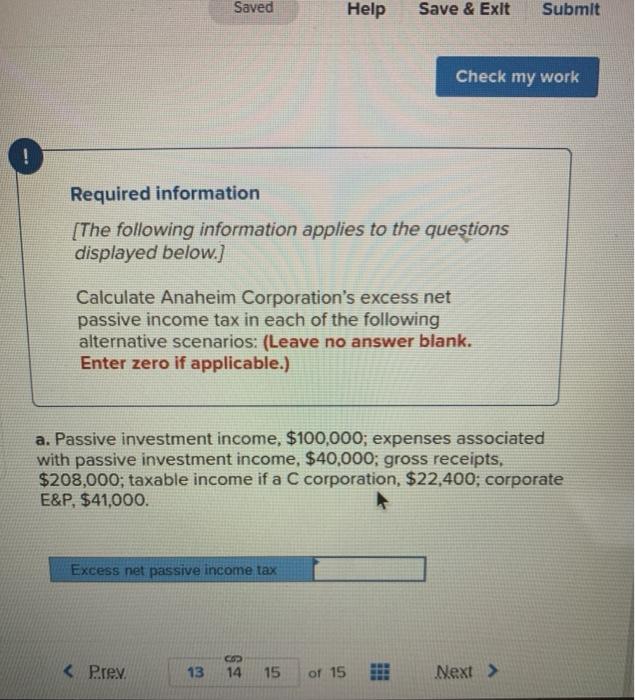

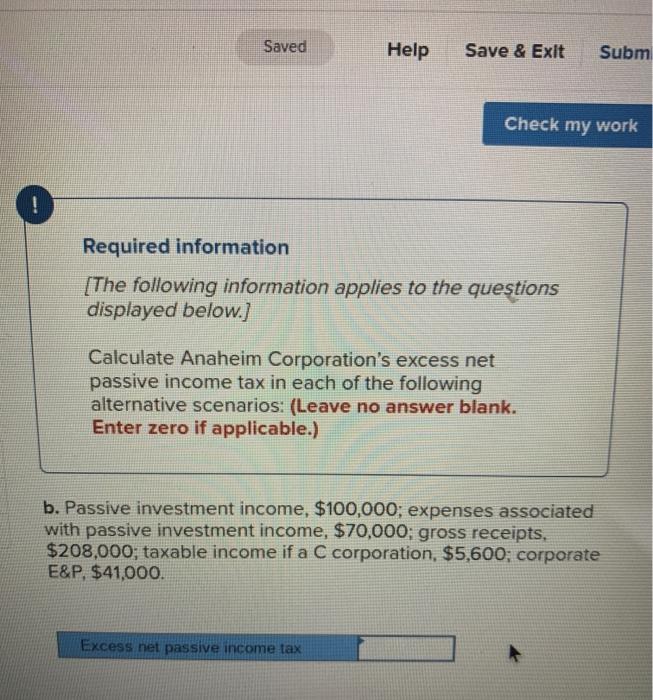

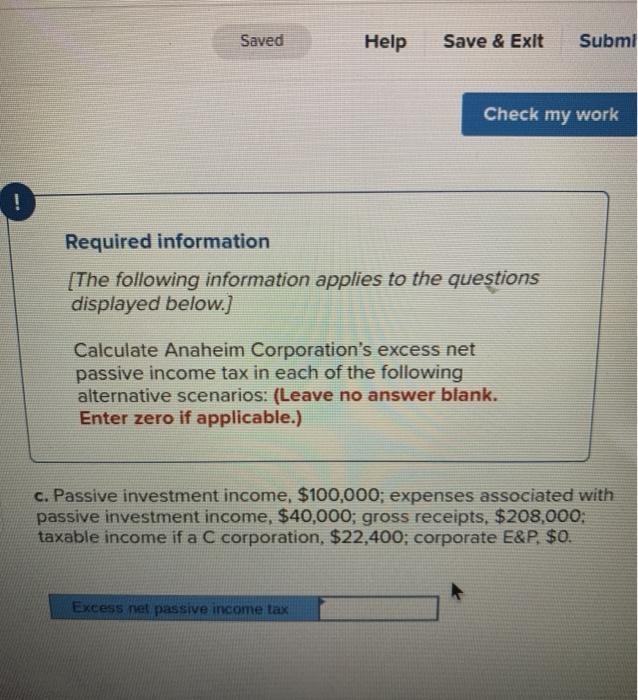

Saved Help Save & Exit Submit Check my work ! Required information [The following information applies to the questions displayed below.] Calculate Anaheim Corporation's excess net passive income tax in each of the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) a. Passive investment income, $100,000; expenses associated with passive investment income, $40,000; gross receipts, $208,000; taxable income if a C corporation, $22,400; corporate E&P, $41,000. Excess net passive income tax Saved Help Save & Exit Subm Check my work ! Required information [The following information applies to the questions displayed below.] Calculate Anaheim Corporation's excess net passive income tax in each of the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) b. Passive investment income, $100,000; expenses associated with passive investment income, $70,000; gross receipts, $208,000; taxable income if a C corporation, $5,600; corporate E&P, $41,000. Excess net passive income tax Saved Help Save & Exit Submi Check my work ! Required information [The following information applies to the questions displayed below.) Calculate Anaheim Corporation's excess net passive income tax in each of the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) c. Passive investment income, $100,000; expenses associated with passive investment income, $40,000; gross receipts, $208,000: taxable income if a C corporation, $22,400; corporate E&P. $0. Excess net passive income tax Saved Help Save & Exit Submit Check my work ! Required information [The following information applies to the questions displayed below.] Calculate Anaheim Corporation's excess net passive income tax in each of the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) a. Passive investment income, $100,000; expenses associated with passive investment income, $40,000; gross receipts, $208,000; taxable income if a C corporation, $22,400; corporate E&P, $41,000. Excess net passive income tax Saved Help Save & Exit Subm Check my work ! Required information [The following information applies to the questions displayed below.] Calculate Anaheim Corporation's excess net passive income tax in each of the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) b. Passive investment income, $100,000; expenses associated with passive investment income, $70,000; gross receipts, $208,000; taxable income if a C corporation, $5,600; corporate E&P, $41,000. Excess net passive income tax Saved Help Save & Exit Submi Check my work ! Required information [The following information applies to the questions displayed below.) Calculate Anaheim Corporation's excess net passive income tax in each of the following alternative scenarios: (Leave no answer blank. Enter zero if applicable.) c. Passive investment income, $100,000; expenses associated with passive investment income, $40,000; gross receipts, $208,000: taxable income if a C corporation, $22,400; corporate E&P. $0. Excess net passive income tax