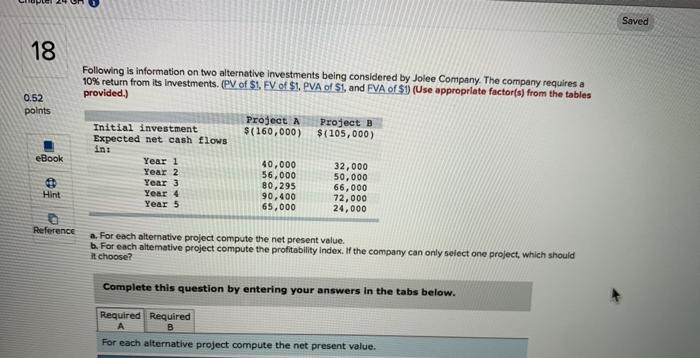

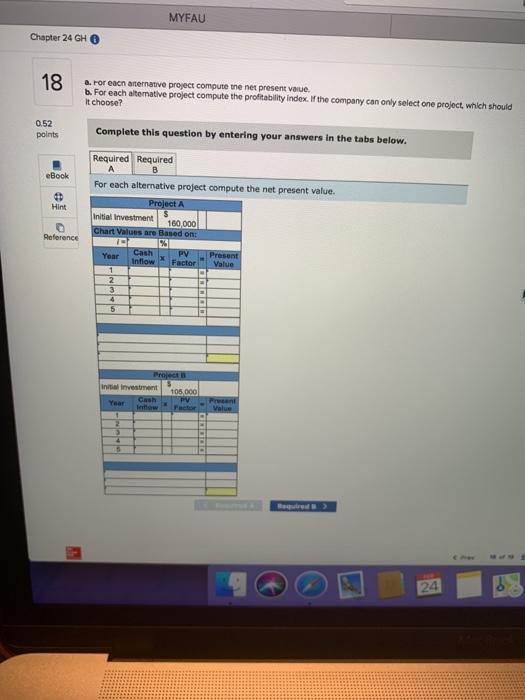

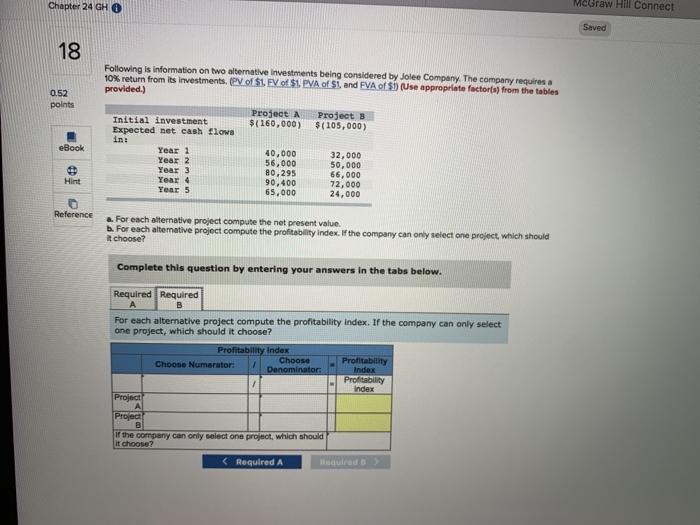

Saved 18 Following is information on two alternative investments being considered by Jolee Company. The company requires a 10% return from its Investments. (PV of $1. FV of $1. PVA of S1, and FVA of $1 (Use appropriate factor(s) from the tables provided.) 0.52 points Project A $(160,000) Project B $(105,000) eBook Initial investment Expected net cash flows in: Year 1 Year 2 Year 3 Year 4 Year 5 40,000 56,000 80,295 90,400 65,000 32,000 50,000 66,000 72,000 24,000 Hint 0 Reference a. For each alternative project compute the net present value. b. For each alterative project compute the profitability Index. If the company can only select one project, which should it choose? Complete this question by entering your answers in the tabs below. Required Required A For each alternative project compute the net present value. MYFAU Chapter 24 GHO 18 a. For each arternative project compute the net present value B. For each alterative project compute the profitability index If the company can only select one project, which should It choose? 0.52 points Complete this question by entering your answers in the tabs below. eBook Hint Reference Required Required B For each alternative project compute the net present value. Project A Initial Investment $ 160 000 Chart Values are Based on: % Year Cash Present Inflow Factor Value 1 2. 3 4 6 PY Project in investment 105,000 Year Cash PV Value 13 4 5 24 Chapter 24 GH O McGraw Hill Connect Saved 18 0.52 points Following is information on two alternative Investments being considered by Jolee Company. The company requires a 10% return from its investments PV of $1. FV of $1. PVA of $and FVA of SD) (Use appropriate factor(s) from the tables provided.) Project A Project B Initial investment $(160,000) $(105,000) Expected net cash flows in: Year 1 40,000 32,000 Year 2 56,000 50,000 Year 3 80,295 66,000 Year 4 90.400 72,000 Year 5 65,000 24,000 eBook Hint Reference a. For each alternative project compute the net present value. b. For each alternative project compute the profitability index. If the company can only select one project, which should it choose? Complete this question by entering your answers in the tabs below. Required Required B For each alternative project compute the profitability index. If the company can only select one project, which should it choose? Profitability Index Choose Choose Numerator: Profitability Denominator Index Profitability Index Project Project if the company can only select one project, which should it choose?