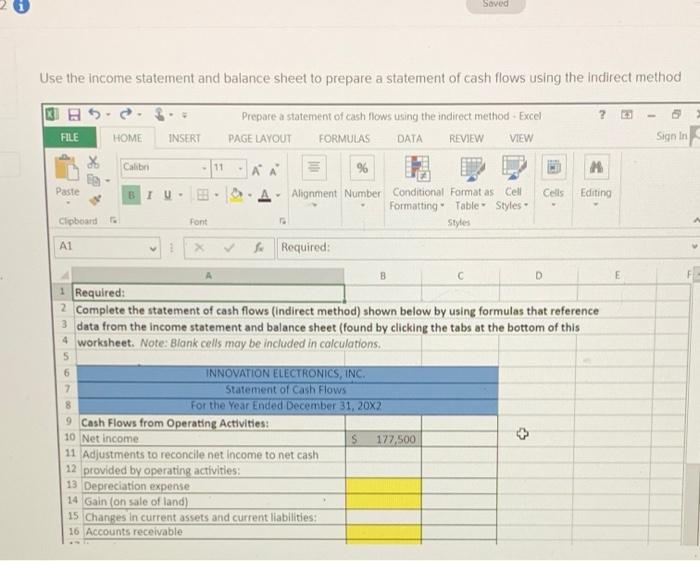

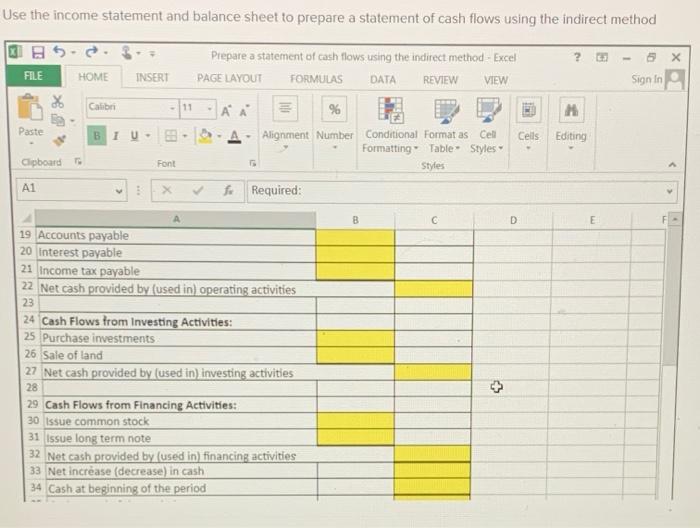

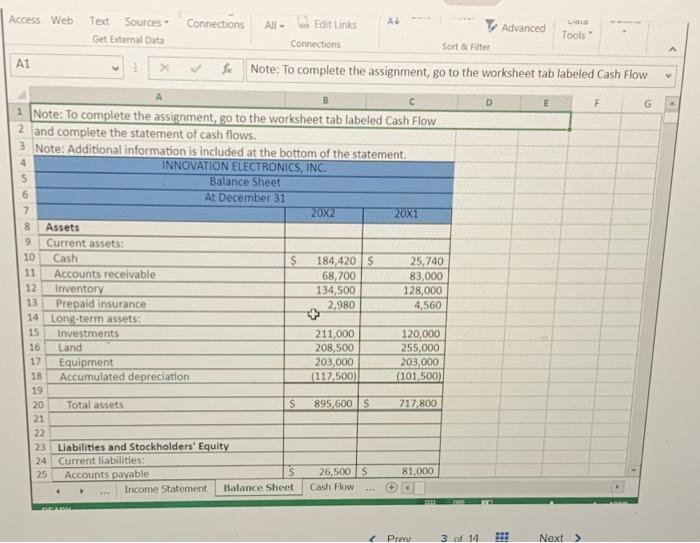

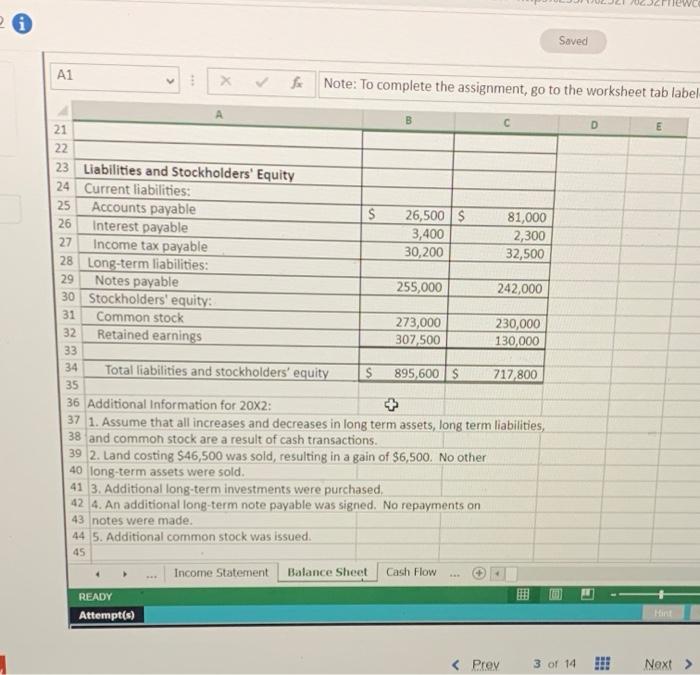

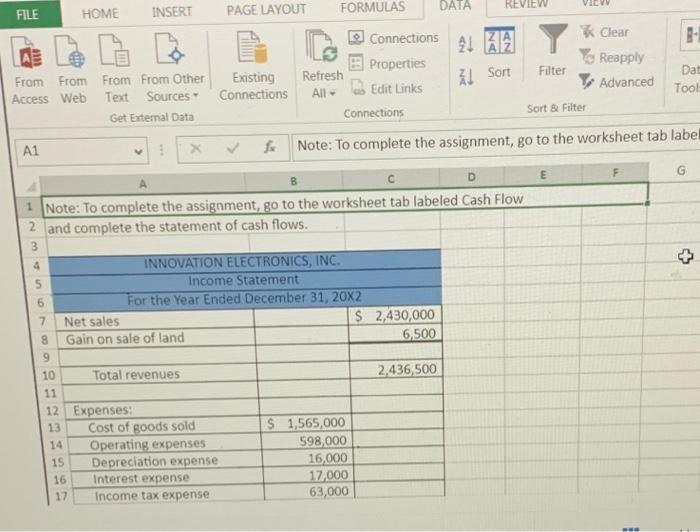

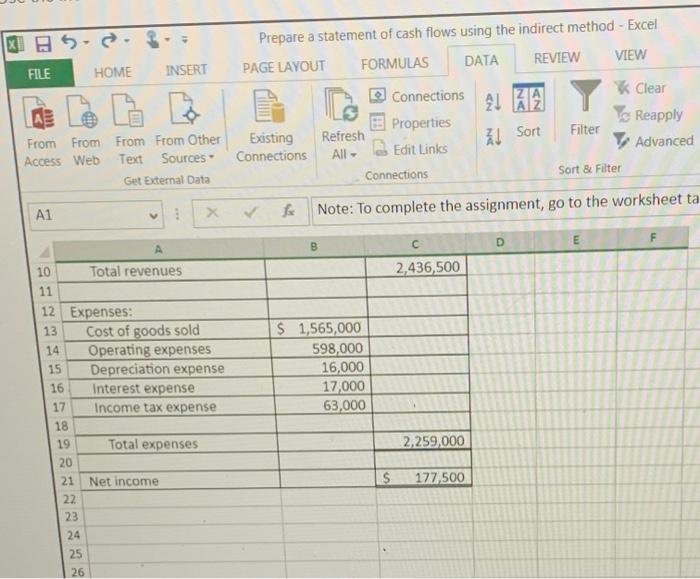

Saved Use the income statement and balance sheet to prepare a statement of cash flows using the Indirect method ? FILE HOME INSERT Sign In Calibri - 11 M Prepare a statement of cash flows using the indirect method - Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW AA % Alignment Number Conditional Format as Cell Cells Formatting Table Styles Styles Required: Paste BIU- Editing Clipboard Font A1 D E 4 5 6 7 8 1 Required: 2 Complete the statement of cash flows (indirect method) shown below by using formulas that reference 3 data from the income statement and balance sheet (found by clicking the tabs at the bottom of this worksheet. Note: Blank cells may be included in calculations. INNOVATION ELECTRONICS, INC. Statement of Cash Flows For the Year Ended December 31, 20X2 9 Cash Flows from Operating Activities: 10 Net income 177,500 11 Adjustments to reconcile net income to net cash 12 provided by operating activities 13 Depreciation expense 14 Gain (on sale of land) 15 Changes in current assets and current liabilities: 16 Accounts receivable Use the income statement and balance sheet to prepare a statement of cash flows using the indirect method Prepare a statement of cash flows using the indirect method - Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW FILE HOME INSERT Sign In Calibri -11 M Paste BIU Cells Editing %6 Alignment Number Conditional Format as Cel Formatting Table Styles Styles fr Required: Clipboard Font Saved A1 X fx Note: To complete the assignment, go to the worksheet