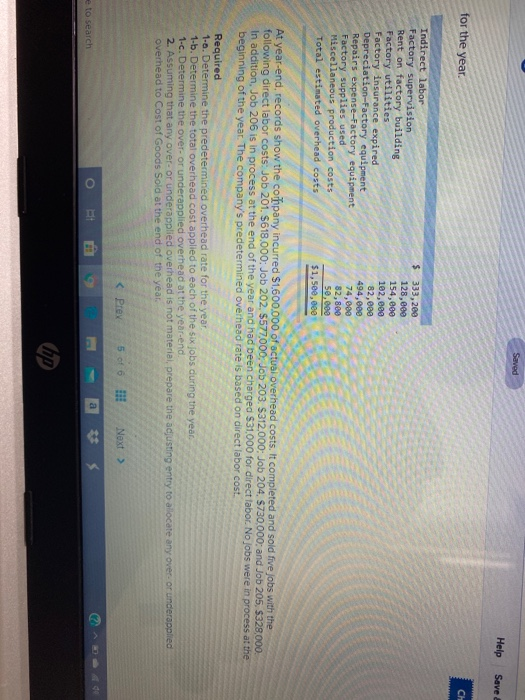

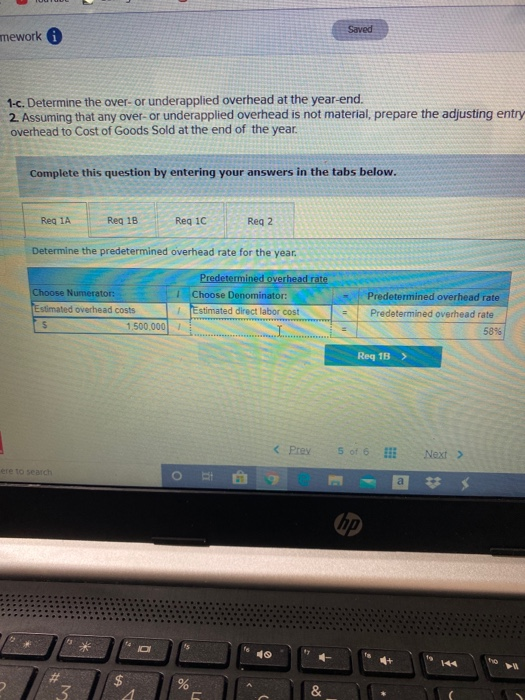

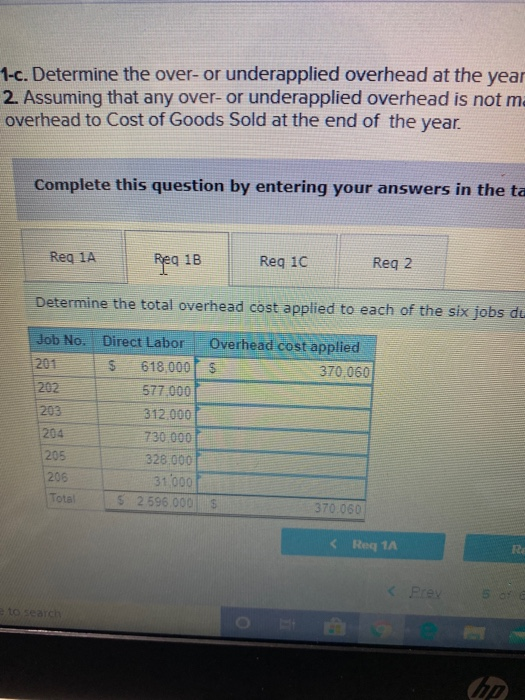

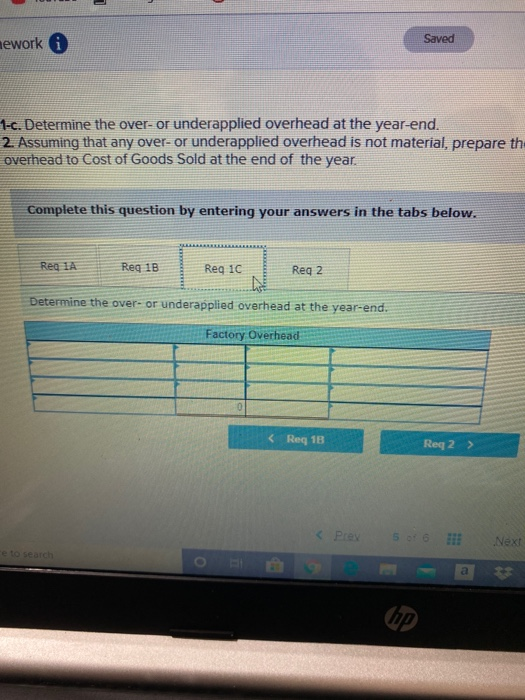

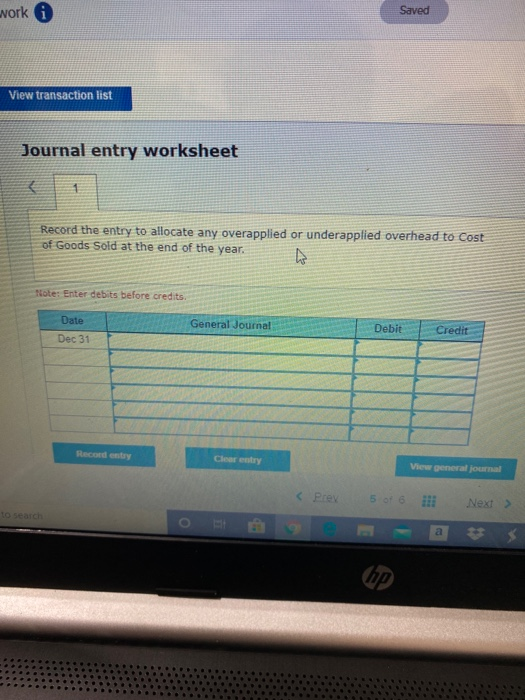

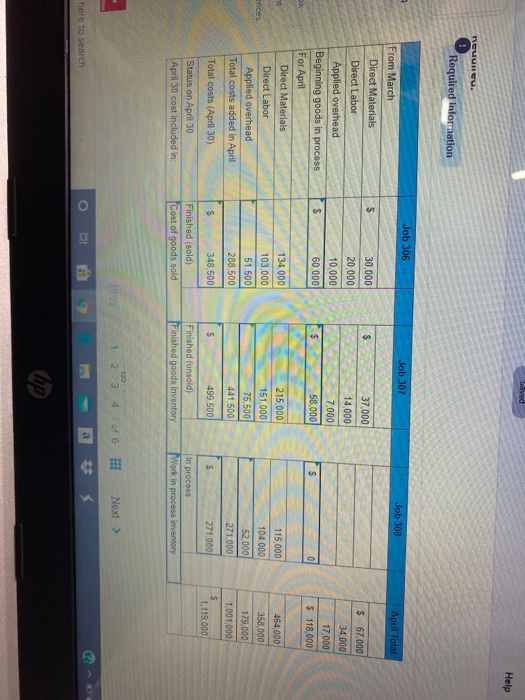

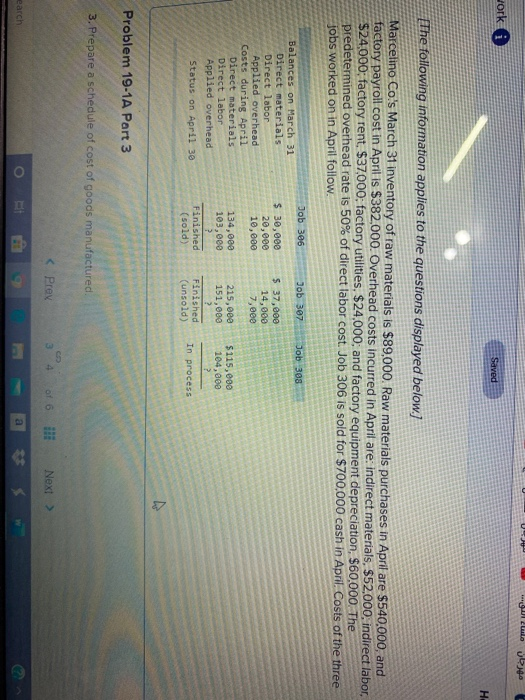

Saved Help Save for the year. CH Indirect labor Factory supervision Rent on factory building Factory utilities Factory insurance expired Depreciation-Factory equipment Repairs expense-Factory equipment Factory supplies used Miscellaneous production costs Total estimated overhead costs $ 333,200 128,000 154,000 102,000 82,000 494,000 74,000 82,800 50.000 $1,500,000 At year-end, records show the company incurred $1.600.000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201. $618,000: Job 202. $577,000Job 203. $312,000: Job 204 $730,000: and Job 205. $328,000. In addition, Job 206 is in process at the end of the year and had been charged $31.000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on direct labor cost. Required 1-a. Determine the predetermined overhead rate for the year 1-b. Determine the total overhead cost applied to each of the six jobs during the year 1-c. Determine the over- or underapplied overhead at the year-end. 2. Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold at the end of the year. e to search a hp Saved mework 1-c. Determine the over- or underapplied overhead at the year-end. 2. Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry overhead to Cost of Goods Sold at the end of the year. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 1C Reg 2 Determine the predetermined overhead rate for the year. Choose Numerator: Estimated overhead costs 5 1.500.000 Predetermined overhead rate 1 Choose Denominator: Estimated direct labor cost Predetermined overhead rate Predetermined overhead rate 5898 Reg 1B > ere to search a hp 15 0 145 > % & 5 1-c. Determine the over- or underapplied overhead at the year 2. Assuming that any over- or underapplied