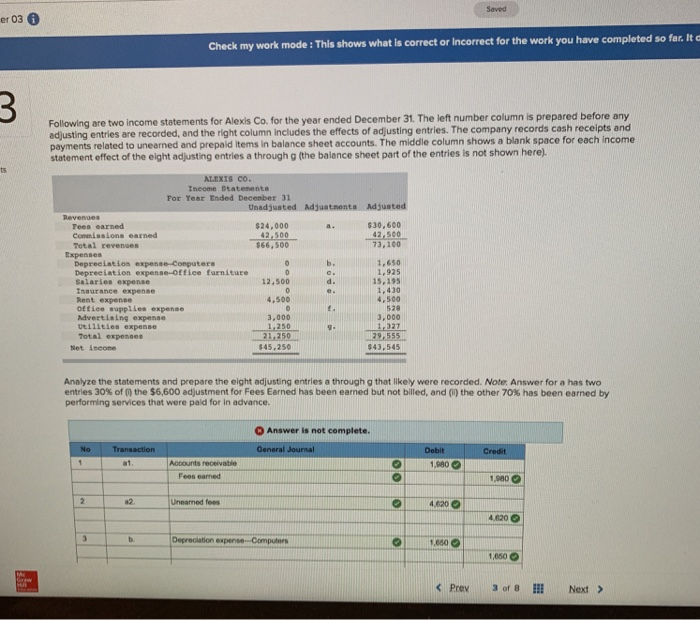

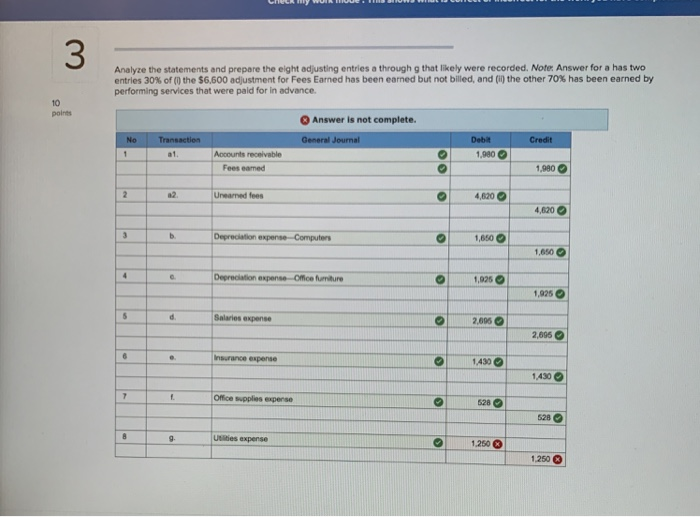

Saved er 03 6 Check my work mode : This shows what is correct or Incorrect for the work you have completed so far. Itc Following are two income statements for Alexis Co. for the year ended December 31. The left number column is prepared before any edjusting entries are recorded, and the right column includes the effects of adjusting entries. The company records cash receipts and payments related to uneerned and prepaid items in balance sheet accounts. The middle column shows a blank space for each income statement effect of the eight adjusting entries a through g (the balance sheet part of the entries is not shown here). ALEXIS Co. Ineome Statenenta For Year Ended Decenber 31 Unadjusted Adjuatments ndjusted $24,000 42 500 66, 500 $30,600 Fees earned Commissions earned Total revenues 73,100 1,650 1,925 15,195 1,430 4,500 28 3,000 1.327 Depreciation expense-Computers Depreeiation expense-office furniture Salaries expense Innurance expense Rent expense office suppliee expense Advertising expenae vtiiities expense Total expenses b. 12,500 4,500 3,000 1,250 $45,250 $43,545 Net income Analyze the statements and prepare the eight adjusting entries a through g that likely were recorded. Note: Answer for a has two entries 30% of ( ) the $6,600 adjustment for Fees Earned has been earned but not billed, and 0) the other 70% has been earned by performing services that were pald for in advance. O Answer is not complete. No General Journal Fees earned a2 Unearned fees 4820 4620 1,650 K Prev 3 of 8 l Next> 3 Analyze the statements and prepare the eight adjusting entries a through g that likely were recorded. Note: Answer for a has two entries 30% of (0 the S6.600 adjustment for Fees Earned has been earned but not billed, and the other 70% has been earned by performing services that were pald for in advance 10 points O Answer is not complete. Debit No Transactien Credit Aocounts recelivable Fees eamed a1 1,980 4,820 ,620 1,650 ,850 0 O 1,025 Depreciation expense Office furniture ,925 Salaries expense 2,696 2,695 1,430 430 Office supplies experse 528 528 Utlities expense 1,.250 1,250