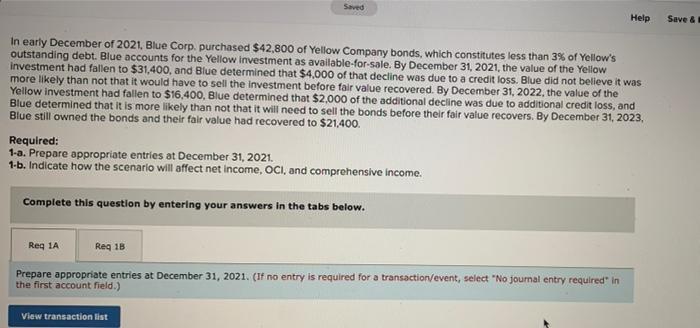

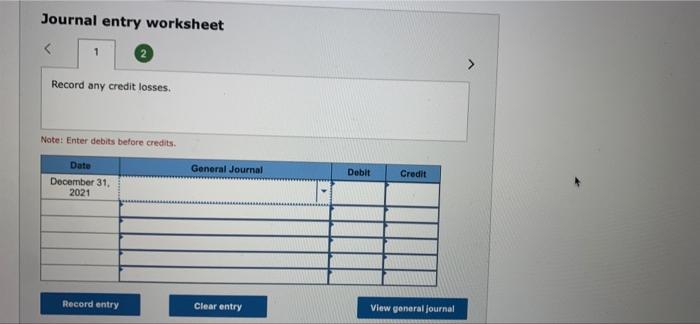

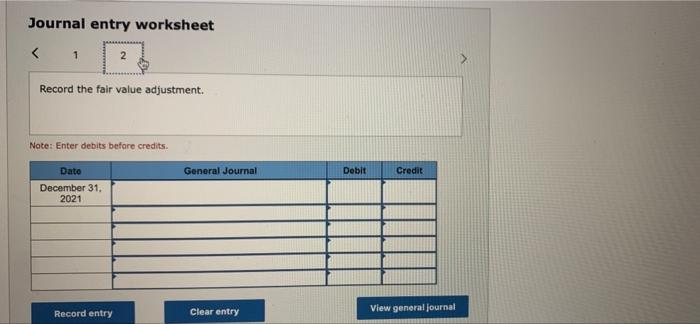

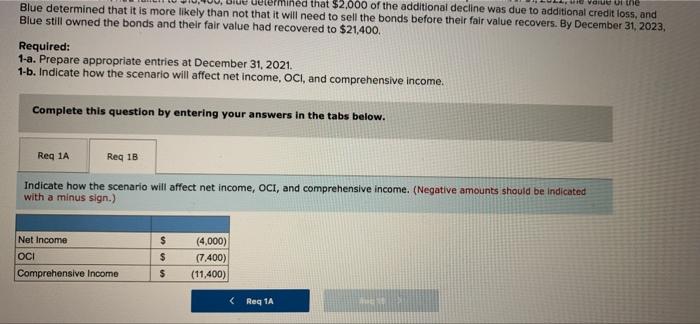

Saved Help Save & In early December of 2021. Blue Corp purchased $42.800 of Yellow Company bonds, which constitutes less than 3% of Yellow's outstanding debt. Blue accounts for the Yellow Investment as available-for-sale. By December 31, 2021, the value of the Yellow Investment had fallen to $31,400, and Blue determined that $4,000 of that decline was due to a credit loss. Blue did not believe it was more likely than not that it would have to sell the investment before fair value recovered. By December 31, 2022, the value of the Yellow investment had fallen to $16,400, Blue determined that $2,000 of the additional decline was due to additional credit loss, and Blue determined that it is more likely than not that it will need to sell the bonds before their fair value recovers. By December 31, 2023, Blue still owned the bonds and their fair value had recovered to $21.400. Required: 1-a. Prepare appropriate entries at December 31, 2021. 1-b. Indicate how the scenario will affect net income, OCI, and comprehensive Income. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Prepare appropriate entries at December 31, 2021. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record any credit losses Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2021 Record entry Clear entry View general Journal Journal entry worksheet 1 2 Record the fair value adjustment. Note: Enter debits before credits. General Journal Debit Credit Dato December 31. 2021 Record entry Clear entry View general Journal rue me ed that $2,000 of the additional decline was due to additional credit loss, and Blue determined that it is more likely than not that it will need to sell the bonds before their fair value recovers. By December 31, 2023, Blue still owned the bonds and their fair value had recovered to $21,400. Required: 1-a. Prepare appropriate entries at December 31, 2021. 1-b. Indicate how the scenario will affect net income, OCI, and comprehensive income. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Indicate how the scenario will affect net income, OCI, and comprehensive income. (Negative amounts should be indicated with a minus sign.) $ Net Income $ (4,000) (7.400) (11,400) Comprehensive Income $