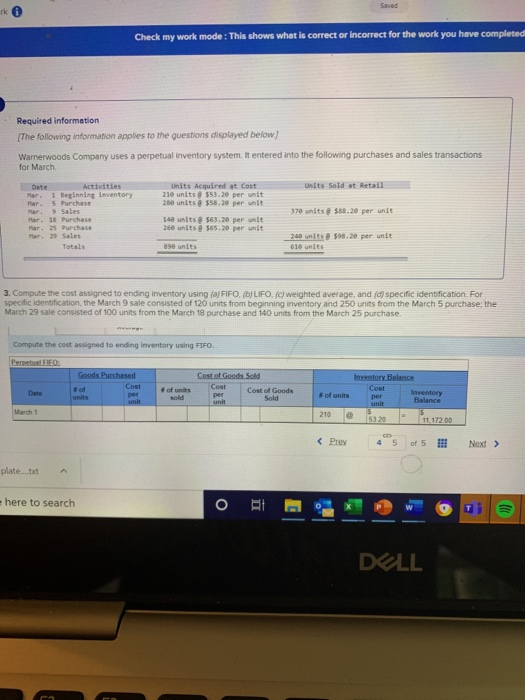

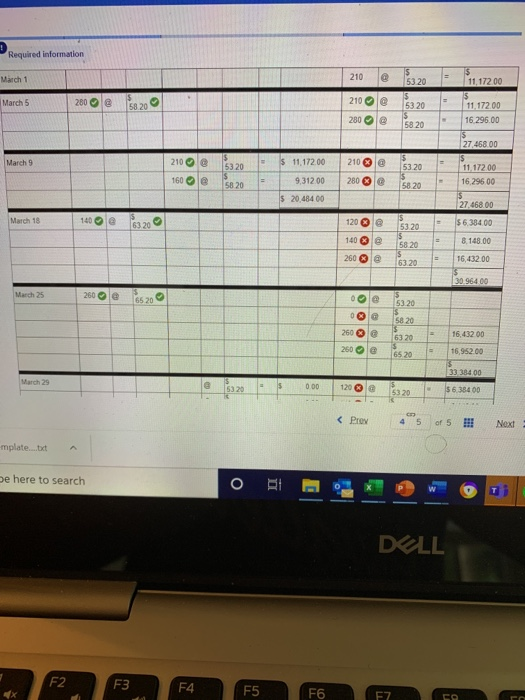

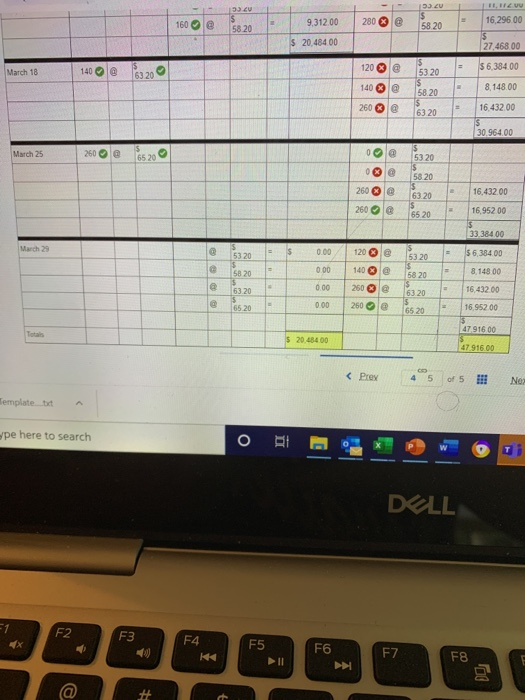

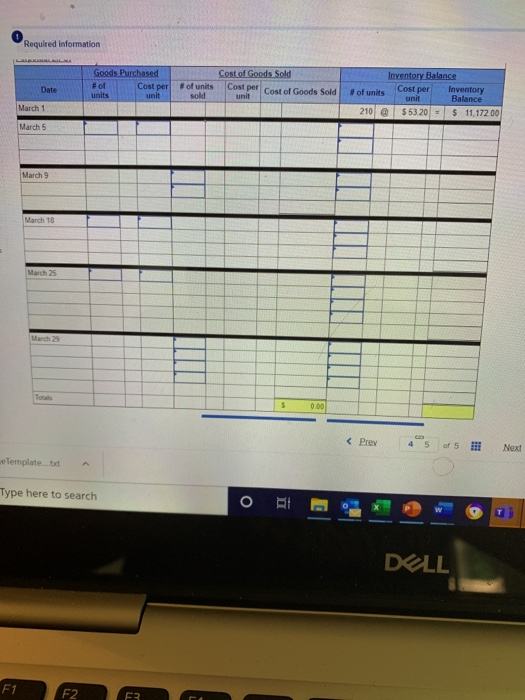

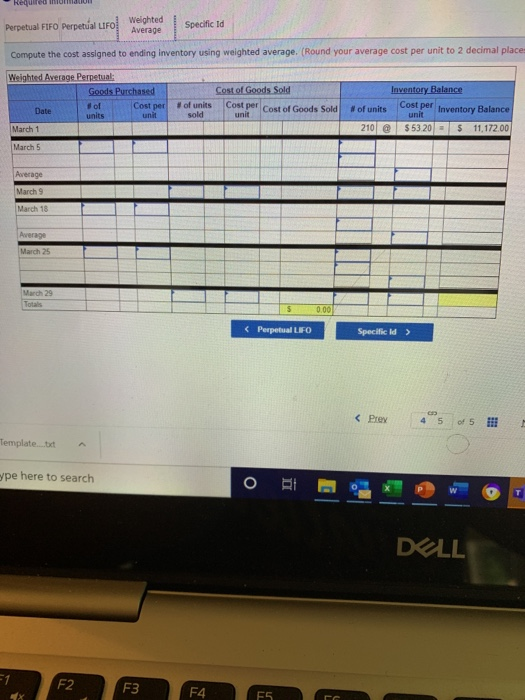

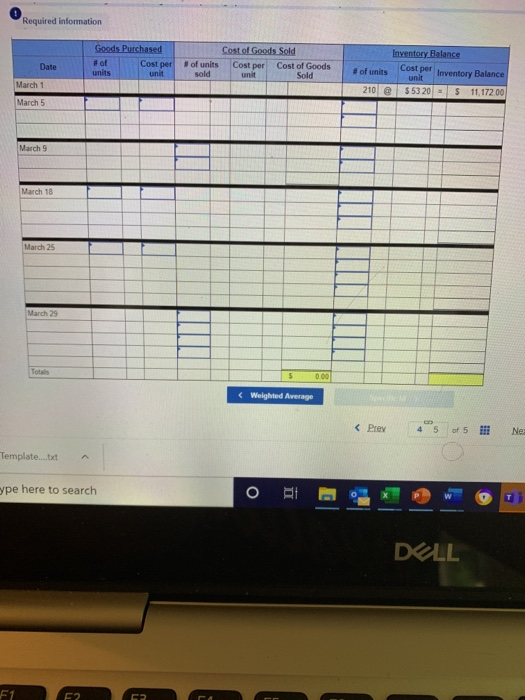

Saved rk Check my work mode: This shows what is correct or incorrect for the work you have completed Required information [The following information applies to the questions displayed below) Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March Units Sold at Retail Units Acquired at Cost 210 units 553.2e per unit 280 units @ $58.20 per unit Date Activities Mar. 1 Beginning inventory Har 5 Purchase Mr. Sales Mar. 18 Purchase Mar. 25 Purchase Mar 29 Sales Totals 370 units $ $88.20 per unit 140 units 563.20 per wit 260 units 565.20 per unit 890 units 240 units $98.20 per unit 618 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (D) LIFO. (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 120 units from beginning inventory and 250 units from the March 5 purchase, the March 29 sale consisted of 100 units from the March 18 purchase and 140 units