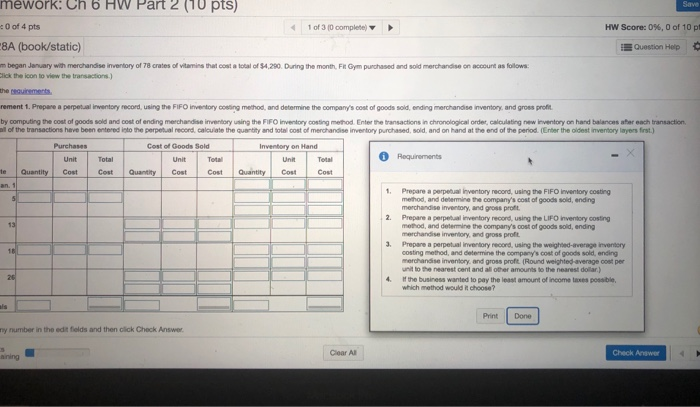

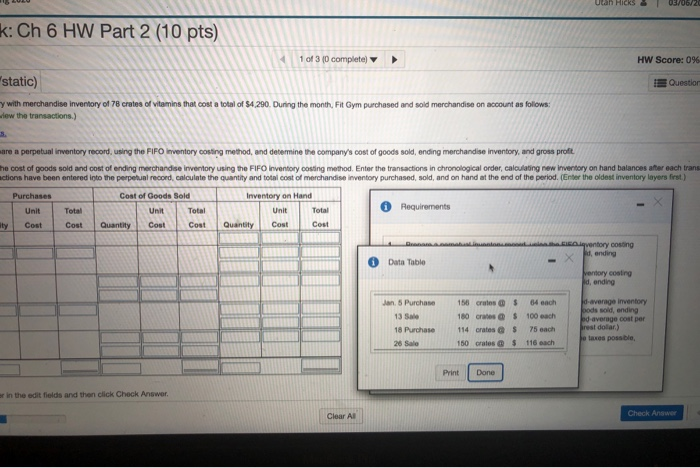

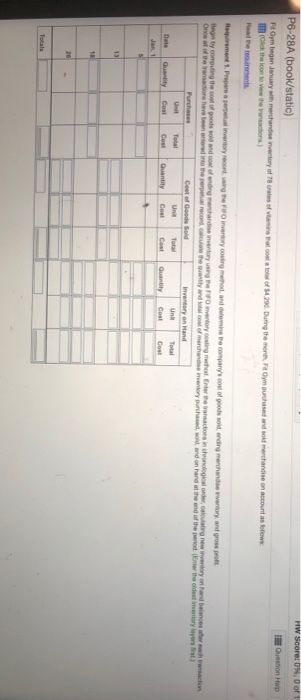

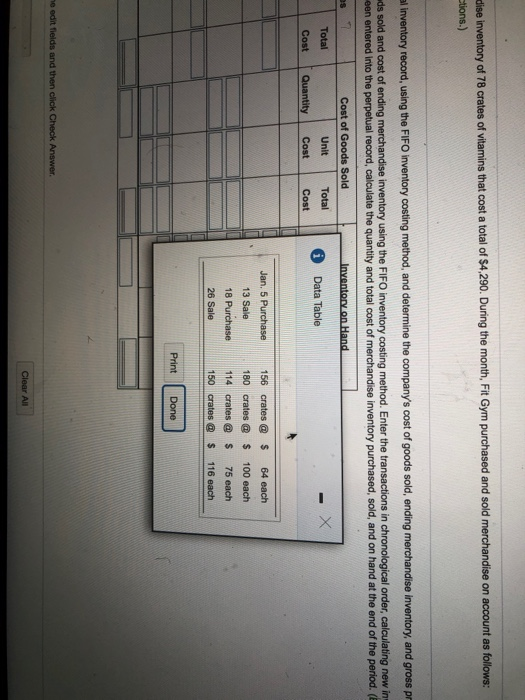

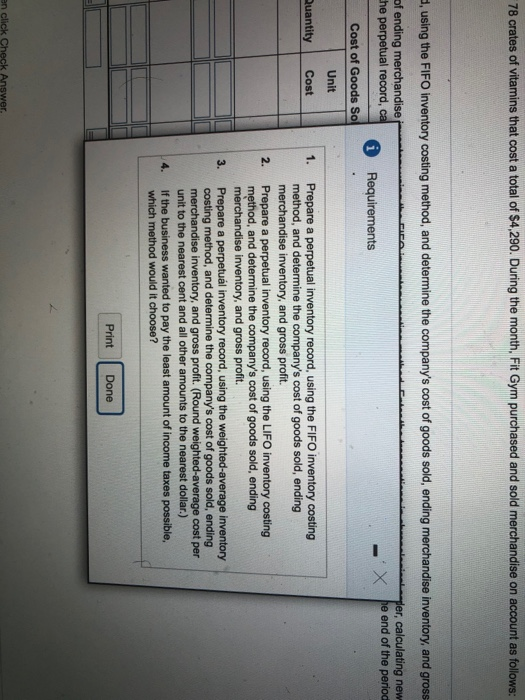

Save mework: Ch 6 HW Part 2 (10 pts) 0 of 4 pts 8A (book/static) 1 of 3 (0 complete HW Score: 0%, 0 of 10 p Question Help mbegan January with merchandise inventory of 78 crates of vitamins that cost a total of 34.290. During the month Fit Gym purchased and sold merchandise on account as follows: Click the icon to view the transactions.) the requirements rement 1. Prepare a perpetual inventory record, using the FIFO inventory cosing method and determine the company's cost of goods sold ending merchandise inventory, and gross profit by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method Enter the transactions in chronological order, calculating new inventory on hand balances abar each transaction all of the transactions have been entered into the perpetual record calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Enter the oldest inventory layers first.) Inventory on Hand 0 Cost of Goods Sold Unit Total Quantity Cost Cost Unit Cost Requirements Total Cost te Quantity Quantity Cost Cost 1. 2. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory and gross proft. Prepare a perpetual verbory record, using the weighted average inventory costing method, and determine the company's cost of goods sold enging merchandise inventory, and gross proft (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar) the business wanted to pay the least amount of income taxes possible which method would it choose? Arne Dane my number in the edit fields and then click Check Answer aning Check Answer 16 LULU Utan Hicks 03/06/2 k: Ch 6 HW Part 2 (10 pts) 1 of 3 (0 complete) HW Score: 0% "static) Question y with merchandise Inventory of 78 crates of vitamins that cost a total of 84.290. During the month, Fit Gym purchased and sold merchandise on account as follows: wew the