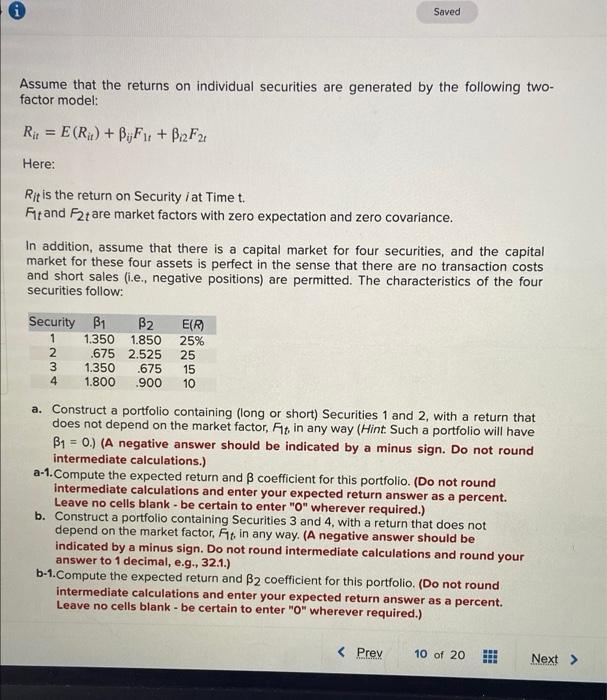

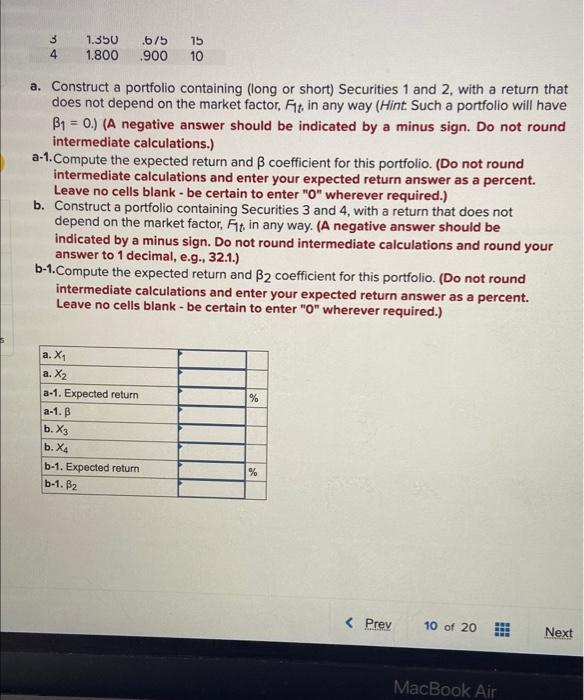

Saved Assume that the returns on individual securities are generated by the following two- factor model: Rit = E(R1) + B,F1. + B2 F21 Here: Ritis the return on Security i at Time t. Ftand F2tare market factors with zero expectation and zero covariance. In addition, assume that there is a capital market for four securities, and the capital market for these four assets is perfect in the sense that there are no transaction costs and short sales (i.e, negative positions) are permitted. The characteristics of the four securities follow: Security B1 B2 E(R) 1 1.350 1.850 25% 2 .675 2.525 25 3 1.350 675 15 4 1.800 900 10 a. Construct a portfolio containing (long or short) Securities 1 and 2, with a return that does not depend on the market factor, F1 in any way (Hint: Such a portfolio will have B1 = 0) (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.) a-1. Compute the expected return and coefficient for this portfolio. (Do not round Intermediate calculations and enter your expected return answer as a percent. Leave no cells blank - be certain to enter "0" wherever required.) b. Construct a portfolio containing Securities 3 and 4, with a return that does not depend on the market factor, Fit, in any way. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 1 decimal, e.g.. 32.1.) b-1.Compute the expected return and B2 coefficient for this portfolio. (Do not round intermediate calculations and enter your expected return answer as a percent. Leave no cells blank - be certain to enter "0" wherever required.) 3 1.350 675 15 4 1.800 900 10 a. Construct a portfolio containing (long or short) Securities 1 and 2, with a return that does not depend on the market factor, Ft. in any way (Hint Such a portfolio will have B1 = 0) (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.) a-1. Compute the expected return and coefficient for this portfolio. (Do not round intermediate calculations and enter your expected return answer as a percent. Leave no cells blank - be certain to enter "O" wherever required.) b. Construct a portfolio containing Securities 3 and 4, with a return that does not depend on the market factor, Fit in any way. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 1 decimal, e.g., 32.1.) b-1.Compute the expected return and B2 coefficient for this portfolio. (Do not round intermediate calculations and enter your expected return answer as a percent. Leave no cells blank - be certain to enter "0" wherever required.) % a. X1 a. X2 a-1. Expected return a-1.B b. X3 b. X4 b-1. Expected return b-1. B2 %