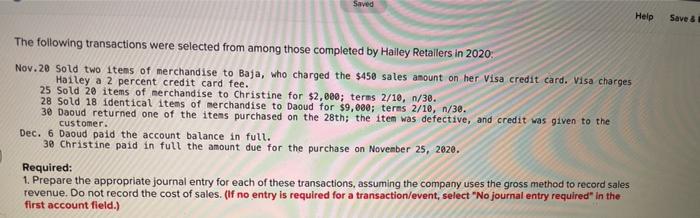

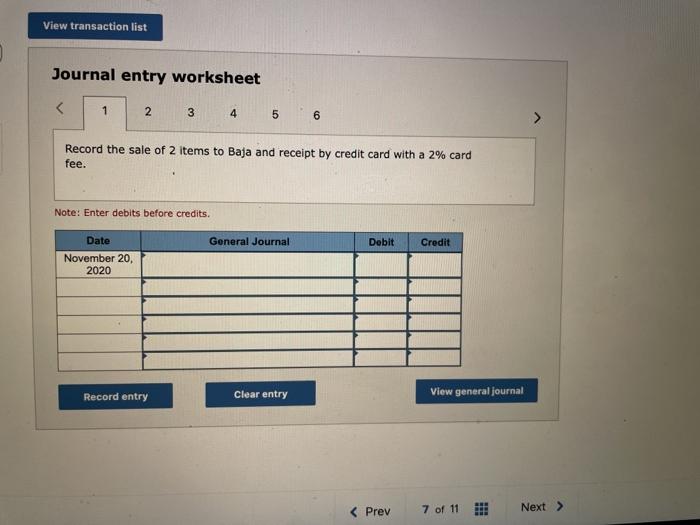

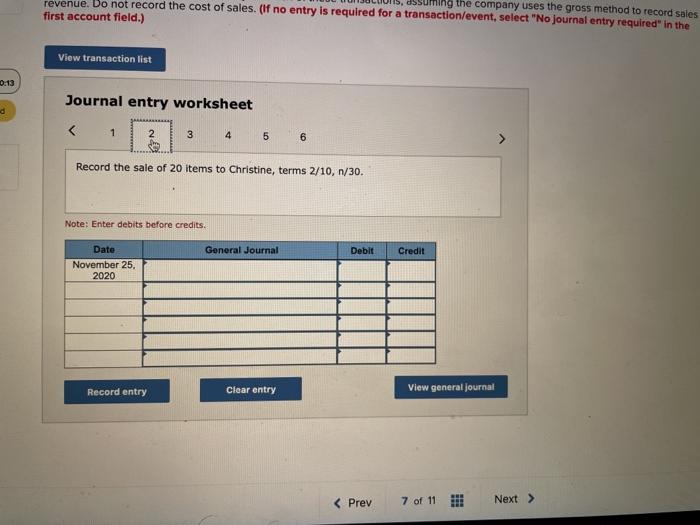

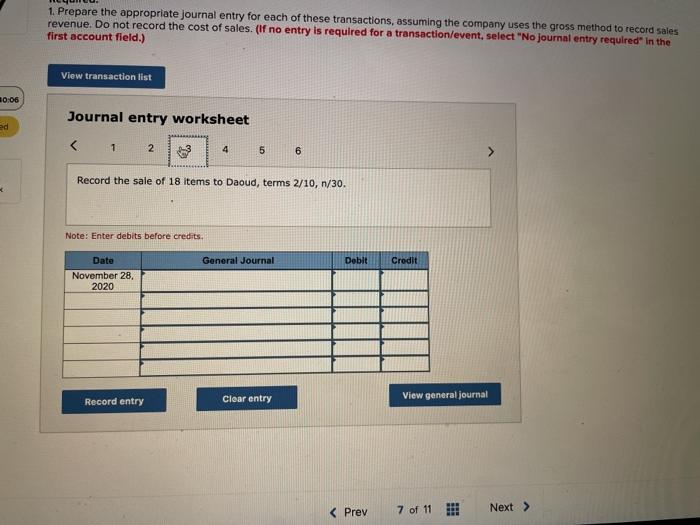

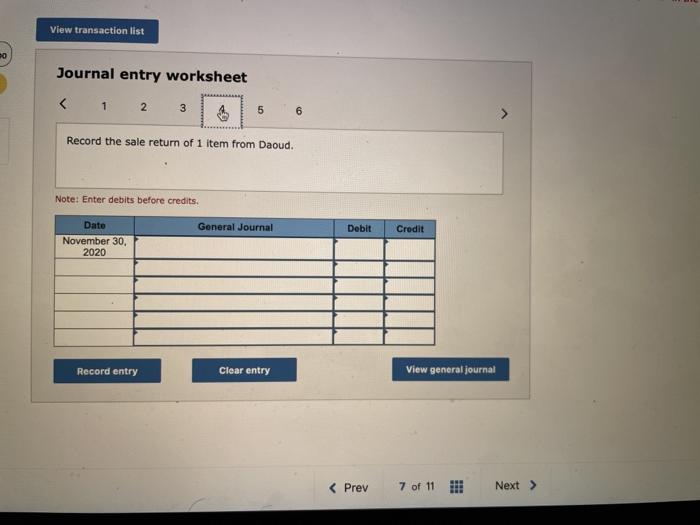

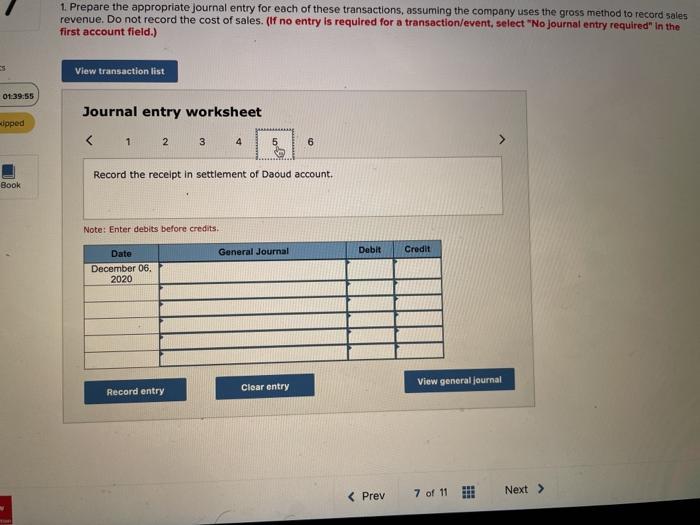

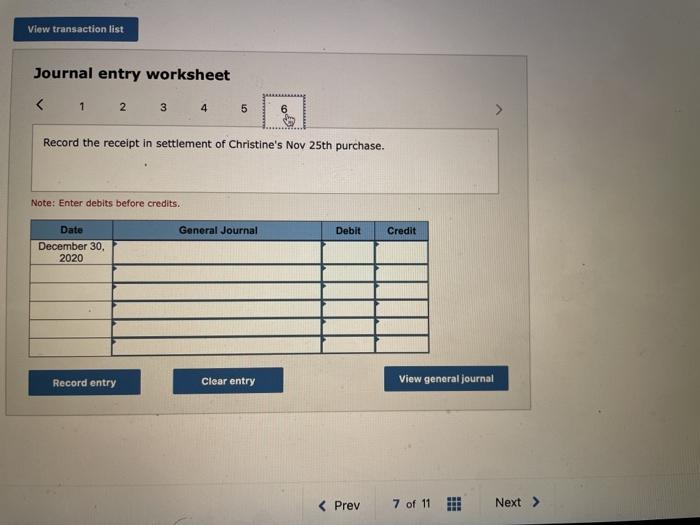

Saved Help Save & The following transactions were selected from among those completed by Hailey Retailers in 2020: Nov.20 Sold two items of merchandise to Baja, who charged the $450 sales amount on her Visa credit card. Visa charges Hailey a 2 percent credit card fee. 25 Sold 28 items of merchandise to Christine for $2,000; terms 2/10, n/30. 28 Sold 18 identical items of merchandise to Daoud for $9,000; terms 2/10, n/30. 30 Daoud returned one of the items purchased on the 28th the iten was defective, and credit was given to the customer. Dec. 6 Daoud paid the account balance in full. 3e Christine paid in full the amount due for the purchase on November 25, 2020. Required: 1. Prepare the appropriate journal entry for each of these transactions, assuming the company uses the gross method to record sales revenue. Do not record the cost of sales. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 Record the sale of 2 items to Baja and receipt by credit card with a 2% card fee. Note: Enter debits before credits. Date General Journal Debit Credit November 20, 2020 Record entry Clear entry View general journal Suining the company uses the gross method to record sales revenue. Do not record the cost of sales. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list 0:13 Journal entry worksheet 1. Prepare the appropriate journal entry for each of these transactions, assuming the company uses the gross method to record sales revenue. Do not record the cost of sales. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list 20:06 Journal entry worksheet 2 4 5 6 Record the sale of 18 items to Daoud, terms 2/10, n/30. Note: Enter debits before credits General Journal Debit Credit Date November 28. 2020 Record entry Clear entry View general journal View transaction list 20 Journal entry worksheet 1 2 3 5 6 Record the sale return of 1 item from Daoud. Note: Enter debits before credits. General Journal Debit Credit Date November 30, 2020 Record entry Clear entry View general journal 1. Prepare the appropriate journal entry for each of these transactions, assuming the company uses the gross method to record sales revenue. Do not record the cost of sales. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list 01:39:55 Journal entry worksheet ipped 1 2 3 4 5 6 Record the receipt in settlement of Daoud account. Book Note: Enter debits before credits General Journal Debit Credit Date December 06, 2020 Record entry Clear entry View general journal View transaction list Journal entry worksheet 1 2 3 4 5 6 Record the receipt in settlement of Christine's Nov 25th purchase. Note: Enter debits before credits. General Journal Debit Credit Date December 30, 2020 Record entry Clear entry View general journal