from the March 25 purchase Compute the cost assigned to ending inventory using FIFO. Perpetual Goods Purchased Cost of Goods Sold Cost Cost Cost of Goods per Sold Inventory Balance Cost per Inventory unit Balance of units March 1 210 53 20 11.172.00 plate....txt here to search 0 W W DOLL Required information March 1 210 53 20 11,172.00 March 5 280 . 210e 58.20 53 20 is 58 20 11,172.00 16.296.00 280 March 9 210 5320 $ 11,172.00 210 @ @ 5320 27.468.00 $ 11,172.00 16.296.00 $ 27.468.00 160 le 9,312.00 280 e 58 20 58.20 $ 20 48400 March 18 140 63 20 120 $6.384.00 5320 140 e 8.148.00 260 @ 58 20 $ 63.20 = 16,432.00 30,96400 March 25 260e 6520 o e ole 53.20 58 20 260 260 le 6320 16,432 00 16,952.00 6520 33 38400 March 29 5320 0.00 120 e 5320 $6.36400 @ $ 6,384.00 March 18 6320 $ 53 20 $ 58.20 140 @ 8. 148.00 260 @ 63.20 16.432.00 $ 30.96400 March 25 260 e65 20 ola 53 20 @ @ 260 le 58 20 $ 6320 $ 65.20 16,432.00 260@ 16,952 00 33.384.00 March 20 @ $ 0.00 5320 120 le 53 20 56,384.00 58 20 000 140 58 20 8 148 00 @ 63.20 0.00 250 16.432.00 @ 65.20 0.00 63.20 6520 260 le 16,95200 47 916 00 $ 20.484.00 47 91600