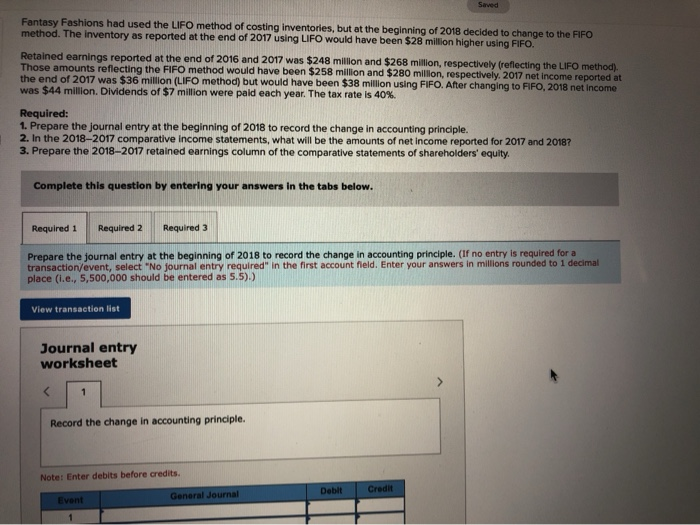

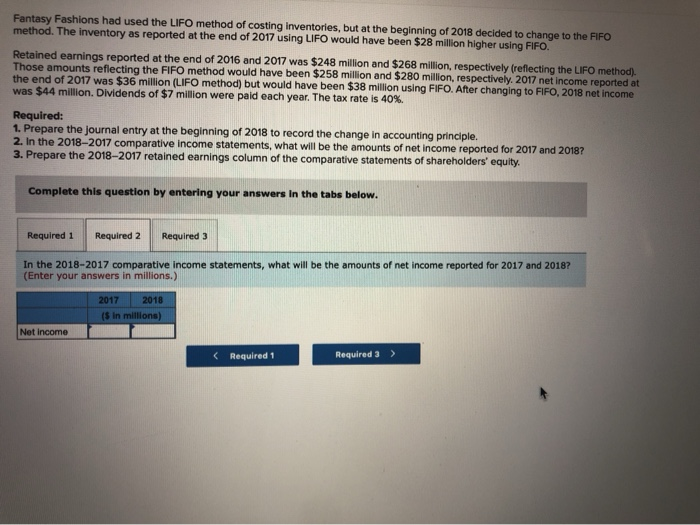

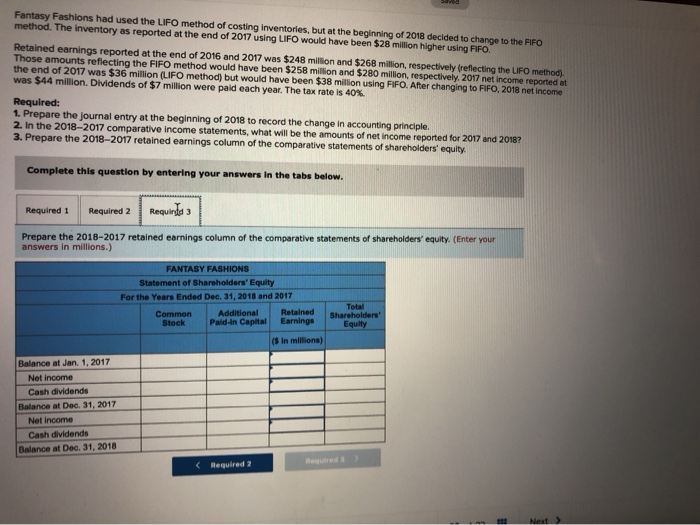

Saved Fantasy Fashions had used the LIFO method of costing inventories, but at the beginning of 2018 decided to change to the FIFO method. The inventory as reported at the end of 2017 using LIFO would have been $28 million higher using FIFO. Retained earnings reported at the end of 2016 and 2017 was $248 million and $268 million, respectively (reflecting the LIFO method). Those amounts reflecting the FIFO method would have been $258 million and $280 million, respectively. 2017 net income reported at the end of 2017 was $36 million (LIFO method) but would have been $38 million using FIFO. After changing to FIFO, 2018 net income was $44 million. Dividends of $7 million were paid each year. The tax rate is 40%. Required: 1. Prepare the journal entry at the beginning of 2018 to record the change in accounting principle. 2. In the 2018-2017 comparative Income statements, what will be the amounts of net income reported for 2017 and 2018? 3. Prepare the 2018-2017 retained earnings column of the comparative statements of shareholders' equity. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entry at the beginning of 2018 to record the change in accounting principle. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (I.e., 5,500,000 should be entered as 5.5).) View transaction list Journal entry worksheet Record the change in accounting principle. Note: Enter debits before credits. Dobit Credit Event General Journal 1 Fantasy Fashions had used the LIFO method of costing inventories, but at the beginning of 2018 decided to change to the FIFO method. The inventory as reported at the end of 2017 using LIFO would have been $28 million higher using FIFO. Retained earnings reported at the end of 2016 and 2017 was $248 million and $268 million, respectively (reflecting the LIFO method). Those amounts reflecting the FIFO method would have been $258 million and $280 million, respectively. 2017 net income reported at the end of 2017 was $36 million (LIFO method) but would have been $38 million using FIFO. After changing to FIFO, 2018 net income was $44 million. Dividends of $7 million were paid each year. The tax rate is 40% Required: 1. Prepare the journal entry at the beginning of 2018 to record the change in accounting principle. 2. In the 2018-2017 comparative income statements, what will be the amounts of net income reported for 2017 and 2018? 3. Prepare the 2018-2017 retained earnings column of the comparative statements of shareholders' equity. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 In the 2018-2017 comparative income statements, what will be the amounts of net income reported for 2017 and 2018? (Enter your answers in millions.) 2017 2018 ($ in millions) Net income (Required 1 Required 3 > Fantasy Fashions had used the LIFO method of costing inventories, but at the beginning of 2018 decided to change to the FIFO method. The inventory as reported at the end of 2017 using LIFO would have been $28 million higher using FIFO. Retained earnings reported at the end of 2016 and 2017 was $248 million and $268 million, respectively reflecting the LIFO method). Those amounts reflecting the FIFO method would have been $258 million and $280 million, respectively. 2017 net income reported at the end of 2017 was $36 million (LIFO method, but would have been $38 million using FIFO. After changing to FIFO, 2018 net income was $44 million. Dividends of $7 million were paid each year. The tax rate is 40%. Required: 1. Prepare the journal entry at the beginning of 2018 to record the change in accounting principle. 2. In the 2018-2017 comparative Income statements, what will be the amounts of net income reported for 2017 and 2018? 3. Prepare the 2018-2017 retained earnings column of the comparative statements of shareholders' equity. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Requindd 3 Prepare the 2018-2017 retained earnings column of the comparative statements of shareholders' equity. (Enter your answers in millions.) FANTASY FASHIONS Statement of Shareholders' Equity For the Years Ended Dec 31, 2018 and 2017 Common Additional Retained Stock Pald-in Capital Earnings Total Shareholders Equity ($ in millions) Balance at Jan 1, 2017 Net Income Cash dividends Balance at Dec 31, 2017 Net Income Cash dividends Balance at Dec 31, 2018 (Required 2 Next