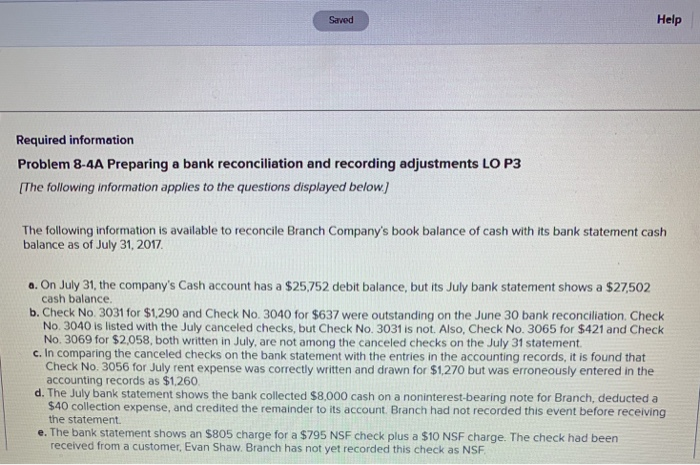

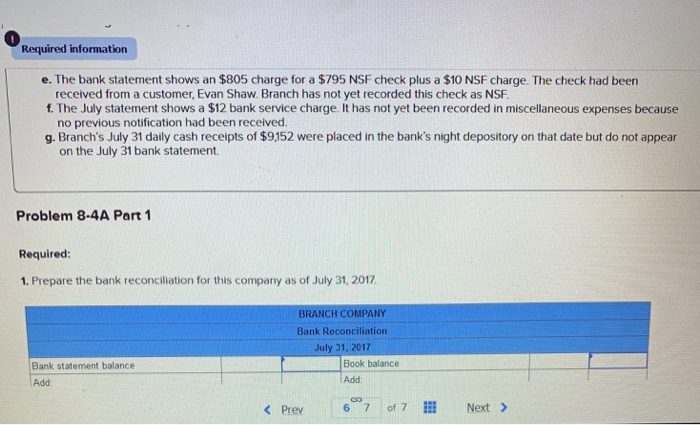

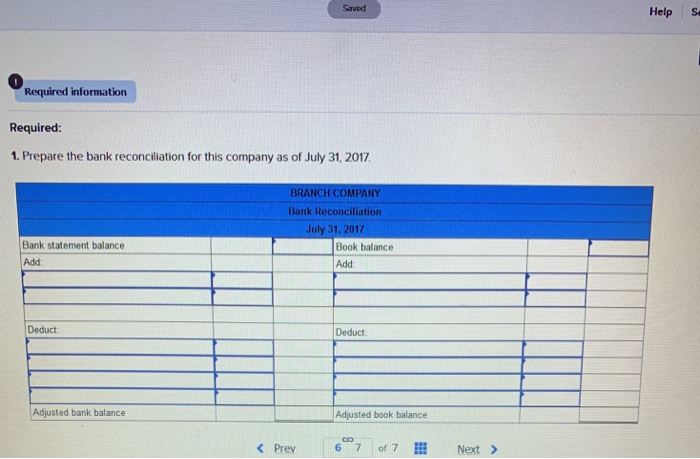

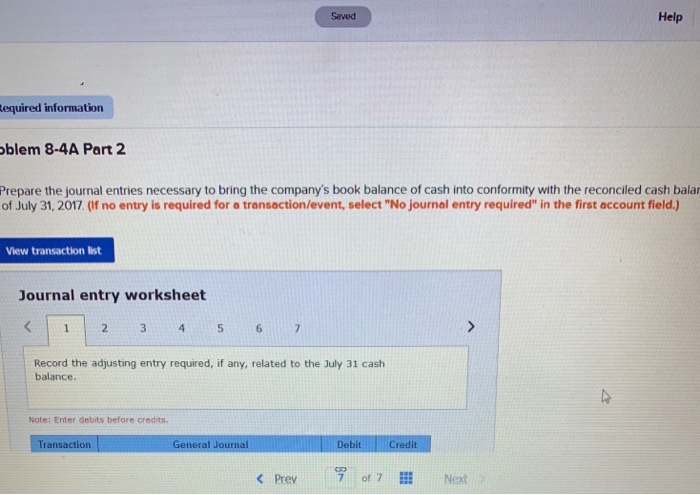

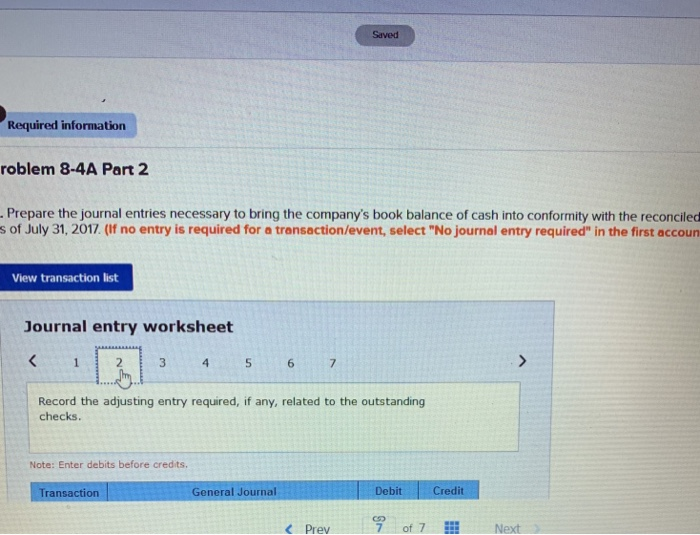

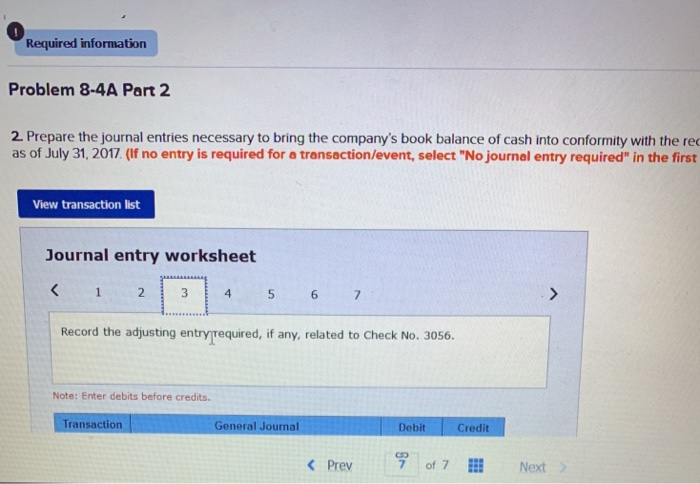

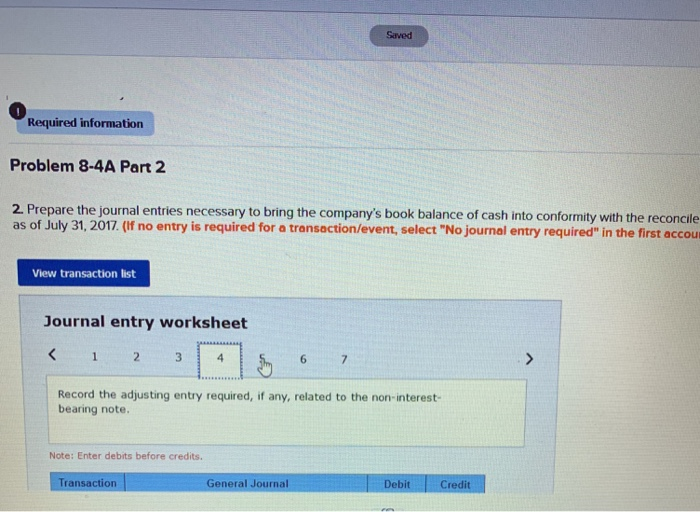

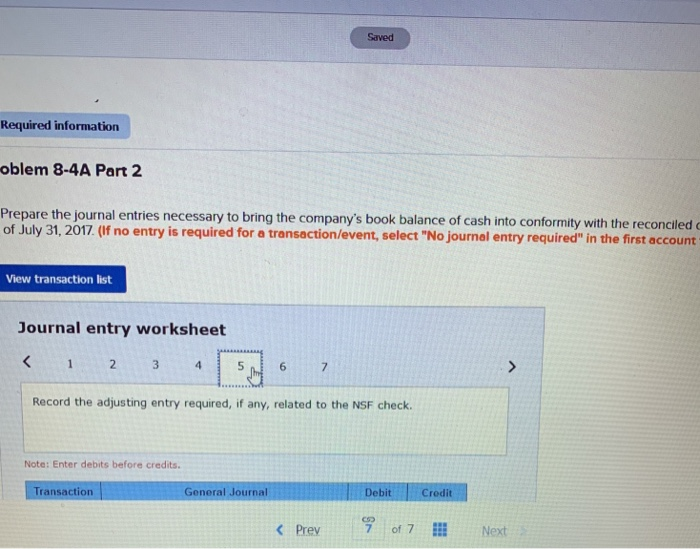

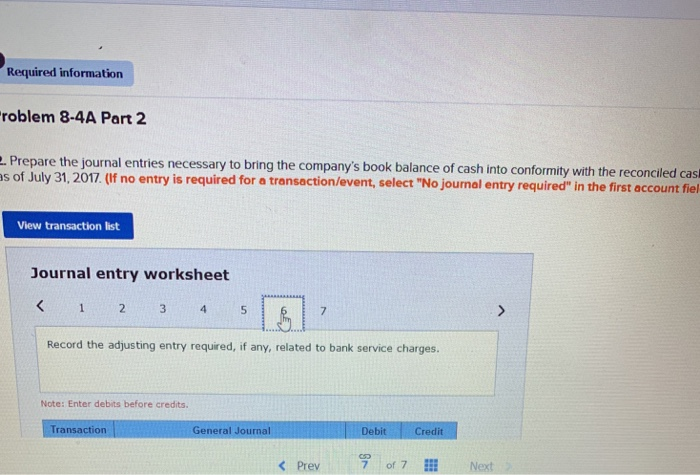

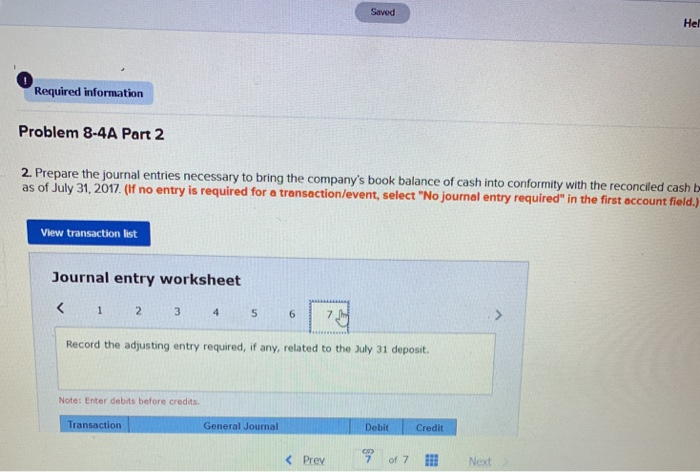

Saved Help Required information Problem 8-4A Preparing a bank reconciliation and recording adjustments LO P3 The following information applies to the questions displayed below The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31, 2017 o. On July 31, the company's Cash account has a $25,752 debit balance, but its July bank statement shows a $27502 cash balance. b. Check No. 3031 for $1,290 and Check No. 3040 for $637 were outstanding on the June 30 bank reconciliation. Check No. 3040 is listed with the July canceled checks, but Check No. 3031 is not. Also, Check No. 3065 for $421 and Check No. 3069 for $2,058, both written in July, are not among the canceled checks on the July 31 statement c. In comparing the canceled checks on the bank statement with the entries in the accounting records, it is found that d. The July bank statement shows the bank collected $8,000 cash on a noninterest-bearing note for Branch, deducted a e. The bank statement shows an $805 charge for a $795 NSF check plus a $10 NSF charge. The check had been Check No. 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accounting records as $1,260 $40 collection expense, and credited the remainder to its account. Branch had not recorded this event before receiving the statement received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF 0 Required information e. The bank statement shows an $805 charge for a $795 NSF check plus a $10 NSF charge. The check had been f. The July statement shows a $12 bank service charge. It has not yet been recorded in miscellaneous expenses because g. Branch's July 31 daily cash receipts of $9,152 were placed in the bank's night depository on that date but do not appear received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF no previous notification had been received on the July 31 bank statement Problem 8-4A Part 1 Required: 1. Prepare the bank reconciliation for this company as of July 31, 2017 BRANCH COMPANY Bank Reconciliation July 31, 2017 Book balance Add Bank statement balance Add Saved Help Se 0 Required information Required: 1. Prepare the bank reconciliation for this company as of July 31, 2017 BRANCH COMPANY Bank Reconciliation July 31, 2017 Bank statement balance Add: Book balance Add Deduct Deduct Adjusted bank balance Adjusted book balance K Prev6 7 of 7 Next> Saved Help equired information blem 8-4A Part 2 Prepare the journal entries necessary to bring the company's book balance of cash into conformity with the reconciled cash balar of July 31, 2017 (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry required, if any, related to the July 31 cash balance Note: Enter debits before credits. ransaction General Journal