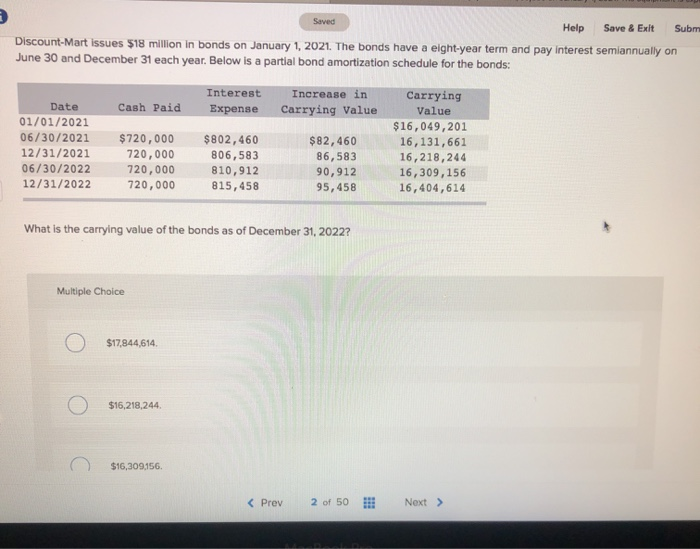

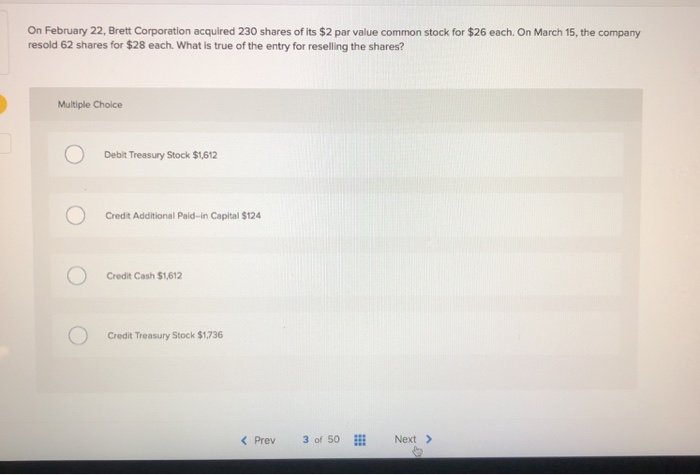

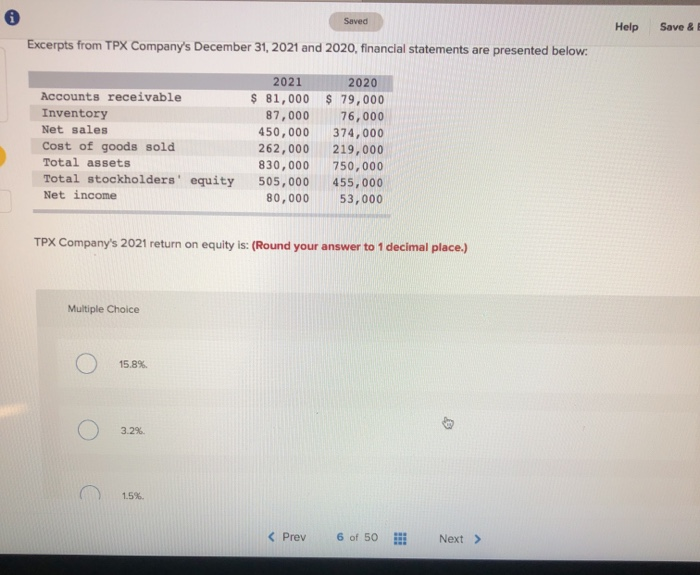

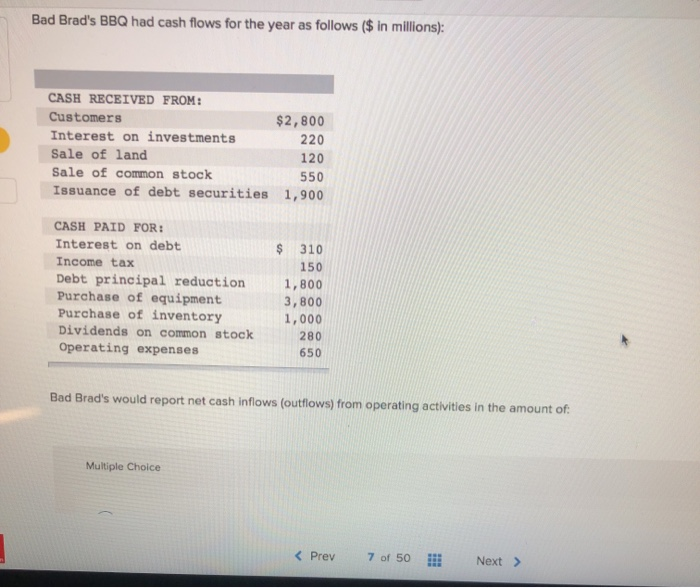

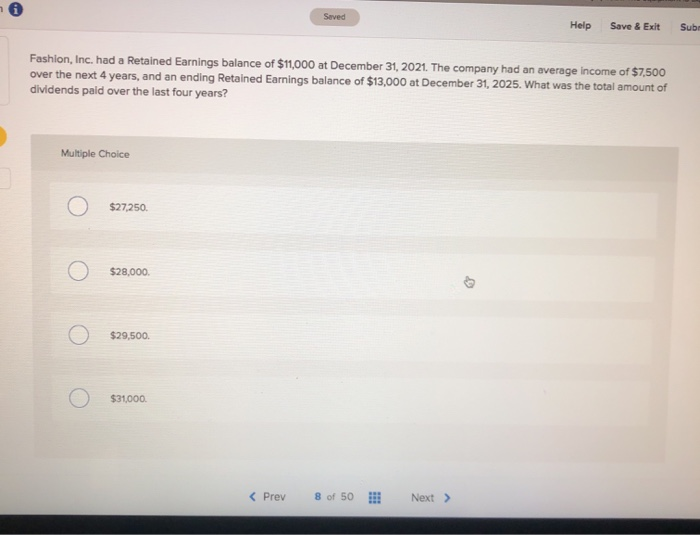

Saved Save & Exit Subm Help Discount-Mart issues $18 million in bonds on January 1, 2021. The bonds have a eight-year term and pay interest semiannually on June 30 and December 31 each year. Below is a partial bond amortization schedule for the bonds: Cash Paid Interest Expense Increase in Carrying Value Date 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 $ 720,000 720,000 720,000 720,000 $802,460 806,583 810,912 815,458 $82,460 86,583 90,912 95,458 Carrying Value $16,049,201 16,131,661 16,218,244 16,309,156 16,404,614 What is the carrying value of the bonds as of December 31, 2022? Multiple Choice $17,844,614 $16,218,244 $16,309,156, On February 22, Brett Corporation acquired 230 shares of its $2 par value common stock for $26 each On March 15, the company resold 62 shares for $28 each. What is true of the entry for reselling the shares? Multiple Choice Debit Treasury Stock $1,612 Credit Additional Paid-in Capital $124 Credit Cash $1,612 Credit Treasury Stock $1,736 Saved Help Save & Excerpts from TPX Company's December 31, 2021 and 