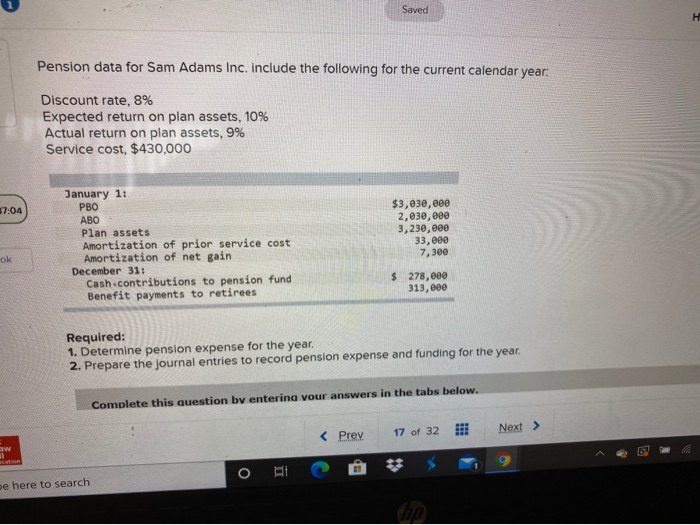

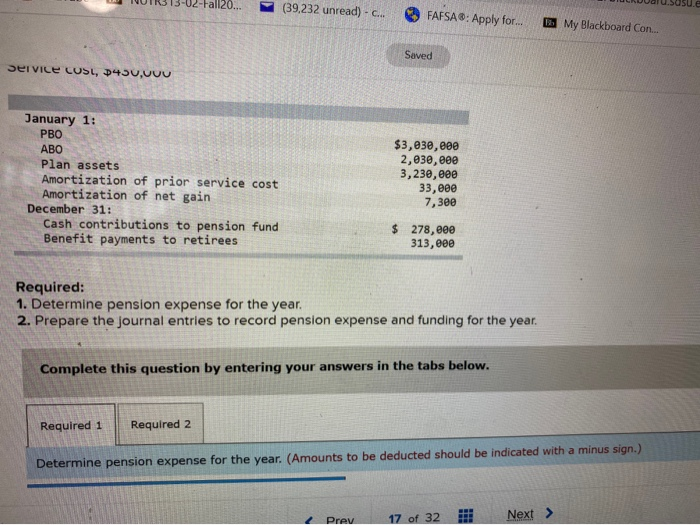

Saved Pension data for Sam Adams Inc. include the following for the current calendar year: Discount rate, 8% Expected return on plan assets, 10% Actual return on plan assets, 9% Service cost, $430,000 37:04 January 1: PBO ABO Plan assets Amortization of prior service cost Amortization of net gain December 31: Cash.contributions to pension fund Benefit payments to retirees $3,030,000 2,030, eee 3,230, eee 33, eee 7,300 ok $ 278,000 313,000 Required: 1. Determine pension expense for the year, 2. Prepare the journal entries to record pension expense and funding for the year. Complete this question by entering vour answers in the tabs below. 17 of 32 w 1 coton O RW pe here to search Fall20... - (39,232 unread) - C... FAFSA: Apply for... My Blackboard Con... Saved service COSL, P450,00 January 1: PBO ABO Plan assets Amortization of prior service cost Amortization of net gain December 31: Cash contributions to pension fund Benefit payments to retirees $3,030,000 2,030,000 3,230,000 33, e80 7,300 $ 278,000 313,000 Required: 1. Determine pension expense for the year. 2. Prepare the journal entries to record pension expense and funding for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine pension expense for the year. (Amounts to be deducted should be indicated with a minus sign.) Prev 17 of 32 Next > Saved Pension data for Sam Adams Inc. include the following for the current calendar year: Discount rate, 8% Expected return on plan assets, 10% Actual return on plan assets, 9% Service cost, $430,000 37:04 January 1: PBO ABO Plan assets Amortization of prior service cost Amortization of net gain December 31: Cash.contributions to pension fund Benefit payments to retirees $3,030,000 2,030, eee 3,230, eee 33, eee 7,300 ok $ 278,000 313,000 Required: 1. Determine pension expense for the year, 2. Prepare the journal entries to record pension expense and funding for the year. Complete this question by entering vour answers in the tabs below. 17 of 32 w 1 coton O RW pe here to search Fall20... - (39,232 unread) - C... FAFSA: Apply for... My Blackboard Con... Saved service COSL, P450,00 January 1: PBO ABO Plan assets Amortization of prior service cost Amortization of net gain December 31: Cash contributions to pension fund Benefit payments to retirees $3,030,000 2,030,000 3,230,000 33, e80 7,300 $ 278,000 313,000 Required: 1. Determine pension expense for the year. 2. Prepare the journal entries to record pension expense and funding for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine pension expense for the year. (Amounts to be deducted should be indicated with a minus sign.) Prev 17 of 32 Next >