Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Saving for Retirement ( SOLVE ON EXCEL ) ohn Morrow is ten years away from retirement. He has accumulated a $ 1 0 0 ,

Saving for Retirement SOLVE ON EXCEL

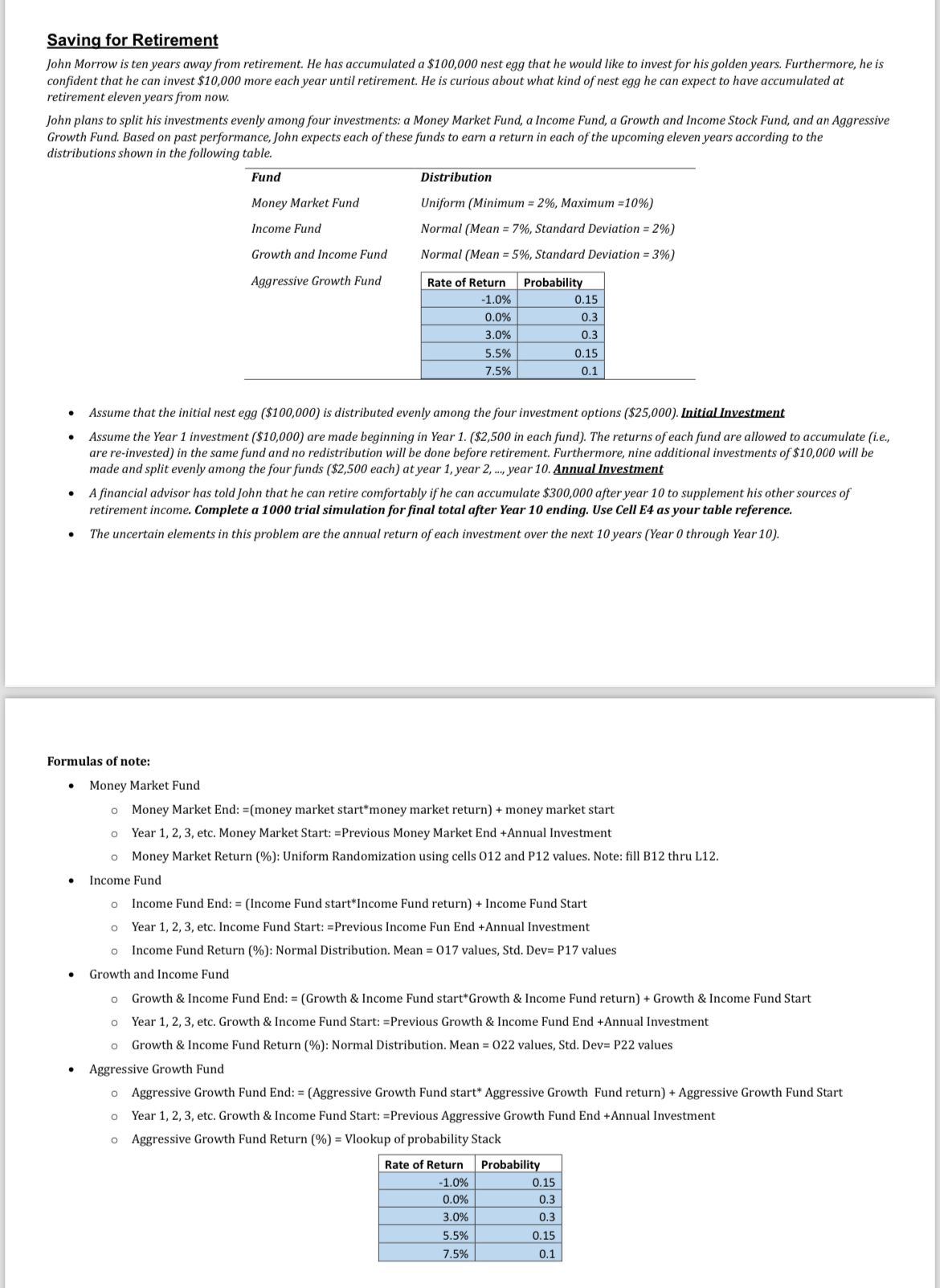

ohn Morrow is ten years away from retirement. He has accumulated a $ nest egg that he would like to invest for his golden years. Furthermore, he is confident that he can invest $ more each year until retirement. He is curious about what kind of nest egg he can expect to have accumulated at retirement eleven years from now.

John plans to split his investments evenly among four investments: a Money Market Fund, a Income Fund, a Growth and Income Stock Fund, and an Aggressive Growth Fund. Based on past performance, John expects each of these funds to earn a return in each of the upcoming eleven years according to the distributions shown in the following table.

tableFundDistribution,Money Market Fund,Uniform Minimum Maximum Income Fund,Normal Mean Standard Deviation Growth and Income Fund,Normal Mean Standard Deviation Aggressive Growth Fund,Rate of Return,Probability

Assume that the initial nest egg $ is distributed evenly among the four investment options $ Initial Investment

Assume the Year investment $ are made beginning in Year in each fund The returns of each fund are allowed to accumulate ie are reinvested in the same fund and no redistribution will be done before retirement. Furthermore, nine additional investments of $ will be made and split evenly among the four funds $ each at year year dots, year Annual Investment

A financial advisor has told John that he can retire comfortably if he can accumulate $ after year to supplement his other sources of retirement income. Complete a trial simulation for final total after Year ending. Use Cell E as your table reference.

The uncertain elements in this problem are the annual return of each investment over the next years Year through Year

Formulas of note:

Money Market Fund

Money Market End: money market start money market return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started