Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Save Planning Partners Investors is opening an office in Atlanta, Georgia. Fixed monthly expenses are office rent ($2,000), depreciation on office furniture ($270), utilities

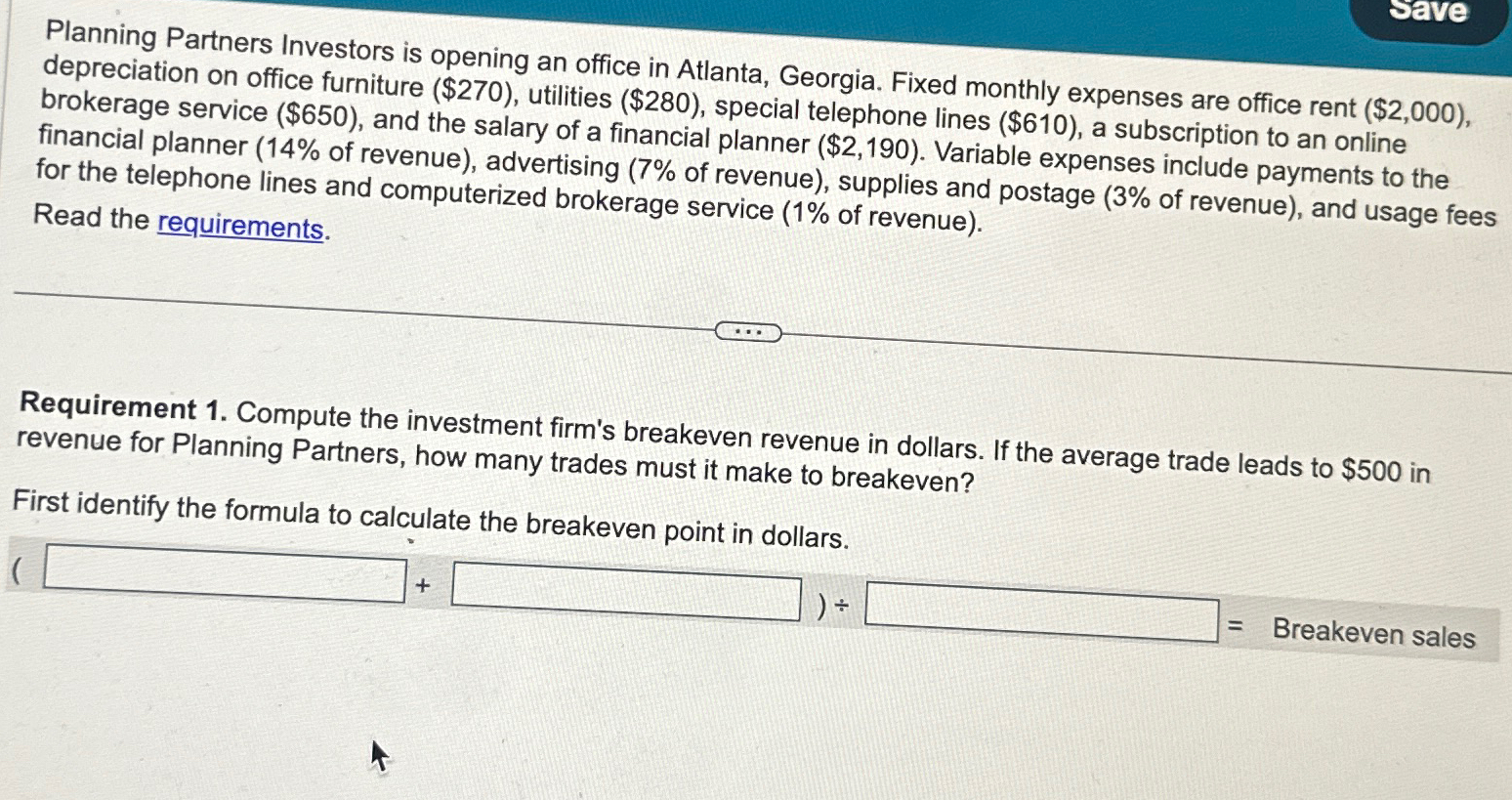

Save Planning Partners Investors is opening an office in Atlanta, Georgia. Fixed monthly expenses are office rent ($2,000), depreciation on office furniture ($270), utilities ($280), special telephone lines ($610), a subscription to an online brokerage service ($650), and the salary of a financial planner ($2,190). Variable expenses include payments to the financial planner (14% of revenue), advertising (7% of revenue), supplies and postage (3% of revenue), and usage fees for the telephone lines and computerized brokerage service (1% of revenue). Read the requirements. Requirement 1. Compute the investment firm's breakeven revenue in dollars. If the average trade leads to $500 in revenue for Planning Partners, how many trades must it make to breakeven? First identify the formula to calculate the breakeven point in dollars. + = = Breakeven sales

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the investment firms breakeven revenue in dollars we need to determine the total fixed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started