Answered step by step

Verified Expert Solution

Question

1 Approved Answer

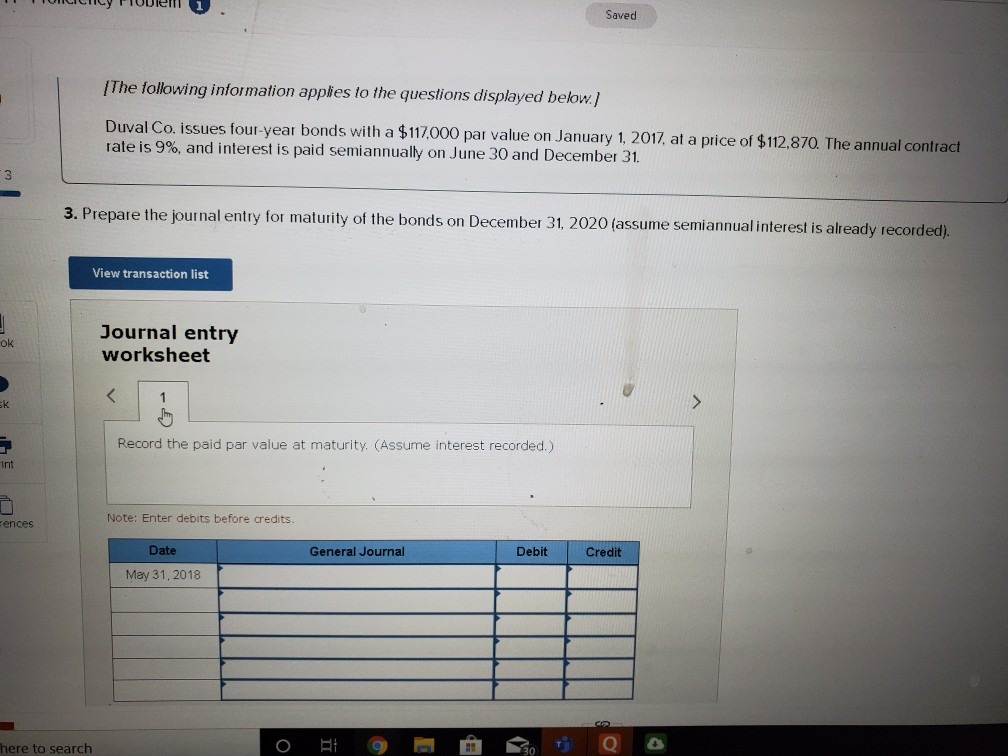

Saved IThe following information applies to the questions displayed below. Duval Co. issues four-year bonds with a $117,000 par value on January 1, 2017, at