overhead is not m overhead to Cost of Goods Sold at the end of the year. Complete this question by entering your answers in the ta Reg 1A Rea 1B Req 1C Reg 2 Determine the total overhead cost applied to each of the six jobs du Job No. Direct Labor Overhead cost applied 201 $ 618.000 $ 370.060 202 577.000 203 312.000 204 730 000 205 328.000 206 31000 Total 52 596.000 370.060 a hip Saved Help REUungu. Required information Job 306 Job 307 Job 308 April Total $ 30,000 20.000 10,000 60.000 37,000 14,000 7,000 58,000 $ 67.000 34,000 17,000 $ 118,000 $ $ 0 From March Direct Materials Direct Labor Applied overhead Beginning goods in process For April Direct Materials Direct Labor Applied overhead Total costs added in April Total costs (April 30) 464 000 ances 134,000 103.000 51.500 288,500 215.000 151,000 75,500 441 115,000 104.000 52.000 271.000 358,000 179.000 1.001.000 s 348,500 $ 499,500 $ 5 271.000 1.119.000 Status on April 30 April 30 cost included in Finished (sold) Cost of goods sold Finished (unsold) Finished goods inventory In process Work in process inventory 1 2 3 4 of 6 Next > here to search o a hp UZULO ork Saved H. [The following information applies to the questions displayed below.) Marcelino Co.'s March 31 inventory of raw materials is $89,000. Raw materials purchases in April are $540,000, and factory payroll cost in April is $382,000. Overhead costs incurred in April are: indirect materials, $52,000, indirect labor, $24.000; factory rent, $37,000; factory utilities, $24,000, and factory equipment depreciation, $60,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $700,000 cash in April. Costs of the three jobs worked on in April follow. Job 306 Job 307 Job 308 $ 30,000 20,000 10,000 $ 37,000 14,000 7,000 Balances on March 31 Direct materials Direct labor Applied overhead Costs during April Direct materials Direct labor Applied overhead Status on April 30 134,00 103,000 215,000 151,000 $115,000 104,000 Finished (sold) Finished (unsold) In process