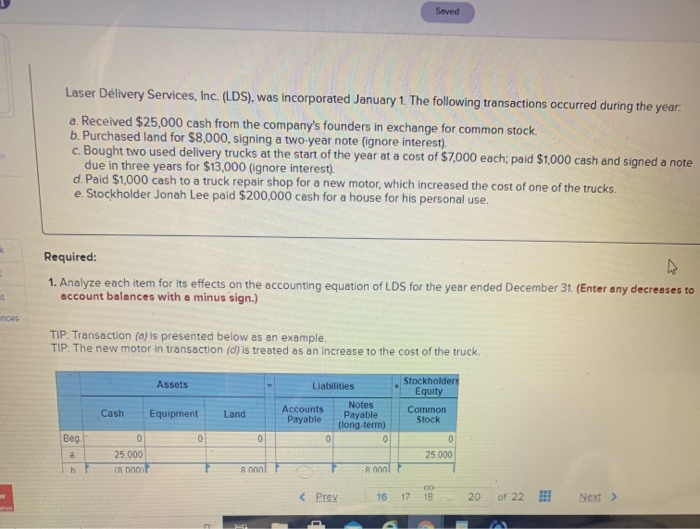

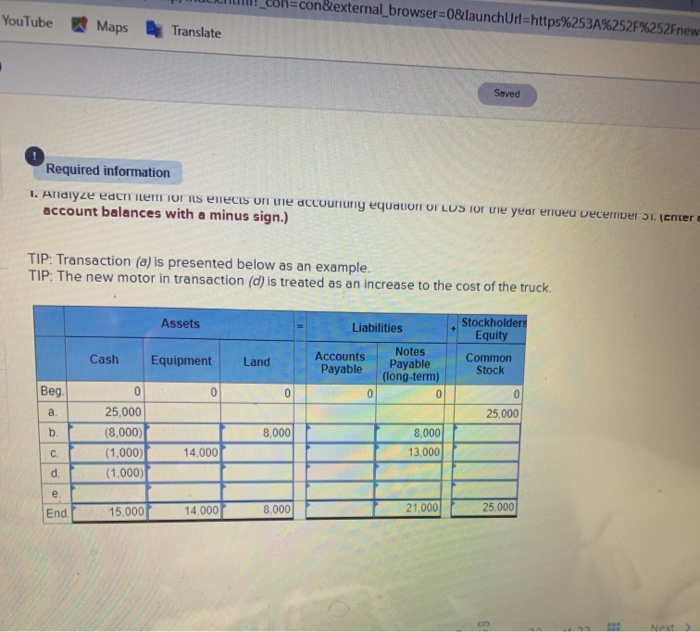

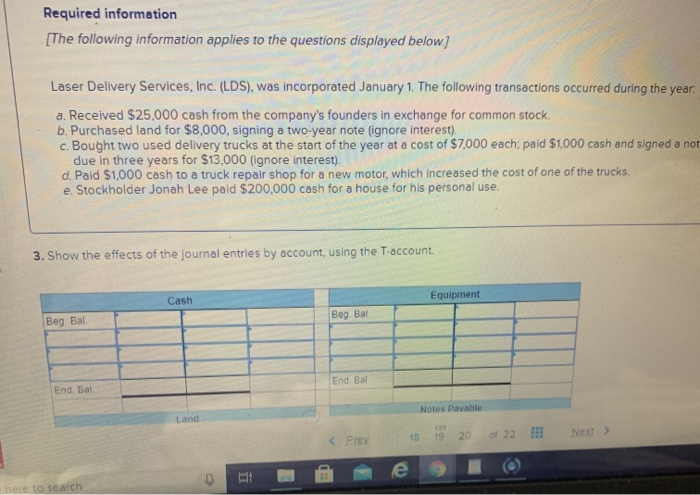

Saved Laser Delivery Services, Inc. (LDS), was incorporated January 1. The following transactions occurred during the year. a. Received $25,000 cash from the company's founders in exchange for common stock. b. Purchased land for $8,000, signing a two-year note (ignore interest). c. Bought two used delivery trucks at the start of the year at a cost of $7,000 each; paid $1,000 cash and signed a note due in three years for $13,000 (ignore interest). d. Paid $1,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. e. Stockholder Jonah Lee paid $200,000 cash for a house for his personal use. k Required: 1. Analyze each item for its effects on the accounting equation of LDS for the year ended December 31. (Enter any decreases to account balances with a minus sign.) nces TIP: Transaction (a) is presented below as an example. TIP: The new motor in transaction (d) is treated as an increase to the cost of the truck. Assets Stockholders Equity Common Stock Cash Equipment Liabilities Accounts Notes Payable Payable (long-term) 0 0 Land Beg 0 0 0 0 25.000 TR00011 25,000 h Ron 8 10 con&external_browser=0&launchUrl=https%253A%252F%252Fnew YouTube Maps Translate Saved Required information 1. Andiyze each item or its elects on the accountry equator UrLUS Ior me year erueu vecember 5. (enter account balances with a minus sign.) TIP: Transaction (a) is presented below as an example. TIP: The new motor in transaction (d) is treated as an increase to the cost of the truck. Assets Liabilities Stockholders Equity Cash Equipment Land Accounts Payable Notes Payable (long-term) 0 Common Stock 0 0 0 0 0 Beg a. 25,000 b 8,000 25,000 (8,000) (1.000) (1,000) 8,000 13,000 C 14.000 d e End 15,000 14.000 8.000 21,000 25.000 NA Required information [The following information applies to the questions displayed below) Laser Delivery Services, Inc. (LDS), was incorporated January 1. The following transactions occurred during the year. a. Received $25,000 cash from the company's founders in exchange for common stock. b. Purchased land for $8,000, signing a two-year note (ignore interest). c. Bought two used delivery trucks at the start of the year at a cost of $7,000 each; paid $1,000 cash and signed a not due in three years for $13,000 (ignore interest). d. Paid $1,000 cash to a truck repair shop for a new motor, which increased the cost of one of the trucks. e. Stockholder Jonah Lee paid $200,000 cash for a house for his personal use. 3. Show the effects of the journal entries by account, using the T-account. Cash Equipment Beg Bai Beg Bal End Bal End Bal Notes Pavable Land 19 here to search