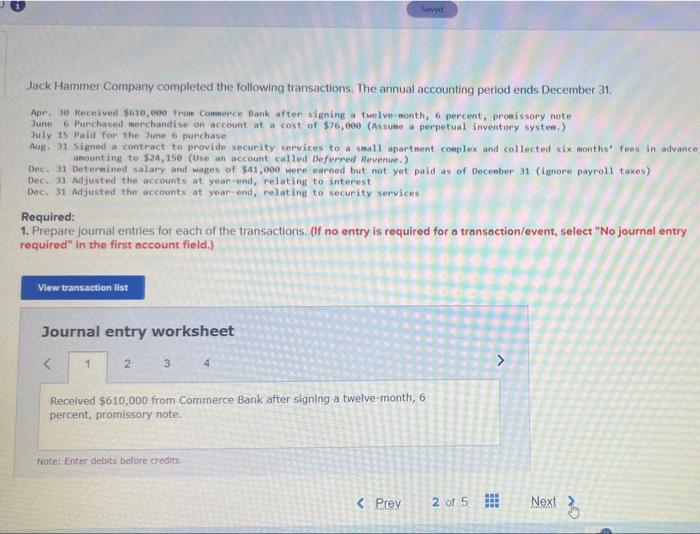

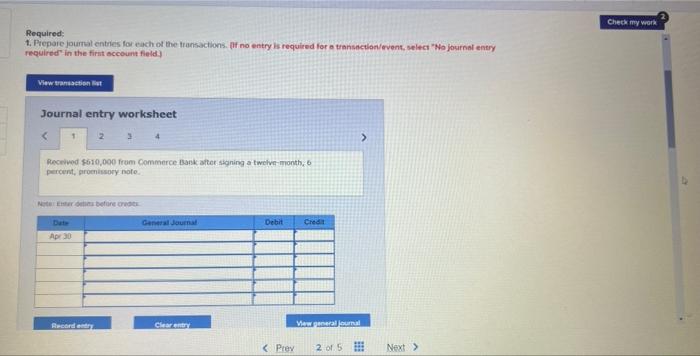

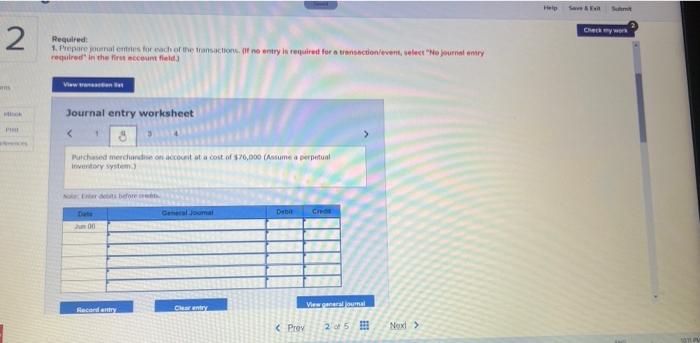

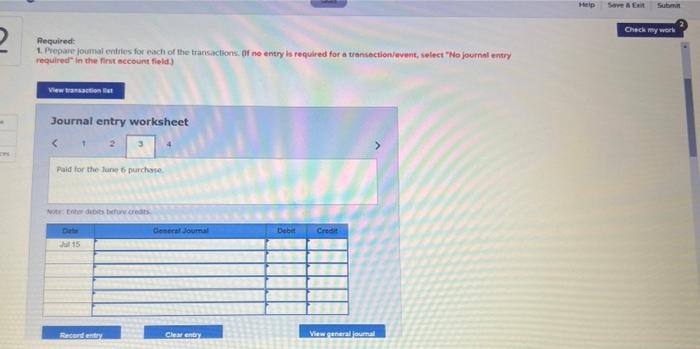

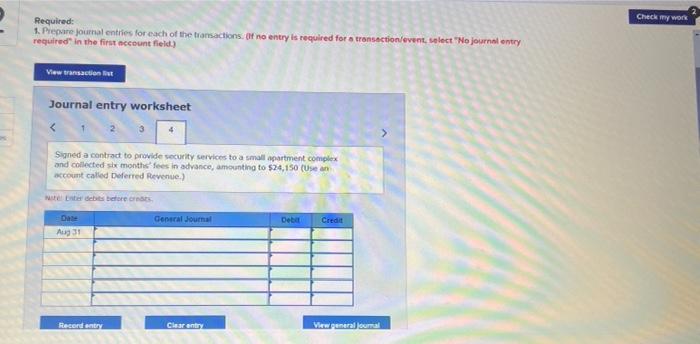

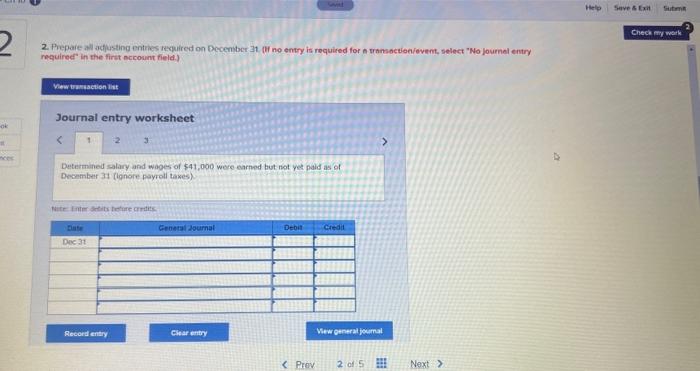

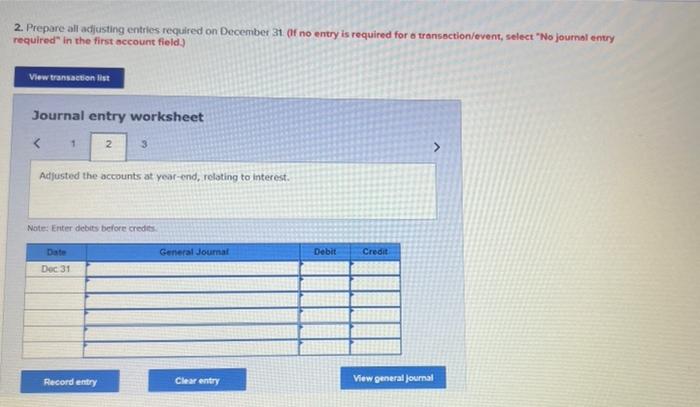

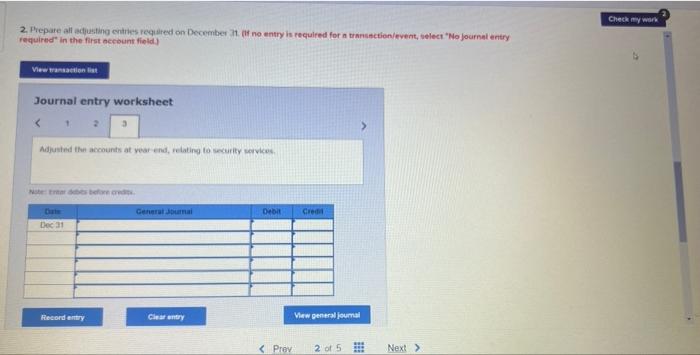

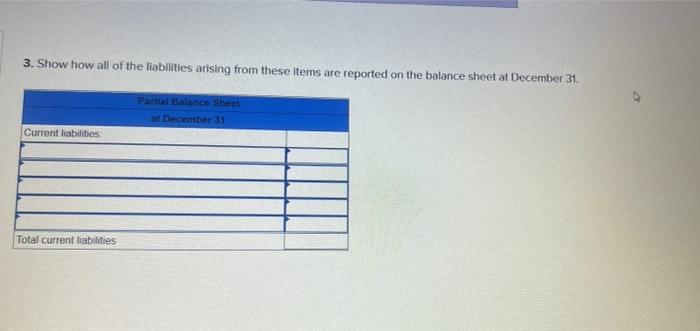

Saved Jack Hammer Company completed the following transactions. The annual accounting period ends December 31, Apr. 30 Received $610,000 from Commerce Bank after signing a twelve month, 6 percent, promissory note June Purchased merchandise on account at a cost of $76,000 (Assume a perpetual inventory system.) July 15 Paid for the June 6 purchase Aug 31 signed a contract to provide security services to a small apartment complex and collected six months' foes in advance amounting to $24,150 (Use an account called Deferred Revenue.) Dec. 31 Determined salary and wates of 541,000 were earned but not yet paid as of December 31 (ignore payroll taxes) Dec. 31 Adjusted the accounts at year-end, relating to interest Dec. 31 Adjusted the accounts at year-end, relating to security services Required: 1. Prepare journal entries for each of the transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 > Received $610,000 from Commerce Bank after signing a twelve-month, 6 percent, promissory note. Note: Enter debits before credits Received $610,000 from Commerce Bank after signing a twelve-month, percent, promissory note. Non before General Journal Debit Credit Apr 30 Clearen Meanai au Crew 2 Required 1. Prepare ournal arts for each of the transactions. If no try is required for a transaction event, select your required in the count Journal entry worksheet Help Sub Check my work 2 Required: 1. Prepare journal entries for each of the transactions. Of no entry is required for a transaction/event, select "No journal entry required in the first account field) View transaction Journal entry worksheet Determined salary and wages of $41,000 were earned but not yet palds of December 31 (ignore payroll taxes) Nettsted General Journal De Credit Dec 31 Record entry Clear entry View general journal 2. Prepare all adjusting entries required on December 31 (f no entry is required for transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 2 1 > Adjusted the accounts at year-end, relating to interest. Note: Enter debits before credits General Journal Debit Credit Date Dec 31 Record entry Clear entry View general journal Check my work 2. Prepare all achtingentes required on December no entry is required for a transaction/event, seleci. "Ne journal entry required in the first secountfield) View transaction et Journal entry worksheet Adjusted the accounts at vear end, relating to security services Notebore.co ebit Dec 31 Record entry Clear entry View general journal 3. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31 Partial Balance Sheet at December 31 Current liabilities Total current liabilities