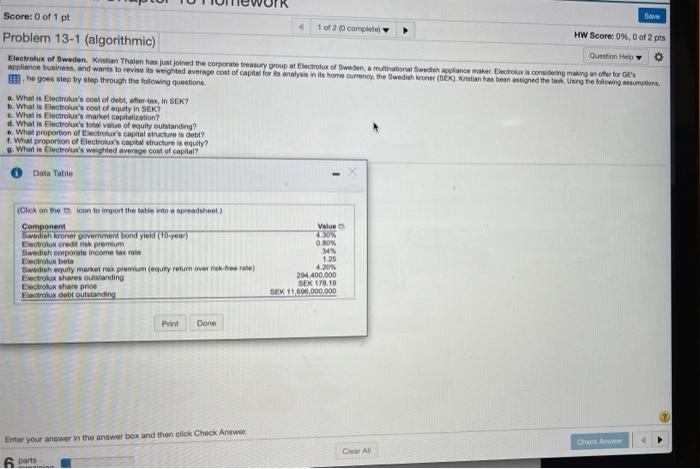

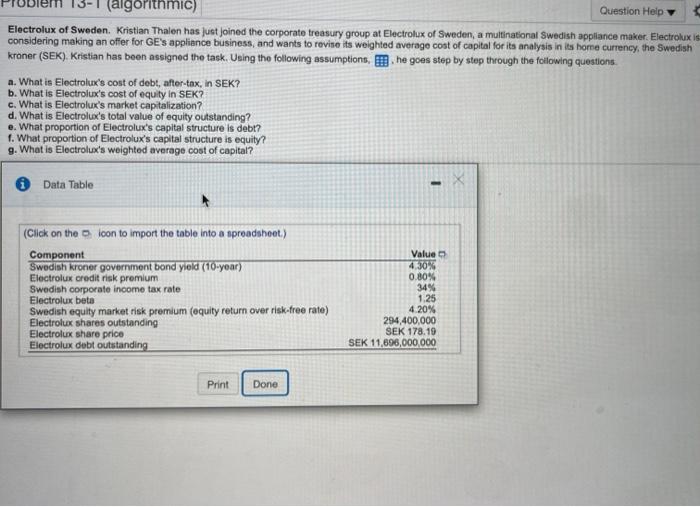

save Score: 0 of 1 pt 1 of 2 complete HW Score: 0%, 0 of 2 pts Problem 13-1 (algorithmic) Question Help Electrolux of Sweden Kristian Thalen has just joined the corporate treasury group at Electrolux of Sweden, a multinational Swedish appliance maker Electrons concern making an offer forge's appliance Business and wants to revise its weighted average cost of capital for analysis in its home currency, the Swedish Krone (SEK. Kristian has been assigned the task Ung the following tutor he goes step by step through the folowing questions, What is Electrolux's cost of debt, after tax, in SEK? b. What is Electrolux's cost of equity in SEK? e. What is Electrolux's market capitalization? d. What is Electrolux's total value of equity outstanding? .. Wat proportion of Electrolux's capital structure is debt? 1. What proportion of Electro's capital structure is equity? Q. What is Electrolux's weighted average cost of capital? Data Table Value O.MN Click on the loon to import the table into a spreadsheet) Component wedish kroner government bond yield (10-year) Electrolux creditnik premium Swedish corporate income tax rate Detrolu bola Swedish equity market premium (equiry return over.erate) Electrolux shares outstanding Electrolux share price Electroki debit outstanding 1.25 4.206 254,400.000 SEK 178.10 SEK 1160,000,000 Print Done Enter your answer in the answer box and then click Check Answer Check Clear All 6 parts (algorithmic) Question Help Electrolux of Sweden Kristian Thalen has just joined the corporate treasury group at Electrolux of Sweden, a multinational Swedish appliance maker. Electrolux is considering making an offer for GE's appliance business, and wants to revine its weighted average cost of capital for its analysis in its home currency, the Swedish kroner (SEK). Kristian has been assigned the task. Using the following assumptions, he goes step by step through the following questions a. What in Electrolux's cost of debt, after tax in SEK? b. What is Electrolux's cost of equity in SEK? c. What is Electrolux's market capitalization? d. What is Electrolux's total value of equity outstanding? e. What proportion of Electrolux's capital structure is debt? 1. What proportion of Electrolux's capital structure is equity? g. What is Electrolux's weighted average cost of capital? Data Table - (Click on the foon to import the table into a spreadshot) Component Swedish kroner government bond yield (10-year) Electrolux credit risk premium Swedish corporate income tax rate Electrolux beta Swedish equity market risk premium (equity return over risk-free rate) Electrolux shares outstanding Electrolux share price Electrolux debt outstanding Value 4.30% 0.80% 34% 1.25 4.20% 294,400,000 SEK 178.10 SEK 11,696,000,000 Print Done