transactions.) are a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit the cost of goods sold and cost of ending merchandise inventory using the FIFO Inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each trans actions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Unit aty Cost Cost of Goods Sold Unit Total Quantity Cost Cost A Inventory on Hand Unit Total Quantity Cost Cost Total Cost Requirements qventory costing banding 1 Data Table ventory coating d. ending Jan 5 Purchase 13 S 18 Purchase 156 crates 180 Cres 114 crates @ 150 crates $ $ $ $ 64 ench 100 each 75 each d-average inventory pods sold, ending ed average cost per best dolar) Jo taxes possible, 116 each Print Done or in the edit fields and then click Check Answer. Check Answer PO-28A (book/static) Gymban January actory the others) W teorets of of Dungeo n dise inventory of 78 crates of vitamins that cost a total of $4,290. During the month, Fit Gym purchased and sold merchandise on account as follows: tions.) al inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross pr ads sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new in een entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. ( Inventory on Hand Total Cost Cost of Goods Sold Unit Total Quantity Cost Cost * Data Table Jan. 5 Purchase 13 Sale 18 Purchase 156 crates @ 180 crates @ 114 crates @ 150 crates @ $ $ $ $ 64 each 100 each 75 each 116 each 26 Sale Print Done he edit fields and then click Check Answer. Clear All 78 crates of vitamins that cost a total of $4,290. During the month. Fit Gym purchased and sold merchandise on account as follows: , using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross BEA L E ger, calculating new of ending merchandise he perpetual record, ca X be end of the period Requirements Cost of Goods So Unit Quantity Cost Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) If the business wanted to pay the least amount of income taxes possible, which method would it choose? Print Done en click Check