Answered step by step

Verified Expert Solution

Question

1 Approved Answer

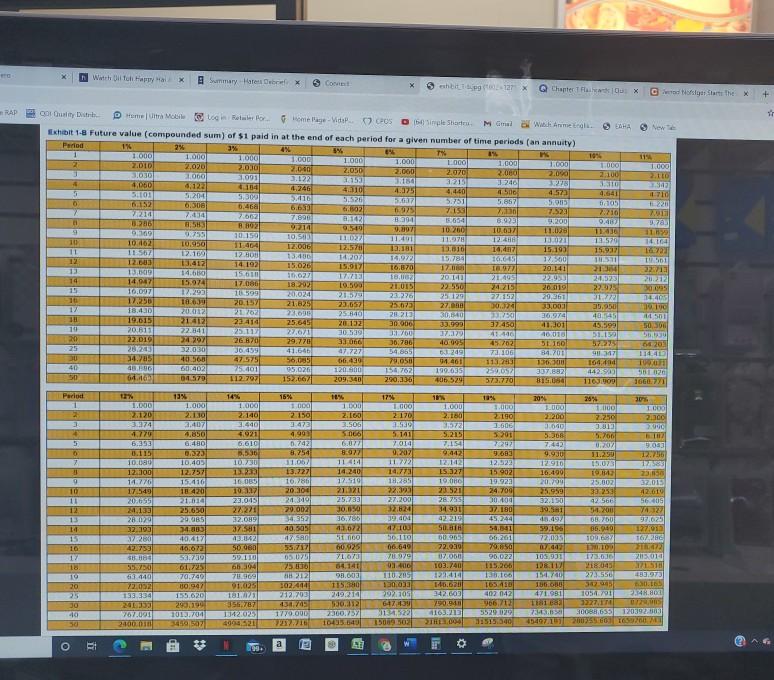

Saved 5 Carla Lopez deposits $4,000 a year into her retirement account. If these funds have an average earning of 6 percent over the 40