Problem 19-1A Part 3 3. Prepare a schedule of cost of goods manufactured earch Saved Help Save for the year. CH Indirect labor Factory supervision Rent on factory building Factory utilities Factory insurance expired Depreciation-Factory equipment Repairs expense-Factory equipment Factory supplies used Miscellaneous production costs Total estimated overhead costs $ 333,200 128,000 154,000 102,000 82,000 494,000 74,000 82,800 50.000 $1,500,000 At year-end, records show the company incurred $1.600.000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201. $618,000: Job 202. $577,000Job 203. $312,000: Job 204 $730,000: and Job 205. $328,000. In addition, Job 206 is in process at the end of the year and had been charged $31.000 for direct labor. No jobs were in process at the beginning of the year. The company's predetermined overhead rate is based on direct labor cost. Required 1-a. Determine the predetermined overhead rate for the year 1-b. Determine the total overhead cost applied to each of the six jobs during the year 1-c. Determine the over- or underapplied overhead at the year-end. 2. Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold at the end of the year. e to search a hp Saved mework 1-c. Determine the over- or underapplied overhead at the year-end. 2. Assuming that any over- or underapplied overhead is not material, prepare the adjusting entry overhead to Cost of Goods Sold at the end of the year. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 1C Reg 2 Determine the predetermined overhead rate for the year. Choose Numerator: Estimated overhead costs 5 1.500.000 Predetermined overhead rate 1 Choose Denominator: Estimated direct labor cost Predetermined overhead rate Predetermined overhead rate 5898 Reg 1B > ere to search a hp 15 0 145 > % & 5 1-c. Determine the over- or underapplied overhead at the year 2. Assuming that any over- or underapplied overhead is not m overhead to Cost of Goods Sold at the end of the year. Complete this question by entering