on Dece nalize all entries for Manle Bank related to the note for 2018 and 2019. (Record debits first then credits. S rnal entre oblem da i Requirements X en ne loan or Journalize all entries for Maple Bank related to the note for 2018 and 2019. Which party has a a. note receivable? b. note payable? c. interest revenue? d. interest expense? Suppose that Kelly Sperry defaulted on the note. What entry would Maple record for the dishonored note? Print Done list or enter any number in the input fields and then click Check