tab label E S 21 22 23 Liabilities and Stockholders' Equity 24 Current liabilities: 25 Accounts payable 26 Interest payable 27 Income tax payable 28 Long-term liabilities: 29 Notes payable 30 Stockholders' equity: 31 Common stock 32 Retained earnings 26,500 $ 3,400 30,200 81,000 2,300 32,500 255,000 242,000 273,000 307,500 230,000 130,000 33 34 Total liabilities and stockholders' equity $ 895,600S 717,800 35 36 Additional Information for 20X2: 37 1. Assume that all increases and decreases in long term assets, long term liabilities, 38 and common stock are a result of cash transactions 39 2. Land costing $46,500 was sold, resulting in a gain of $6,500. No other 40 long-term assets were sold. 41 3. Additional long-term investments were purchased, 42 4. An additional long-term note payable was signed. No repayments on 43 notes were made. 44 5. Additional common stock was issued. 45 Income Statement Balance Sheet Cash Flow READY Attempt(s) REVIEW VIEW FILE HOME INSERT PAGE LAYOUT FORMULAS DATA Connections Clear A1 A2 8. Properties Reapply From From From From Other Existing Refresh Filter Dat Access Web Advanced All- Text Sources Connections Edit Links Tool Get External Data Connections Sort & Filter A1 : fs Note: To complete the assignment, go to the worksheet tab label 1 Sort G D 1 Note: To complete the assignment, go to the worksheet tab labeled Cash Flow 2 and complete the statement of cash flows. 3 4 INNOVATION ELECTRONICS, INC. 5 Income Statement 6 For the Year Ended December 31, 20X2 7 Net sales $ 2,430,000 8 Gain on sale of land 6,500 9 10 Total revenues 2,436,500 11 12 Expenses: 13 Cost of goods sold $ 1,565,000 14 Operating expenses 598,000 15 Depreciation expense 16,000 16 Interest expense 17,000 17 Income tax expense 63,000 ***