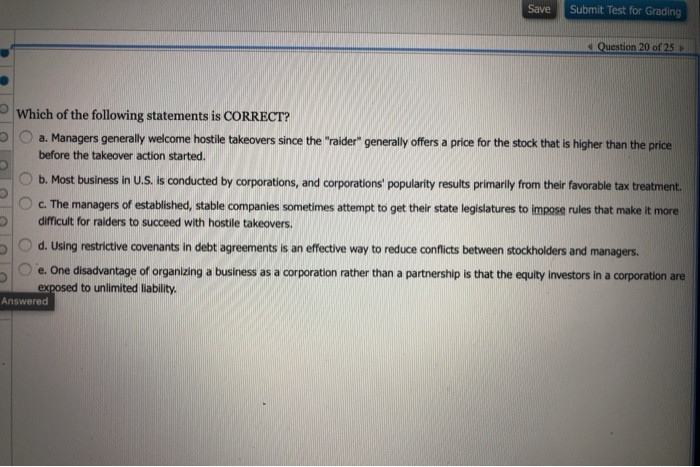

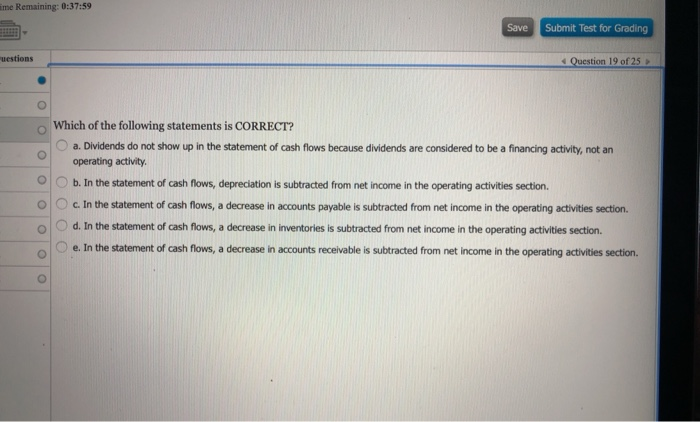

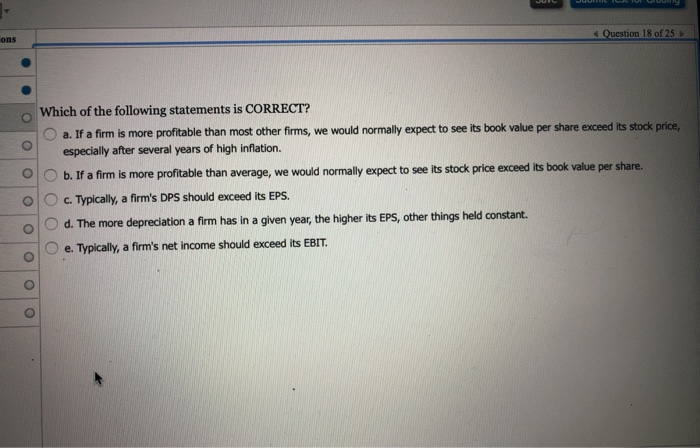

Save Submit Test for Grading Question 20 of 25 Which of the following statements is CORRECT? Dl a . Managers generally welcome hostile takeovers since the "raider" generally offers a price for the stock that is higher than the price before the takeover action started. b. Most business in U.S. is conducted by corporations, and corporations' popularity results primarily from their favorable tax treatment. O c. The managers of established, stable companies sometimes attempt to get their state legislatures to impose rules that make it more difficult for raiders to succeed with hostile takeovers. S o d. Using restrictive covenants in debt agreements is an effective way to reduce conflicts between stockholders and managers. 10e. One disadvantage of organizing a business as a corporation rather than a partnership is that the equity investors in a corporation are exposed to unlimited liability. Answered me Remaining: 0:37:59 Save Submit Test for Grading uestions Question 19 of 25 Which of the following statements is CORRECT? a. Dividends do not show up in the statement of cash flows because dividends are considered to be a financing activity, not an operating activity b. In the statement of cash flows, depreciation is subtracted from net income in the operating activities section c. In the statement of cash flows, a decrease in accounts payable is subtracted from net income in the operating activities section Ol o d . In the statement of cash flows, a decrease in inventories is subtracted from net income in the operating activities section. e. In the statement of cash flows, a decrease in accounts receivable is subtracted from net income in the operating activities section. Question 18 of 25 ons Which of the following statements is CORRECT? O a. If a firm is more profitable than most other firms, we would normally expect to see its book value per share exceed its stock price, especially after several years of high inflation. b. If a firm is more profitable than average, we would normally expect to see its stock price exceed its book value per share. O c. Typically, a firm's DPS should exceed its EPS. O d. The more depreciation a firm has in a given year, the higher its EPS, other things held constant. O e. Typically, a firm's net income should exceed its EBIT. OO