your answers in the ta Reg 1A Rea 1B Req 1C Reg 2 Determine the total overhead cost applied to each of the six jobs du Job No. Direct Labor Overhead cost applied 201 $ 618.000 $ 370.060 202 577.000 203 312.000 204 730 000 205 328.000 206 31000 Total 52 596.000 370.060 a hip Saved Help REUungu. Required information Job 306 Job 307 Job 308 April Total $ 30,000 20.000 10,000 60.000 37,000 14,000 7,000 58,000 $ 67.000 34,000 17,000 $ 118,000 $ $ 0 From March Direct Materials Direct Labor Applied overhead Beginning goods in process For April Direct Materials Direct Labor Applied overhead Total costs added in April Total costs (April 30) 464 000 ances 134,000 103.000 51.500 288,500 215.000 151,000 75,500 441 115,000 104.000 52.000 271.000 358,000 179.000 1.001.000 s 348,500 $ 499,500 $ 5 271.000 1.119.000 Status on April 30 April 30 cost included in Finished (sold) Cost of goods sold Finished (unsold) Finished goods inventory In process Work in process inventory 1 2 3 4 of 6 Next > here to search o a hp UZULO ork Saved H. [The following information applies to the questions displayed below.) Marcelino Co.'s March 31 inventory of raw materials is $89,000. Raw materials purchases in April are $540,000, and factory payroll cost in April is $382,000. Overhead costs incurred in April are: indirect materials, $52,000, indirect labor, $24.000; factory rent, $37,000; factory utilities, $24,000, and factory equipment depreciation, $60,000. The predetermined overhead rate is 50% of direct labor cost. Job 306 is sold for $700,000 cash in April. Costs of the three jobs worked on in April follow. Job 306 Job 307 Job 308 $ 30,000 20,000 10,000 $ 37,000 14,000 7,000 Balances on March 31 Direct materials Direct labor Applied overhead Costs during April Direct materials Direct labor Applied overhead Status on April 30 134,00 103,000 215,000 151,000 $115,000 104,000 Finished (sold) Finished (unsold) In process Problem 19-1A Part 3 3. Prepare a schedule of cost of goods manufactured earch