2020, financial statements are presented below: Accounts receivable Inventory Net sales Cost of goods sold Total assets Total stockholders' equity Net income 2021 2020 $ 81,000 $ 79,000 87,000 76,000 450,000 374,000 262,000 219,000 830,000 750,000 505,000 455,000 80,000 53,000 TPX Company's 2021 return on equity is: (Round your answer to 1 decimal place.) Multiple Choice 15.8%. 3.2% 1.5% Bad Brad's BBQ had cash flows for the year as follows ($ in millions): CASH RECEIVED FROM: Customers $2,800 Interest on investments 220 Sale of land 120 Sale of common stock 550 Issuance of debt securities 1,900 CASH PAID FOR: Interest on debt Income tax Debt principal reduction Purchase of equipment Purchase of inventory Dividends on common stock Operating expenses $ 310 150 1,800 3,800 1,000 280 650 Bad Brad's would report net cash inflows (outflows) from operating activities in the amount of: Multiple Choice Seved Help Save & Exit Subs Fashion, Inc. had a Retained Earnings balance of $11,000 at December 31, 2021. The company had an average income of $7,500 over the next 4 years, and an ending Retained Earnings balance of $13,000 at December 31, 2025. What was the total amount of dividends paid over the last four years? Multiple Choice $27,250 $28,000 6 $29,500 $31,000