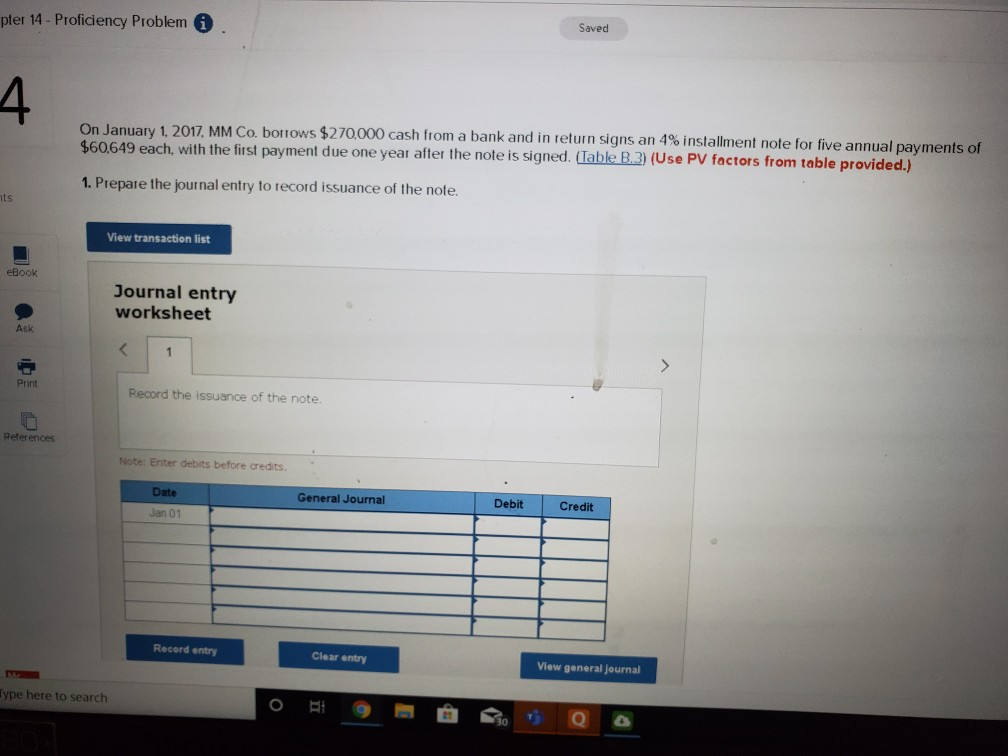

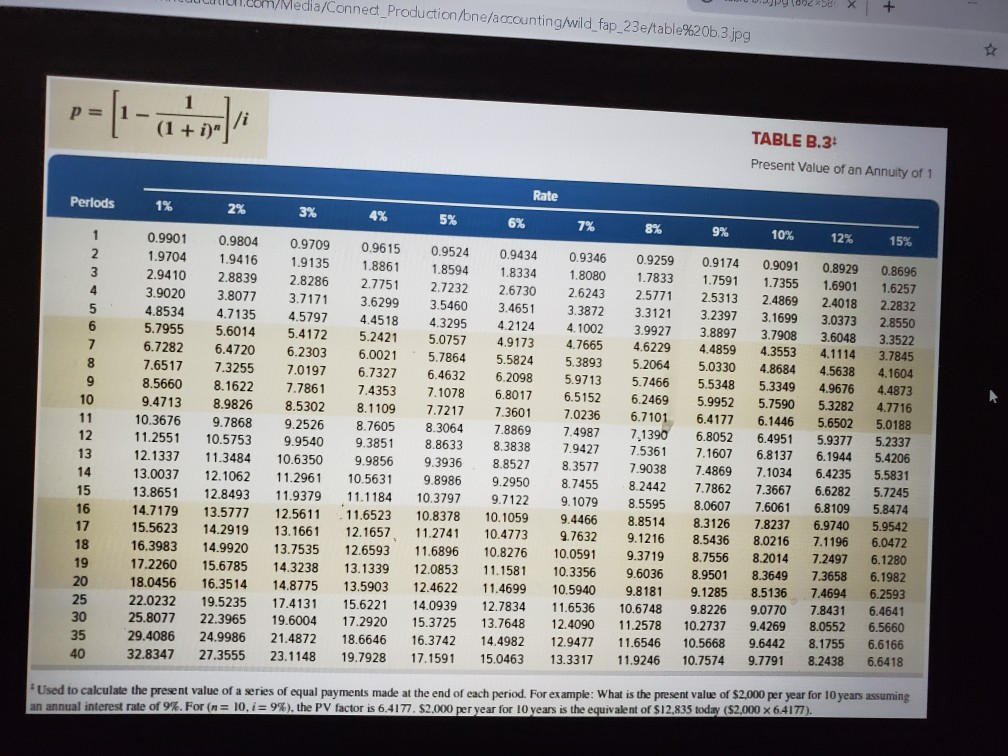

Saved IThe following information applies to the questions displayed below. Duval Co. issues four-year bonds with a $117,000 par value on January 1, 2017, at a price of $112,870. The annual contract rate is 9%, and interest is paid semiannually on June 30 and December 31. 3. Prepare the journal entry for maturity of the bonds on December 31, 2020 (assume semiannual interest is already recorded). View transaction list Journal entry worksheet ok K 1 k Record the paid par value at maturity. (Assume interest recorded.) Int Note: Enter debits before credits. rences Date General Journal Debit Credit ay 31,2018 4 here to search 30 C Saved pler 14- Proficiency Problem 4 On January 1, 2017, MM Co. borrows $270,000 cash from a bank and in return signs an 4 % installment note for five annual payments of $60,649 each, with the first payment due one year after the note is signed. (Table B.3) (Use PV factors from table provided.) 1. Prepare the journal entry to record issuance of the note. ts View transaction list eBook Journal entry worksheet Ask 1 Print Record the issuance of the note Peferences Note: Enter debits before credits Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journal M ype here to search /Media/Connect Production/bne/accounting/wild fap 23e/table %20b.3 jpg -ml 1 p= Vi (1 +i TABLE B.3 Present Value of an Annuity of 1 Rate Perlods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0.9901 12% 0.9804 15% 0.9709 0.9615 0.9524 0.9434 1.9704 0.9346 1.9416 0.9259 1.9135 0.9174 0.9091 1.8861 0.8929 1.8594 3 1.8334 0.8696 1.6257 2.9410 1.8080 2.8839 3.8077 1.7833 2.8286 1.7591 2.775 1.7355 1.6901 2.7232 4 2.6730 3.9020 2.6243 2.5771 3.7171 2.5313 2.4869 3.6299 4.4518 2.4018 3.0373 3.6048 4.1114 3.5460 2.2832 5 3.4651 3.3872 4.8534 3.3121 4.7135 3.2397 4.5797 5.4172 6.2303 3.1699 4.3295 2.8550 6 5.7955 4.2124 4.1002 5.6014 3.9927 3.8897 3.7908 4.3553 5.2421 5.0757 3.3522 4.9173 7 4.7665 6.7282 