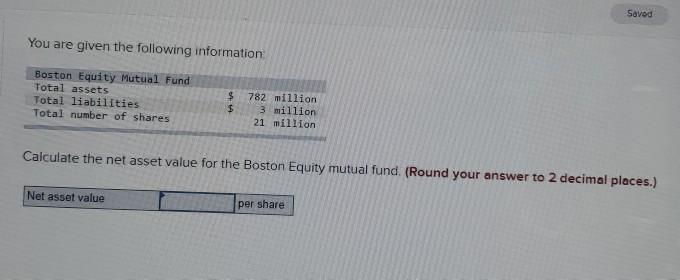

Saved 5 Carla Lopez deposits $4,000 a year into her retirement account. If these funds have an average earning of 6 percent over the 40 years until her retirement, what will be the value of her retirement account? Use Exhibit 1-B. (Round time value factor to 3 decimal places and final answer to the nearest whole number.) Future value of retirement account 02 103 a ! o DE 150092502 15:22 6A7.000 10405.640 200.7571 ZOS OS VOICOT CZ 91 CCM CAS260E cs' HODE CS WELCE DOBRE TASOT CS CLG'EST HISTLE DS OL OC 1779.000 138.745 212.703 1:515340 552029 966,712 402 142 163/410 1.3.106 115.266 CLOTH 067 COOPE 129193 DIE 45497101 7. TE 471.981 166 OBD 151.740 1112 105,931 7.442 72,0351 1842025 356.787 181270 01.025 CROCS TOP SIL COOH ZOE SOLO CEDUCE SZOTT OU O 155.6201 10.947 70.740 OL 007 TOD'Z94 ESTEZ TRGOT OS Y'S BARS SACK TO 27.556 2183043 173.00 103.740 07.060 72.00 2015010 2 60 For 99 DIT GG 09 Os 750 05.075 COLE 00.649 64.141 71673 607925 91.000 41,672 36.786 SI ST'TE ORCES EXO 120 CORTE 50 091 CLOSET 1046 36.40 63.700 Izz'06 USD TODO IS BEST OBLIC PODE LASS DESU SDS OP 256 165 DIT OG COLE TOP 6 260 32 193 2002 13 0600 HOS 6TZ ZD ICOLE SEX BC IZSLE 79.004 250650 CETU 7412 562409 42.610 32.0 mo 895.b ESZ EE COD SE TRSTE GROZE TVZ SV0E LELOT HONE OSTZE 6565 16/02 OSO EELSE IZE 27.200 TOT OPER E IT 01 0 24.700 19.923 CZ 20.304 16,786 10 16.085 16420 152216 12.757 17.549 14.776 12.100 OCH CE 16.490 12 910 15 327 17.519 14.240 11414 3 2005 CZECT CB96 147731 1172 TREET 12.112 of 12.750 EZOT 959 0442 0207 11.05 8.254 0.742 OD CPUL CE 52061 OSTI ZOCIO 90/ CEC CROG 7 0 5 78202 IST 6.393 4.774 1 10C 5300 31.010 2.200 Onn GTC 5.215 3,572 6.610 4021 3.440 DIO IVES GESE OLTZ 0001 6.077 SOCO 3.506 2.160 COPOT CCO OR'S OSA AVE DET 000T KEL 1.606 2.190 2.250 OPTZ 1000 30% VZEE OZI 0001 081 000T 0001 NOE OSIZ 0001 896 OOT 1.009 14% 3 2 1 Pario 20% 18 1671 5102 110109 ta 6902 SCOT 9CE OSZ 2945 51 100s PUOI 12V 200 SR 114.41 905 20/5 DUE DE DE09 LA 900 CE ADE ECOZ OCO TE 500 LIZE 666 CC AIS 661 BOSOS TOG TE 4a14 33.950 LAGU G'DE COOC 1960 DSE ZE GE PCD 1900 DE CIZEZ CAUSE IL TE ZTDOZ COBI C671 19 22075 2.323 SIZ SIO IZ 2ne1 DE GE DE An ETATE TOST ICO BT Lot 51901 TESTRE COST 17 TE 5731770 112.707 04.579 30 337.882 239.057 05.026 25.401 0402 40 150 54.461 050 50,035 30 84.70 54.865 41.646 36591 25 51 150 36.700 29.770 26.870 22.010 20 3:1/60 22.07 20.813 10 25645 23 414 19.015 30,00 25.840 21702 18.1.01 27, 23.657 21825 20.157 122256 23.276 21579 20.024 1009 10.007 20.019 17.086 15.974 14,947 22.93 21.495 2010 14.610 1971 17.00 16.870 15.026 1.412 12 14,072 13.400 11 14,471 10101 12.006 12:48 11.40 10.500 10.637 1000 0.286 5.654 2798 2014 7210 2 7.15 6.466 DUB 0 5.751 312014 4.246 0,122 5 278 2.070 1.000 T 6% 2% Period Exhibiti-a Future value (compounded sum) of $1 paid in at the end of each period for a given number of time periods (an annuity) Gal Winth Amet Dimple Shot romelage-Vidar POS Duit Det COSTO FEL LTO SE Icorn BESTEL I TREET 69 EGZI 295 IT TOOT CO ZOTE BORZE DIE OSTOL 08 TO 002 COES LOT BIT DE ELSE Cine's - TZS 13570 NOTE SEO OT 6 0.467 3,78 W01 220 ECOS DEN 2095 VIC BL CE99 QUS OTEL CUS 0113 DODT COLE TES DIE OTZ 0001 VOL 0 SICE IS COS IS DIE 00012 1000't pie COS BSS OTO CLE OZ ODOTT 00012 0902 LOOT DOS PO 100' OCOZ DOOT KE STO TOS 090 DEORE OOZ 0001 XI DODE OZO ODOT OT 0001 New RAP + Q Chapter X whitga X 3 Co Summary Has Debrex X With loti Ha Ha Savod You are given the following information Boston Equity Mutual Fund Total assets Total liabilities Total number of shares $ $ 782 million 3 million 21 million Calculate the net asset value for the Boston Equity mutual fund. (Round your answer to 2 decimal places.) Net asset value per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started