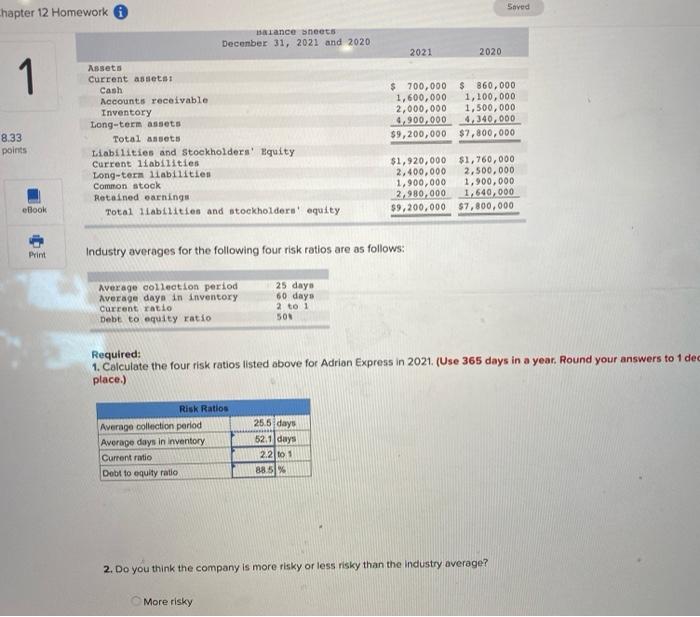

Saved Chapter 12 Homework tance sheets December 31, 2021 and 2020 2021 2020 1 $ 700,000 $360,000 1,600,000 1,100,000 2,000,000 1,500,000 4,900.000 4.340.000 $9,200,000 $7,800,000 8.33 points Assets Current assets Cash Accounts receivable Inventory Long-term assets Total ansets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total 1labilities and stockholders' equity $1,920,000 $1,760,000 2,400,000 2,500,000 1,900,000 1,900,000 2,980,000 1.640,000 $9,200,000 $7,800,000 eBook Print Industry averages for the following four risk ratios are as follows: Average collection period Average days in inventory Current ratio Debt to equity ratio 25 daya 60 days 2 to 1 SON Required: 1. Colculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 dec place.) Risk Ratios Average collection period Average days in Inventory Current ratio Debt to equity ratio 25.5 days 52.1 days 2.2 to 1 88.51% 2. Do you think the company is more risky or less risky than the industry average? More risky 2. Do you think the company is more risky or less risky than the industry average? More risky Less risky Saved Chapter 12 Homework tance sheets December 31, 2021 and 2020 2021 2020 1 $ 700,000 $360,000 1,600,000 1,100,000 2,000,000 1,500,000 4,900.000 4.340.000 $9,200,000 $7,800,000 8.33 points Assets Current assets Cash Accounts receivable Inventory Long-term assets Total ansets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total 1labilities and stockholders' equity $1,920,000 $1,760,000 2,400,000 2,500,000 1,900,000 1,900,000 2,980,000 1.640,000 $9,200,000 $7,800,000 eBook Print Industry averages for the following four risk ratios are as follows: Average collection period Average days in inventory Current ratio Debt to equity ratio 25 daya 60 days 2 to 1 SON Required: 1. Colculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 dec place.) Risk Ratios Average collection period Average days in Inventory Current ratio Debt to equity ratio 25.5 days 52.1 days 2.2 to 1 88.51% 2. Do you think the company is more risky or less risky than the industry average? More risky 2. Do you think the company is more risky or less risky than the industry average? More risky Less risky