4.6229 6.4720 4.4859 6.0021 5.7864 3.7845 5.5824 8 5.3893 5.2064 7.6517 5.0330 7.3255 4.8684 7.0197 7.7861 4.5638 6.7327 4.1604 6.4632 6.2098 5.9713 8.5660 5.7466 5.5348 8.1622 5.3349 4.9676 7.4353 4.4873 7.1078 6.8017 6.5152 10 6.2469 6.7101 9.4713 5.9952 8.9826 5.7590 5.3282 8.5302 4.7716 8.1109 7.7217 7.3601 7.0236 11 10.3676 11.2551 6.4177 6.1446 9.7868 5.6502 9.2526 5.0188 8.7605 8.3064 7.8869 7.4987 7,1390 7.536 7.9038 12 6.8052 6.4951 10.5753 5.9377 9.9540 9.3851 5.2337 8.8633 8.3838 7.9427 13 12.1337 7.1607 6.8137 6.1944 11.3484 10.6350 5.4206 9.3936 9.9856 8.8527 8.3577 7.4869 14 13.0037 13.8651 7.1034 12.1062 6.4235 5.5831 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.7862 6.6282 6.8109 6.9740 15 7.3667 5.7245 12.8493 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 8.0607 7.6061 16 5.8474 14.7179 15.5623 11.6523 13.5777 12.5611 10.8378 10.1059 9.4466 8.8514 8.3126 8.5436 7.8237 17 5.9542 14.2919 13.1661 12.1657 11.2741 10.4773 9.7632 9.1216 8.0216 7.1196 18 6.0472 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 9.3719 10.0591 8.7556 8.2014 7.2497 6.1280 19 15.6785 17.2260 14.3238 13.1339 12.0853 12.4622 11.1581 10.3356 10.5940 9.6036 8.9501 8.3649 7.3658 6.1982 20 18.0456 16.3514 14.8775 13.5903 11.4699 9.8181 7.4694 7.8431 8.0552 9.1285 8.5136 6.2593 25 22.0232 25.8077 19.5235 17.4131 15.6221 14.0939 12.7834 9.8226 10.2737 10.5668 11.6536 9.0770 9.4269 10.6748 11.2578 6.4641 6.5660 30 22.3965 19.6004 17.2920 15.3725 13.7648 12.4090 35 29.4086 24.9986 21.4872 18.6646 16.3742 14.4982 12.9477 11.6546 9.6442 8.1755 6.6166 40 32.8347 27.3555 23.1148 19.7928 17.1591 15.0463 13.3317 11.9246 10.7574 9.7791 8.2438 6.6418 Used to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present value of $2,000 per year for 10 years assuming an annual interest rate of 9%. For (n= 10, i= 9% ) , the PV factor is 6.4177. $2.000 per year for 10 years is the equivalent of $12,835 today ($2,000 x 6.4177)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started